Australian re/insurance group QBE is expecting to see a deterioration in the performance of its North American Crop business in 2019, owing to recent adverse weather conditions.

Conditions such as an unusually cold growing season and heightened crop hail are likely to push the crop business’s operating ratio to around 107-109% on a net earned premium of nearly $1.2 billion, QBE said.

This compares with a combined operating ratio of 98% for the first six months of 2019, and a 10-year historical average of 90%.

QBE also expects the adverse weather conditions to contribute to slightly elevated attritional loss experience in some of its North American Property classes.

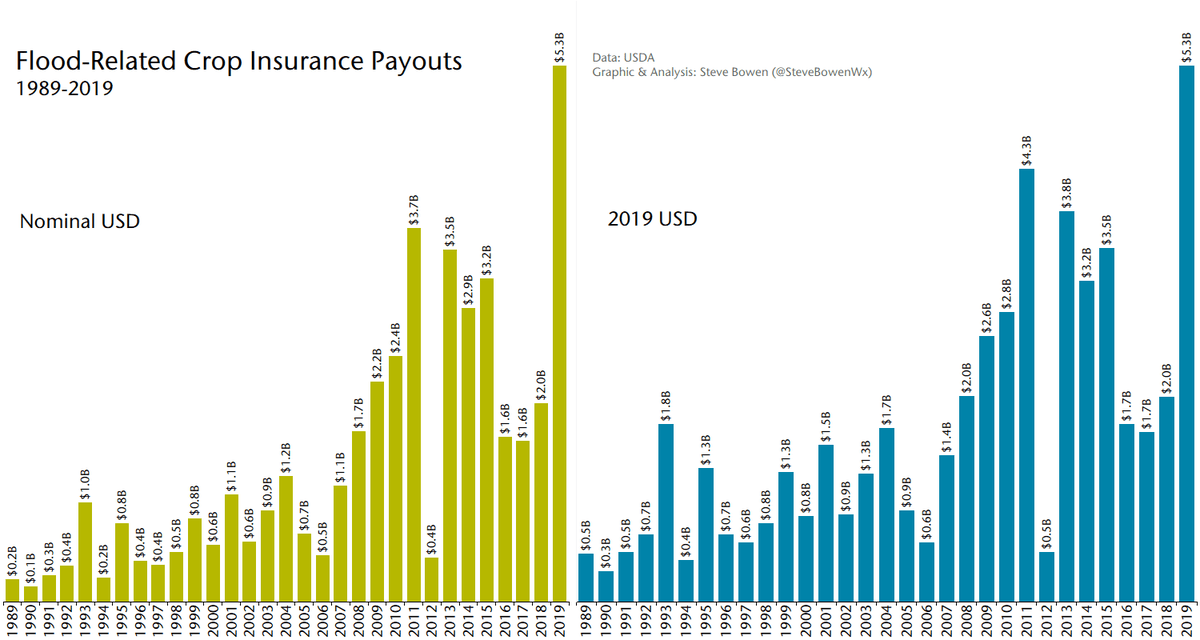

According to data from the United States Department of Agriculture (USDA), total flood and excess moisture related crop insurance payouts topped $5.3 billion as of December 2nd, and $1 billion in South Dakota alone.

Steve Bowen from Aon’s Impact Forecasting team recently provided a comparison of flood & excess moisture related crop insurance payouts from 1989, on both a nomical and inflation adjusted basis.

The below graph shows that 2019 is already the highest on record for the USDA’s RMA program, and this scale of losses is likely to be reflected in the private market at year-end.

Overall, QBE Group’s combined ratio is currently anticipated to be slightly above the top end of the 2019 target range of 94.5-96.5%.

But the company’s investment performance still remains on track to hit the upper end of the 2019 target range of 3.0-3.5%.

Pricing momentum has also accelerated this year, with QBE achieving an average Q3 standalone premium rate increase of 7.5%, up from 4.7% in the first half of the year.

“It’s been an unusually weather-impacted harvest in North America this year,” explained QBE Group CEO Pat Regan.

“But we’ve got a terrific Crop insurance business that should stand us in good stead looking forward,” he added. “The rest of the Group continues to perform well and it is pleasing to see pricing momentum accelerate.”

Looking ahead to 2020, QBE is targeting a combined operating ratio of 93.5-95.5%, and a lower net investment return of 2.5-3.0%, reflecting lower global risk-free rates.