Berenberg analysts in their recent “2023: the dawn of a new reinsurance cycle” report have predicted that rates for European reinsurance will be higher during the upcoming renewal seasons.

Climate change dilutes geographical diversification which in the analyst’s view could be a key driver of the need for more rate.

According to the report, Europe as a region has been infamous for being slower to respond to pricing. The reason for this can be partly contributed to the peak primary natural perils such as hurricanes, tornados, typhoons and earthquakes not being as common in Europe as they are in the US.

Berenberg reports that the large European reinsurers and global reinsurers have traditionally perceived Europe to be a good diversifier of risk, notably when compared to the peak US perils such as earthquakes and hurricanes.

“This is, in our view, evident from the sharp reduction in pricing post-hurricane Katrina, when there was a tremendous amount of pressure as Europe was perceived to be attractive and a good diversifier of risk,” say analysts.

The reason for a change in the tide of this trend is contributed to the fact that European losses have become more frequent and more severe, due to the rise of secondary perils that have been associated by scientists with climate change.

According to Berenberg, climate change now means that there could be a common denominator behind the driver of global natural catastrophe losses, which means the geographic correlation of losses across the globe could increase.

This would subsequently mean frequent losses across different parts of the world, causing the benefits of diversifications on underwriting and capital to be slightly overstated from a pricing and capital modelling standpoint, which analysts feel could be a key driver of higher reinsurance prices in Europe going forward.

This would subsequently mean frequent losses across different parts of the world, causing the benefits of diversifications on underwriting and capital to be slightly overstated from a pricing and capital modelling standpoint, which analysts feel could be a key driver of higher reinsurance prices in Europe going forward.

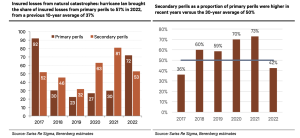

Swiss Re reports have also shown a significant rise in losses due to secondary perils in the last 5 years. Secondary perils as a proportion to primary perils have seen an increase of 50% in a 30-year average according to the statistics provided.