According to reinsurance broker Gallagher Re’s 2022 year-end Florida Market Watch Report, the combined ratio of the industry weakened by over 17% year-over-year to 136.1% compared with 116.3% in 2021.

At the same time, net loss & LAE ratios at an industry level rose by 26.3% to 108.9% at 2022 year-end, as the net expense ratio declined from 30.1% at 2021-end to 27.2% at 2022-end.

The combined ratio of Florida specialists showed an improvement of 6.4 points in 2022 compared to the previous year, reaching 115.3%.

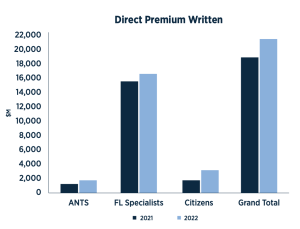

“In 2022, all subgroups experienced an increase in direct premium written (DPW) in comparison to 2021,” according to the report.

Gallagher Re reports that the Florida personal lines DPW increased by 17.7% to $14.4 billion in 2022. Florida specialists grew by 5.4% to $16.4 billion, while Citizens reported a 75.8% increase in DPW to $3.2 billion in 2022.

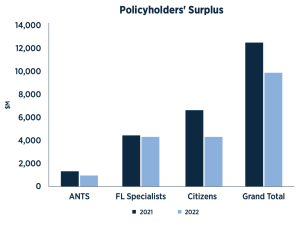

The report notes that for the overall market, the Florida market policyholders’ surplus (PHS) eroded by 21.3% to $9.7 billion in 2022.

The report notes that for the overall market, the Florida market policyholders’ surplus (PHS) eroded by 21.3% to $9.7 billion in 2022.

The surplus of Citizens decreased by 34.4% and reached $4.3 billion, while Florida specialists experienced a slight decrease in their surplus by 1.3%, which amounted to $4.4 billion.

The surplus experienced a net increase due to two main factors – $815.0 million from capital inflows and $487.9 million from the change in surplus notes. This increase was also attributed to the initial capitalisation of three new companies named Slide, Vyrd, and Tower Hill Insurance Exchange.

The surplus experienced a net increase due to two main factors – $815.0 million from capital inflows and $487.9 million from the change in surplus notes. This increase was also attributed to the initial capitalisation of three new companies named Slide, Vyrd, and Tower Hill Insurance Exchange.

However, the net surplus was negatively affected by after-tax net losses of $3.8 billion, stockholder dividends amounting to $41.1 million, and $124.1 million from all other surplus adjustments, the report noted.

All subgroups experienced a net underwriting loss and an after-tax net loss in 2022. The market as a whole reported an after-tax net loss of $3.8 billion, which was primarily due to underwriting losses of $4.2 billion, with Citizens being responsible for the majority of the underwriting losses, the report noted.