Florida-headquartered re/insurance focused holding company HCI Group has completed its catastrophe reinsurance program for 2019-20, securing a total limit of $1.477 billion.

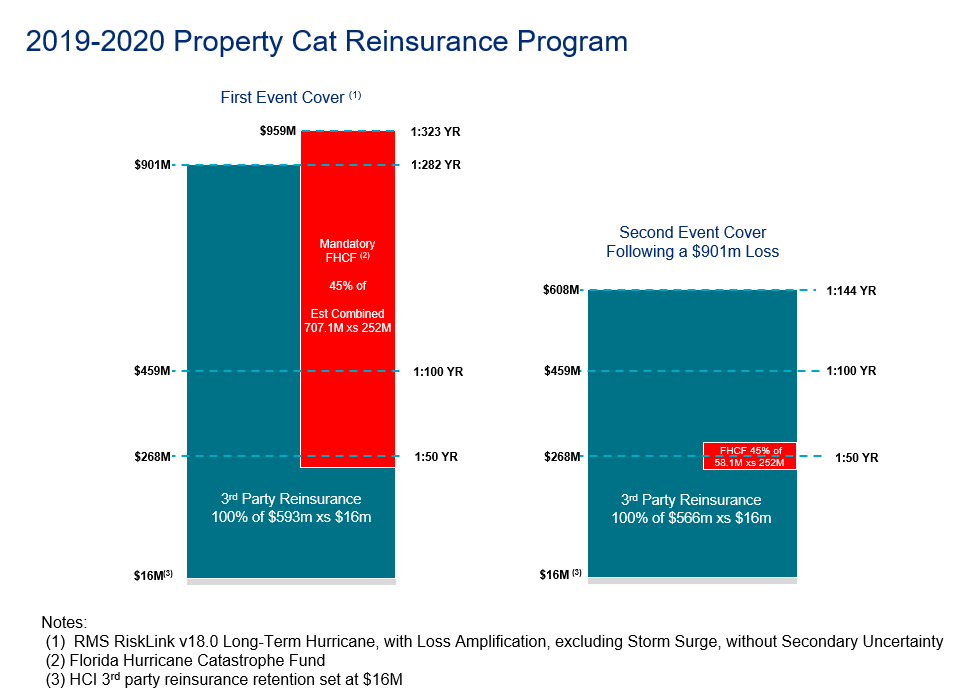

The program provides coverage up to approximately $901 million for a first event loss, excluding flood, and subsequent coverage of up to $608 million for a second event loss.

Third party reinsurance will cover 100% losses in excess of $16 million up to $593 million for the first event and up to $566 million for the second event, with the remaining coverage provided by the Florida Hurricane Catastrophe Fund (FHCF).

According to catastrophe models approved by the Florida Office of Insurance Regulation, the first event protection is sufficient to cover HCI’s probable maximum loss resulting from a 1 in 282-year storm.

HCI’s first event coverage is slightly higher than on its previous program, which provided protection on losses up to $888 million, although its second event coverage is lower than last year, when it had protection for losses up to $717 million.

This means that HCI’s total reinsurance limit for all event occurrences is slightly down on the $1.605 billion it secured previously.

Net reinsurance premiums for the 2019-20 program are expected to be $112 million, assuming no losses occur during the contract year, although projected growth from HCI’s subsidiary TypTap Insurance Company could increase premiums at the exposure true up on September 30, 2019.

Based on assumed growth and including reinsurance premiums for flood, HCI’s total ceded reinsurance premiums for the 2019-2020 contract year are estimated to be $124 million.

“We received strong support from our reinsurers based on our data transparency, insourced business model, and internally developed claims software,” said Paresh Patel, Chief Executive Officer at HCI.

“In addition, we purchased a similar tower structure, maintained our 45% FHCF election, and reduced our absolute spend compared with last year’s program while keeping our first and second event retentions unchanged.”