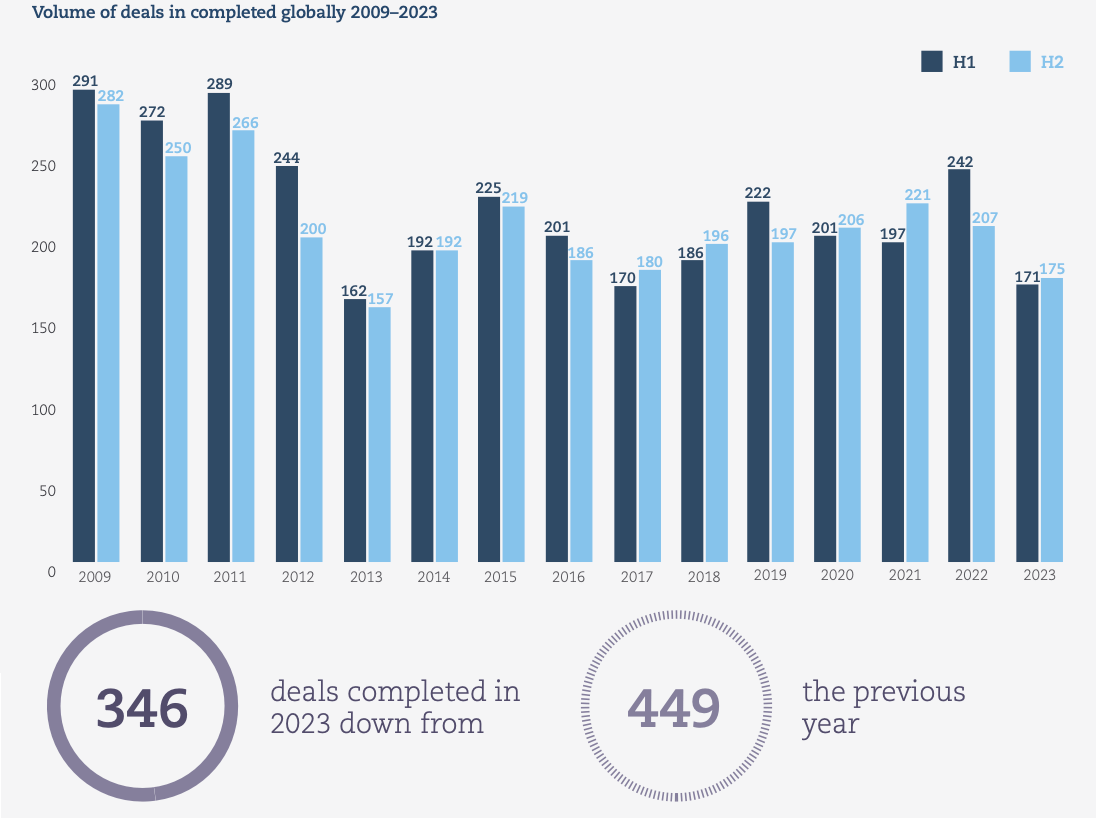

Clyde & Co’s Insurance Growth Report has revealed that mergers and acquisitions (M&A) activity worldwide in the insurance sector was down in 2023, reaching the lowest level for a decade.

According to the firm, there were 346 completed M&As worldwide in the insurance sector in 2023, down from 449 in the previous year.

According to the firm, there were 346 completed M&As worldwide in the insurance sector in 2023, down from 449 in the previous year.

As expected, the Americas remained the most active region for M&A in 2023, though the distance to second-placed Europe narrowed significantly, down to just 55 deals from 106 in 2022.

However, Clyde & Co observed that the downward trend exhibited by Europe and the Americas in H1 of 2023 was reversed in H2, as the number of deals increased.

“The Americas saw a modest increase of 5.1%, with Europe leading the revival with a 22.9% increase compared to the first half of the year,” the firm explained.

On the other hand, the Asia Pacific region saw a 20.7% decrease in activity in H2 of 2023, while the Middle East and Africa regions saw a 33.3% decrease.

Peter Hodgins, Clyde & Co Partner in Dubai, commented, “As the global economy continues to feel the impacts of high inflation, funding for transactions for many insurance businesses has been challenging to find.

“Meanwhile, with over half of the global population expected to be called to the polls in 2024, as well as a number of escalating regional conflicts, heightened geopolitical risks have become a persistent concern.

“In the face of this market uncertainty, deal-makers have remained in wait-and-see mode, with a negative impact on overall transaction volume in 2023.”

Eva-Maria Barbosa, Clyde & Co Partner in Munich, added, “M&A activity is coming back to the European insurance market, as leading global carriers look to acquire specific business lines – particularly those high volume, but relatively low premium contracts that can be sold as embedded or affinity products.

“Companies finding it challenging to achieve healthy margins on commercial business are looking for reliable cash flow in the personal lines space.”

As per Clyde & Co, deal activity has reached the bottom of this current cycle, though it will start to increase through 2024, with Europe leading the way.

Clyde & Co added, “In the US, larger broking players are looking to make acquisitions in both the MGA and broking spaces, while cross-border transactions by intermediaries are also on the move.

“Elsewhere, international interest in the GCC region is returning, with international brokers looking to acquire businesses in the UAE and Saudi Arabia.”

Peter Hodgins concluded, “With financial markets potentially looking more volatile this year, growth in carriers’ investment portfolios is by no means certain. Continuing high-interest rates will also impact the cost of debt funding for acquisitions and contribute to increased claims costs and higher operational costs.

“However, in the face of macroeconomic and geopolitical uncertainty insurers are increasingly viewing the current trading environment as ‘the new normal’ and we expect them to become less cautious with regards to M&A over the coming 12 months.”