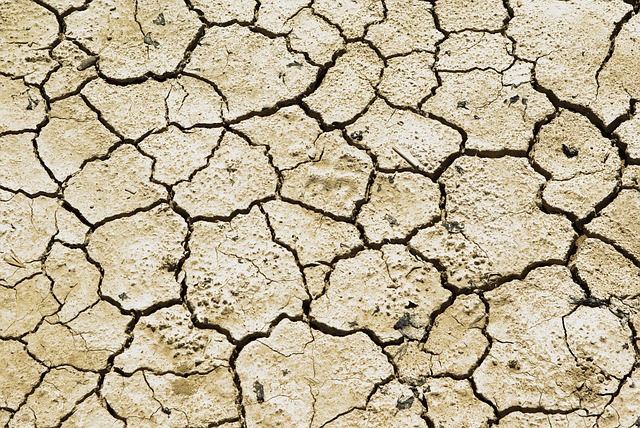

Aholotu Palu, CEO of the Pacific Catastrophe Risk Insurance Company (PCRIC), has said that his firm has been in discussion with stakeholders regarding a parametric drought insurance product with early payout triggers.

Speaking in Egypt during the COP27 climate conference, Palu contributed to a panel that explored innovative solutions in disaster risk finance, and how small island developing states are helping to drive these solutions forward.

Speaking in Egypt during the COP27 climate conference, Palu contributed to a panel that explored innovative solutions in disaster risk finance, and how small island developing states are helping to drive these solutions forward.

Specifically, Palu noted that early payout triggers on parametric policies were a feature of PCRIC’s recent dialogue with stakeholders in Tonga.

“As a result of consultations in Tonga supported by the global risk advisory group, Willis Towers Watson (WTW), our technical team are currently working to include an early trigger for our drought product and to validate the data that has been used for the model,” he commented.

Over the years, there have been multiple discussions on forecast-based financing and anticipatory financing focusing on early triggers as opposed to late triggers for damage payouts.

This means that the availability of funds must be readily accessible before a projected or predicted event, instead of waiting until the disaster has occurred.

For PCRIC, the addition of an early trigger for its drought parametric insurance suggests it will try to have a trigger in place that allows for the protection to be triggered before the full onset of a drought, so based on some signal that a drought is coming.

This is generally considered to be far more useful in enabling countries to respond early and would perhaps even be able to mitigate the impacts of the drought somewhat.

“Early triggers are aligned to anticipatory action which is needed for quick financing support mainly directed towards risk prevention and preparedness when a disaster strikes to avoid loss and damage,” Palu explained during the COP27 panel.

“We endeavour to design our products to support Pacific countries in being proactive against disaster risks and avoid further adding to the enormous burden imposed in the advent of a national crisis,” he added.

Palu also disclosed that this action stemmed from a request from Pacific leaders in 2019, and that the new products are now in advanced stages, with the expectation that they will be released in early 2023.