Munich Re has disclosed details of its retrocession program for 2023, showing that it shrunk its coverage somewhat amid the capacity squeeze of the January renewals.

The reinsurer cited “a very challenging market environment” at 1/1 but said that its retro placement nevertheless remained “robust”.

Details of the program were released alongside Munich Re’s results for 2022, which saw it exceed profit guidance for the year at €3.4 billion and increase gross written premiums by almost 13% to more than €67 billion.

However, with rates continuing to harden and retro capacity becoming strained at the January renewals, Munich Re said it had to adopt a “well-balanced” buying strategy that weighed price against placement volume.

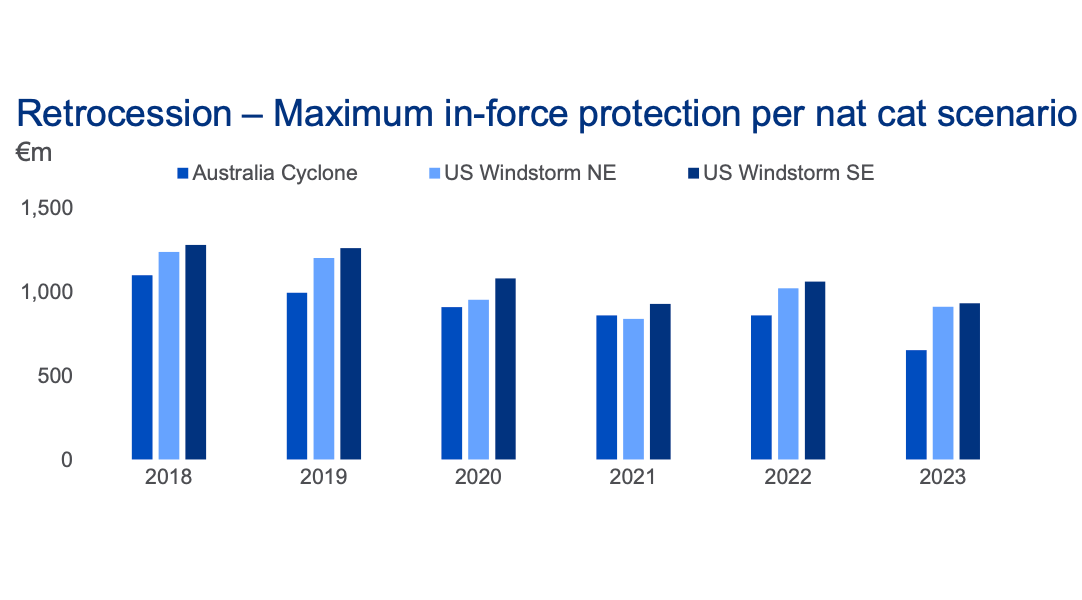

The below graph shows the rough levels of retrocession protection now in place across it’s the reinsurer’s three most protected peak perils, namely Australia cyclone, US northeast windstorm and US southeast windstorm.

While Munich Re has not released precise figures for its retro program, the protection levels show a clear downward trend over the past six year, with all three main coverages now appearing to be below the €1 billion mark, versus 2018 when all were above this level.

Despite the reductions, the reinsurer maintains that its retro purchases for the year should provide it with a “strong” capital base and risk-bearing capacity, as well as stabilisation for its IFRS result and market terms.

Breaking down the multi-format program, Munich Re added that it should provide “material scalability and access to rated-paper capacity, as well as multiple and diverse investment buckets.”

Munich Re’s results show that it incurred major loss costs from natural catastrophe of €2.43 billion for 2022, the costliest of which was Hurricane Ian with losses of roughly €1.6 billion. But despite the high level of catastrophe losses, the company’s P&C combined ratio strengthened from 99.6% in 2021 to 96.2% in 2022.

The reinsurer also grew it nat cat book with an approximately 40% increase in volume written, so will be contending with more catastrophe risk and less retro protection in the coming year.

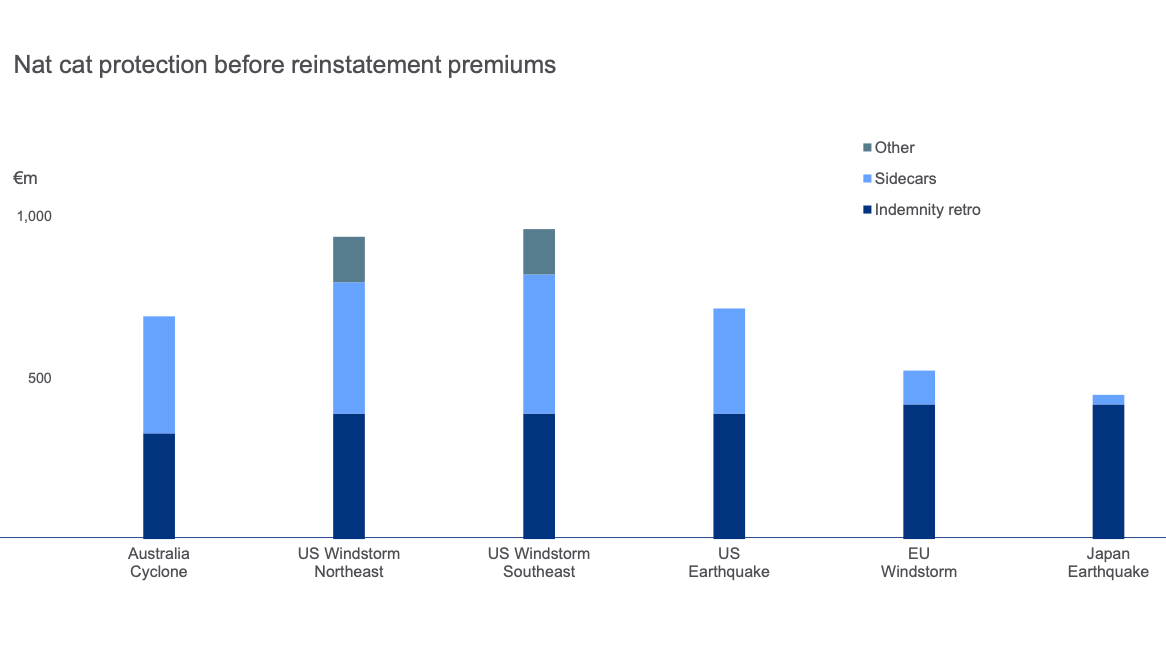

It’s worth noting that Munich Re’s retro program consists not only of traditional coverage but also sidecars, with the company having secured US $513 million in collateralised quota share capacity for 2023.

The sidecar platform will target long-term partnerships with institutional investors, Munich Re said, with pension funds expected to be the predominant partner.

In further details from the graph below, it can be seen that this sidecar capacity in fact accounts for a significant proportion of all Munich Re’s retro covers, and in particular for its three main perils.