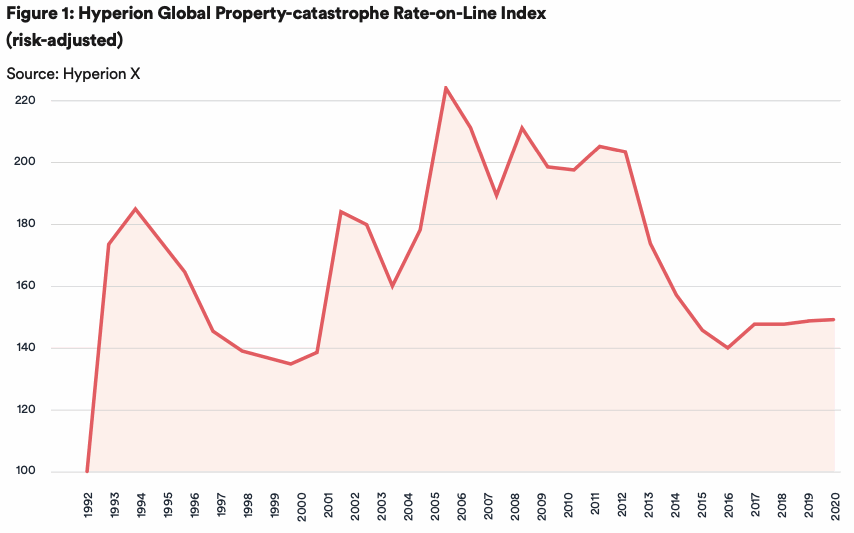

Pricing for property-catastrophe reinsurance remained fairly stable at the January 2020 renewals, with rates-on-line rising 0.8% on average, according to Hyperion X, the data and technology focused unit of the global Hyperion Insurance Group.

The firm noted that property-catastrophe pricing was stable despite more varied results in other lines, including significant volatility in US-exposed retrocession, and mounting inflationary pressures in casualty reinsurance.

Overall, Hyperion X, a data and technology focused division of Hyperion Insurance Group sitting alongside RKH Reinsurance Brokers, felt that the reinsurance and retro markets benefited from plentiful capital and below-average catastrophe losses, offset by diminished investor appetite for some products, a change in reserving trends, and rate adequacy concerns.

For property-catastrophe reinsurance, rates increased by an average of 2% in North America, as insured losses fell markedly in 2019.

In contrast, pricing was flat to marginally down in Europe, Asia, and elsewhere, which has helped to keep rates at a consistent low level for four years now.

Hyperion X explained that these are point estimates within ranges depending on loss experience, exposure, and other client-specific conditions, and mask pockets of significant challenge in terms of price and availability, notably US wildfire-exposed cover.

However, the true test for property cat rates may still be to come in 2020, with the April renewals set to be affect by consecutive accident year losses in Japan, and the June renewals by a Florida market disproportionately served by third party capital.

Analysts noted that it is significant that retro, property cat, and casualty reinsurance rates-on-line are all increasing, albeit on very different trajectories.

And reserving trends, investor appetite, and catastrophe experience could all be important determinants of outcomes at the global level, as well as trends in the primary market.

“The market has continued to show its resilience in an environment of increasingly evident risk factors,” said Elliot Richardson, Chairman of RKH Reinsurance Brokers.

“Given the significant catastrophe losses of 2017 and 2018 and the ensuing capital constraints, our brokers in conjunction with the market have proven their value this year by securing capacity to complete placements at the most favourable terms possible on behalf of our Global clients,” he explained.

David Flandro, Managing Director, Analytics at Hyperion X, also commented: “The market continues to shift from an environment of redundant reserves and abundant capital to one of increasing reserve deficiencies and investor caution.”

“During this phase of the cycle, it is more important than ever that market participants and investors have access to the best information, insights and especially data in order to inform their decision making,” Flandro added.

“Hyperion X are pleased to be able to provide unique access to the most accurate and insightful market data in the business.’