The reinsurance market’s strong capital base heading into 2017 is sufficient to manage losses from what’s expected to be the costliest catastrophe loss year on record for the P&C sector, according to reinsurance broker, JLT Re.

For just the third time on record, global insured catastrophe losses in 2017 are expected to surpass $100 billion, driven mainly by the devastating impacts of hurricanes Harvey, Irma, and Maria on parts of the U.S. and the Caribbean, and two strong earthquakes in Mexico, while other adverse weather events across the globe also added to the tally.

Insured losses from the three hurricanes alone could surpass the $100 billion mark, and while previous loss years of this magnitude, as seen in 2001, 2005 and 2011, resulted in a hardening of the market and drove rates higher, the market dynamics heading into 2017 suggest a different outcome heading into the January 1st, 2018 renewals season, according to JLT Re.

In its latest Viewpoint report, winds of change, the reinsurance arm of global brokerage JLT Group, highlights the strong capital base of the reinsurance sector, a result of the entry of traditional and increasingly alternative capital, as a sign that the reinsurance market will be able to better manage the year’s losses, ultimately limiting any rate increases.

Global Head of Analytics at JLT Re, David Flandro, said; “After eight consecutive years of strong capital growth and lacklustre premiums, the reinsurance sector started the second half of 2017 with more capital relative to risk than at any time in recent memory.

“Circumstances today are considerably different to previous large loss years. It must be remembered that in 2001 and 2005, for example, the sector was respectively entering and exiting the liability crisis which, all told, cost carriers hundreds of billions of dollars worldwide. This meant that the sector’s capital position was both lower and more uncertain during these years.”

According to JLT Re estimates, the marketplace entered the 2017 Atlantic hurricane season with excess capital of $60 billion or higher, which suggests that any reduction in P&C sector capital as a result of recent events will likely be manageable, driven by capital generation by large traditional players, and also continued capital inflows from the alternative reinsurance space.

Mike Reynolds, Global Chief Executive Officer (CEO), JLT Re, commented; “Prior to this year’s hurricane season, expectations heading into 2018 were for a softening, but moderating market. But hurricanes Harvey, Irma and Maria brought a decisive end to a five-year period of below-average global catastrophe losses.”

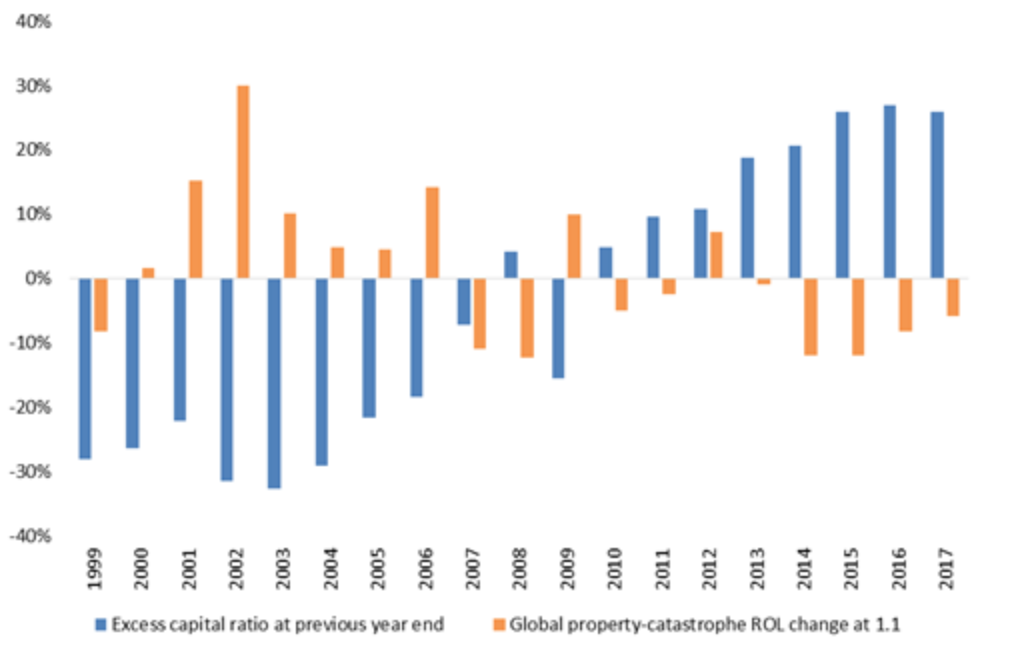

Historically, and as shown by the chart below provided by JLT Re, there’s been a strong correlation between the market’s excess capital ratio and global property/catastrophe pricing, but as mentioned previously, the dynamics of the sector heading into the second-half of the year suggests a different outcome in the weeks and months ahead.

Excess Capital Ratio and Global Property-Catastrophe ROL Index Change – 1999 to 2017

Evidenced by the above chart, JLT Re doesn’t expect there to be a Class of 2017 and, with insured losses of around or above $100 billion, with roughly half of this expected to be covered by reinsurance, 2017 catastrophe events should mainly impact earnings, says JLT Re.

But this doesn’t mean the impact to earnings for some companies won’t be sizeable, and the aggregation of losses for some players could erode excess capital, potentially putting some in a dangerous position heading into the new year.

Many in the sector are hoping for rate increases across the reinsurance sector at the upcoming January 1st renewals, but JLT Re highlights some conflicting drivers. Stating that while catastrophe losses for the year could be record-breaking, strong capitalisation, alternative capital growth, and loss experiences that fall within modelled expectations, is likely to dampen any rate increases.

However, the broker does feel it’s likely that some upwards pressure on rates will be seen in the P&C sector, particularly in loss-affected regions, but, as things stand, any rate increases will likely be more in line with 2011/2012 than 2005/2006, says JLT Re.

“Events over the last couple of months are a stark reminder of how quickly things can change in the world of (re)insurance. This year’s record breaking losses may impact reinsurance rates next year, particularly in loss affected regions. But perhaps more permanent features in the post-2017 environment will centre on risk perceptions and higher loss expectations for future years.

“Growing demand for additional reinsurance protection is already evident and JLT Re is committed to obtaining the best cover and structures available to clients in this new market environment,” said Flandro.