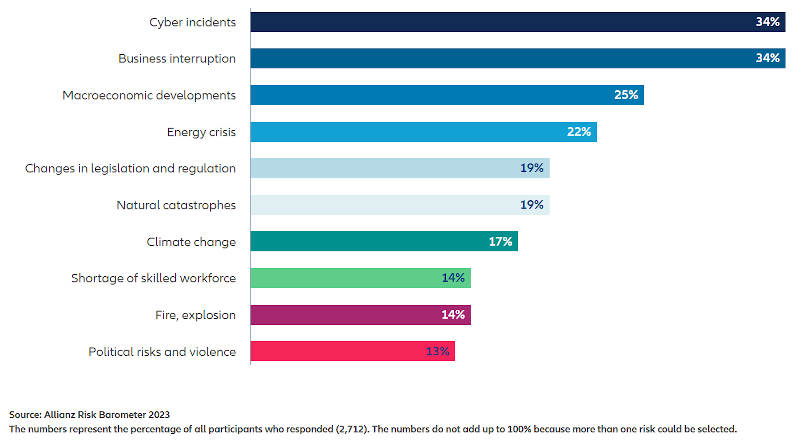

Cyber incidents and business interruption have ranked as the biggest company concerns for the second year in succession, according to the 2023 Risk Barometer report by Allianz, with economic and energy risks also on the rise.

Cyber and business interruption were both flagged as top risks by 34% of the 2,700+ risk management experts surveyed by Allianz for the latest edition of its barometer.

However, it is macroeconomic developments such as inflation, financial market volatility and a looming recession as well as the impact of the energy crisis are the top risers in this year’s list, with these risks respectively climbing from tenth position to third, and newly entering at fourth position.

With such pressing concerns call for immediate action from companies, other major risks such as natural catastrophes dropped from third to sixth position, while climate change moved down from sixth to seventh, and pandemic outbreak fell from fourth to thirteenth.

Political risks and violence was another new entry in the top 10 global risks at #10, while Shortage of skilled workforce rises to #8.

Other notable spots include changes in legislation and regulation, which remains a key risk at fifth place, and fire/explosion, which dropped two positions to number nine.

“For the second year in a row the Allianz Risk Barometer shows that companies are most concerned about mounting cyber risks and business interruption,” said AGCS CEO Joachim Mueller.

“At the same time, they see inflation, an impending recession and the energy crisis as immediate threats to their business. Companies – in Europe and in the US in particular – worry about the current ‘permacrisis’ resulting from the consequences of the pandemic and the economic and political impact from ongoing war in Ukraine. It’s a stress test for every company’s resilience,” Mueller continued.

“The positive news is that as an insurer we see continuous improvement in this area among many of our clients, particularly around making supply chains more failure-proof, improving business continuity planning and strengthening cyber controls. Taking action to build resilience and de-risk is now front and center for companies, given the events of recent years.”