The Australian Reinsurance Pool Corporation (ARPC), Australia’s terrorism insurance scheme, has announced the renewal of its retrocession reinsurance program for 2021, which includes the purchase of an additional $25 million layer at the bottom of the program.

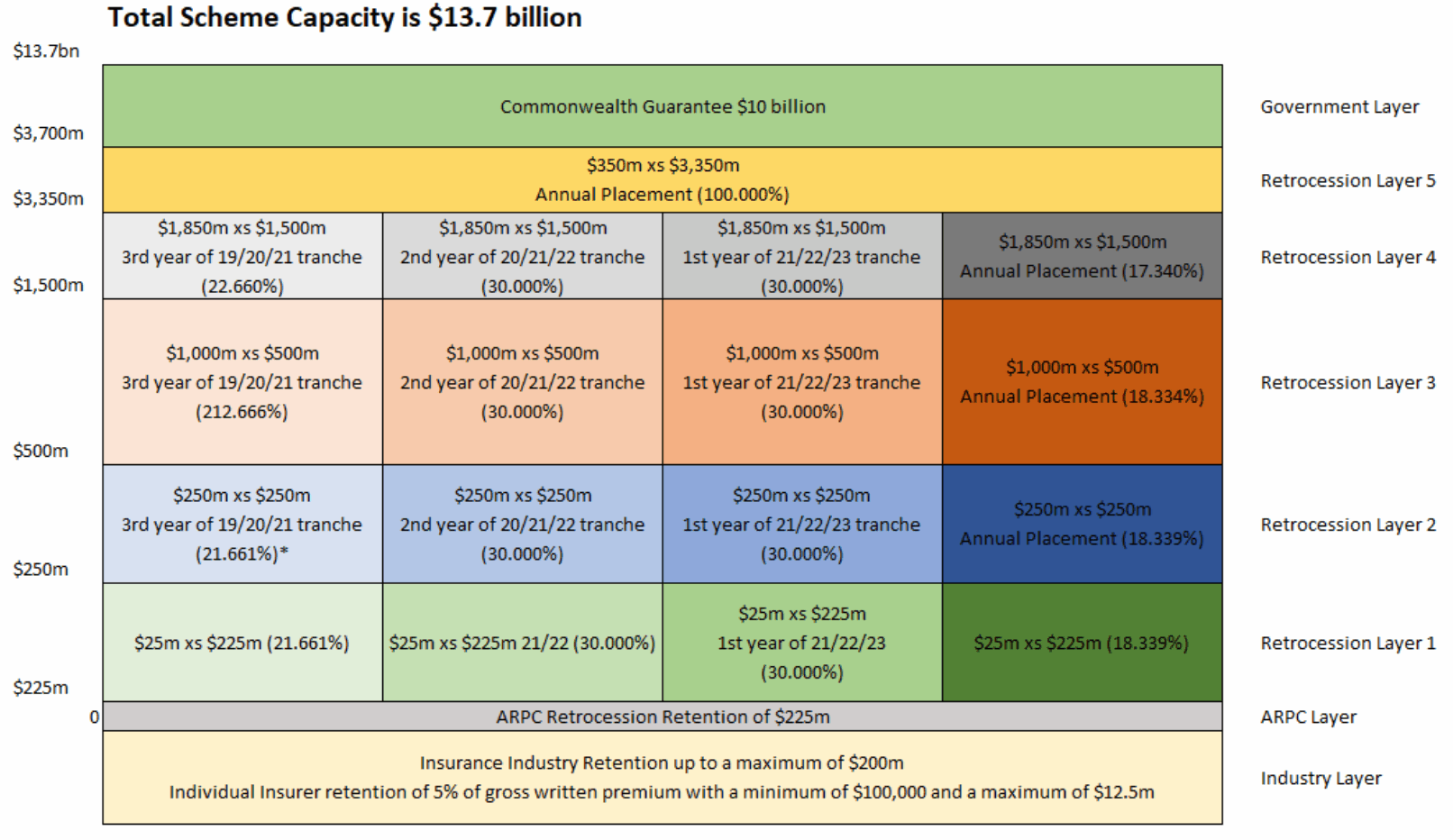

The renewal of the $3.475 billion retro reinsurance program, combined with ARPC’s net assets and the $10 billion Commonwealth guarantee, provides scheme capacity in the event of a declared terrorism incident, against both commercial and eligible property assets, of just shy of $14 billion.

The $3.475 billion retro program and ARPC net assets are the first layers of funding for claims in the event of a terrorism incident.

“ARPC’s retrocession program encourages a mix of global and Australian reinsurers to provide terrorism cover for Australian-based property assets, which transfers the risk and protects the Australian Government Guarantee and Australian taxpayers,” said Dr. Christopher Wallace, ARPC Chief Executive Officer (CEO).

“For the 2021 program, ARPC purchased an additional $25 million layer of reinsurance at the bottom of the program. This reduced ARPC’s deductible from $250 million to $225 million and improved ARPC’s capital strength,” he added.

Dr. Wallace, alongside the ARPC’s Chief Underwriting Officer (CUO), Michael Pennell, met online with close to 70 reinsurers in global markets to negotiate the 2021 reinsurance program.

“ARPC remains well positioned to be an effective provider of terrorism risk insurance that facilitates market participation, supports national resilience and reduces potential losses arising from terrorism catastrophe,” added Wallace.

The ARPC’s retro reinsurance program renews on the 1st of January each year. The organisation notes that the 2021 placement of retro capacity includes roughly $3 billion of capacity written on a multi-year agreement, to reduce pricing volatility for ARPC and its retrocessionaires.

The multi-year arrangement also allows adjustment if the ARPC’s portfolio changes by more than 10% year-on-year or cancellation if its audited forecast premium income reduces by 10% or more.