Analysts at JP Morgan have suggested that the Lloyd’s market is on the cusp of a “new golden era.”

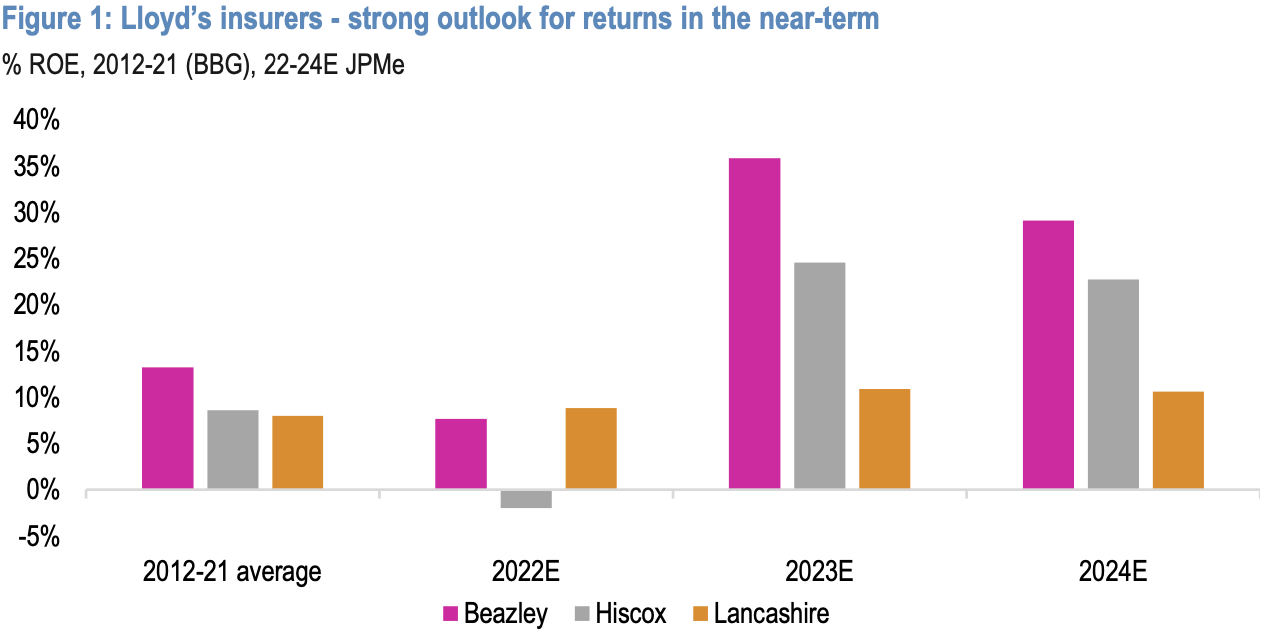

The analysts state that the Lloyd’s space will continue as a cyclical market, though in 2023, they anticipate the delivery of far stronger returns that won’t just rely on “good luck.”

The analysts state that the Lloyd’s space will continue as a cyclical market, though in 2023, they anticipate the delivery of far stronger returns that won’t just rely on “good luck.”

YTD underwriting margins have improved materially, which JP Morgan suggests is signalling the delivery of the long-awaited “super cycle” in the market.

The analysts write, “If 2019/20 was the bottom of the market for the Lloyd’s insurers, we see them entering 2023 on the cusp of a new golden era.”

Further, Underwriting margins in the specialty businesses have been bolstered by significant levels of price increases since 2018, says JP Morgan, adding, “If we look at the price increases that Beazley has seen in its total portfolio since 2017, it totals more than 60%.

“At the same time, it would be difficult to argue that margins have increased by the same quantum, with our sense that price increases have been eaten away to an extent by increases in claims expectations due to various factors including social inflation, inflation and increased levels of claims frequency, which can likely be attributed to climate change.”

Meanwhile, reinsurance pricing has been one of the key headlines in 2023, with increases at their fastest levels since the early 1990s, according to insurance broker Howden.

JP Morgan notes, “All of the Lloyd’s insurers have some exposure to catastrophe reinsurance but their bread and butter is specialty lines with a side serving of reinsurance.

“All of the names will therefore benefit from price increases, but the second order effect is that primary lines in the Lloyd’s market, particularly in areas such as property, marine, and aviation are likely to remain firmer than many expect due to the removal of the safety net that reinsurance has provided in recent years.”

Despite earnings expectations materially increasing for 2023/24E, JP Morgan states that capital returns have not kept pace. As a result, the average payout ratio in the space for 2023E is ~25% (BBG).

JP Morgan’s analysts write, “Assuming the companies can deliver on expectations, we see no reason that payout ratios cannot materially increase in the near term via the use of special dividends or buybacks, with a 75% payout ratio across the space implying a ~9% 2023E dividend yield.

“Whilst we believe management teams will not want to factor this in as a base case for 2023, if the year turns out to be normal on the loss front, we think this is a debate that will gain increasing focus.”