The Macau non-life insurance industry’s ability to withstand Typhoon Hato shows the market’s re/insurance models are robust and well backed up by international reinsurers which shouldered the majority of cedants’ losses, according to an A.M. Best briefing.

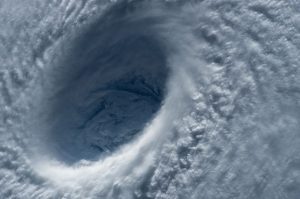

Typhoon Hato struck South China in August 2017 as a strong tropical cyclone, however, the Macau re/insurance market remains strong and well-capitalised despite its small market size and heavy Typhoon Hato losses.

Typhoon Hato struck South China in August 2017 as a strong tropical cyclone, however, the Macau re/insurance market remains strong and well-capitalised despite its small market size and heavy Typhoon Hato losses.

Local insurers retained just a small portion of the typhoon losses, making it an earnings event rather than a capital event for the well-oiled market.

The rating agency attributed re/insurers’ strong earning capabilities and capitalisation levels in part to the Macau insurance regulator’s conservative approach “by requiring a minimum solvency margin for non-life business based on gross premiums written.”

As a result, local insurers focus more on earnings and delivering expected return-on-equity (ROE) to shareholders.

With five-year ROEs ranging from 9% to 24%, A.M. Best said the earning capabilities of the top three non-life insurers in Macau, which represent 70% of the market share, are strong.

Non-life insurers have experienced stable and profitable performance with well-capitalized companies, strong earning capabilities, and strong re/insurance cover all working to withstand and mitigate impact of losses.

A.M. Best expects these companies to recover their losses from Hato in a couple of years, highlighting the scope of protection via sufficient reinsurance cover and a strong focus on capitalisation.