A recent report from Kroll Bond Rating Agency (KBRA) has highlighted a trend of rising re/insured losses resulting from tornadoes in the U.S.

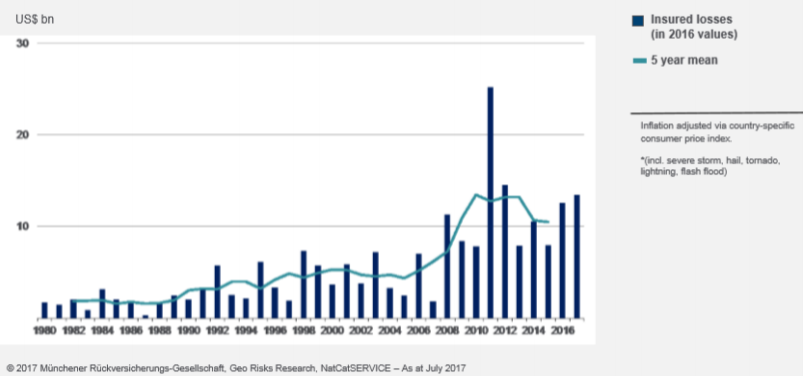

Analysts pointed to recent data from Munich Re showing that the average annual insured losses resulting from tornadoes has more than doubled over the last few decades, with convective storm losses making up the majority of U.S catastrophe losses from 2013 through 2015 when hurricane activity was low.

Over the longer term, severe convective storm losses (which also includes hailstorms) typically run closely behind hurricane losses, with 43% of windstorm losses attributable to severe thunderstorms between 1980-2011, compared to 50% for tropical cyclones.

However, while the overall value of insured losses has been increasing for convective storms, KBRA acknowledged that the question of whether tornadoes are increasing in frequency and strength is up for debate due to improvements in the reporting of tornadoes.

NOAA and its National Severe Storms Laboratory believe there is no trend in the number of strong tornadoes between 1950 and 2012, suggesting that the number of high intensity events has not increased over that period.

All but one of the top ten costliest tornadoes in U.S history occurred in the months of March, April or May, with three of the costliest outbreaks occurring in Spring 2011 alone, resulting in approximately $7 billion in insured losses from May 20-27 of that year.

These included a tornado in Joplin, Missouri that caused $2.8 billion in insured losses and led to three insurers – Barton Mutual Insurance Co., Gateway Mutual Insurance Co., and Cape Mutual Insurance Co. – becoming insolvent.

KBRA noted that tornado damage is predominantly related to wind and is therefore typically covered by homeowners’ policies, unlike hurricane damage which often entails coverage gaps for factors such as flooding.

Analysts recommended that re/insurers take steps to become more conscious of risk concentrations related to tornadoes, which are a leading cause of insurer insolvency.

KBRA believes thorough financial analysis and stress testing can better identify risk concentrations, as opposed to solely or predominantly relying on a capital model.