Over the last 25 years, the schism between global insured and economic losses has been steadily widening, a factor that when combined with growing climate, cyber, and geopolitical threat, leaves a dangerous and costly protection gap both in developed and emerging markets.

2016 stats show fast-developing Asian economies were hardest hit; struggling with both high levels of natural catastrophes and low re/insurance penetration.

128 – or over two-thirds of global natural disasters – struck the region, causing $60 billion in economic losses.

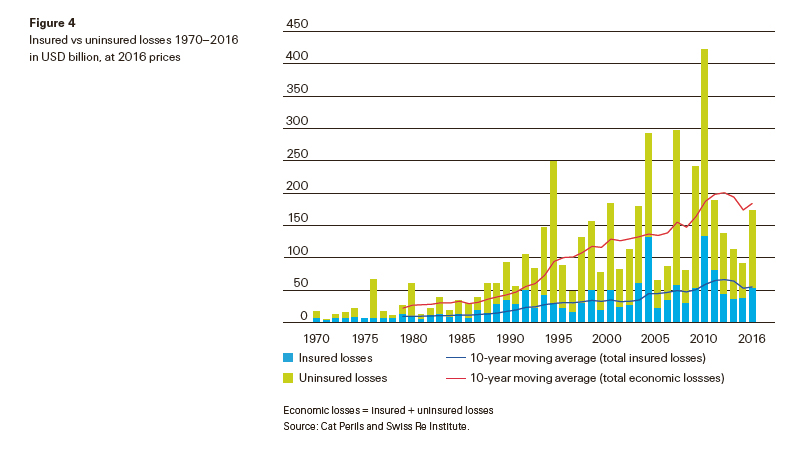

But Swiss Re’s latest sigma report highlighted that a significant and growing protection gap is not just an emerging market, but a global phenomena; “rate of growth of economic losses has outpaced the growth of insured losses over the last 25 years.”

Speaking of the protection gap growth, Swiss Re said; “In terms of 10-year rolling averages, insured losses grew by 4.6% between 1991 and 2016, and economic losses by 5.6%.”

The sigma report explained that this protection gap increase is in part due to a global urbanisation boom – increased city wealth and populations mean the blow dealt to cities in the event of a natural disaster is potentially much higher than it would have been in previous years.

Last year just one third of economic losses were covered by insurance on a global level; insured losses came to $54 billion, leaving a protection gap of $121 billion.

Heavy precipitation triggered major flooding last year across many corners of the globe, however, in the highly developed U.S. markets, the growing flood protection gap posed a serious risk to local economies, Swiss Re said; “Today the majority of US flood coverage comes from the National Flood Insurance Program (NFIP), but the flood protection gap of around USD 10 billion annually shows that even the US remains critically under-insured for flood risk.”

A severe flood in the Baton Rouge region, the State of Louisiana, left 100,000 people displaced, and 50,000 houses, 20,000 vehicles and 20,000 businesses damaged or destroyed.

Swiss Re said although estimated economic losses came to $10 billion, insured losses were at just $3.1 billion.

Hurricane Matthew and the resulting storm surge caused heavy infrastructure damage in Florida and North Carolina, and heavy agriculture damage across the Carolinas, Georgia and Virginia.

The Hurricane’s total economic losses were about $12 billion, with just $4 billion insured – disaster events which underline a large protection gap for U.S. catastrophe insurance that leaves states struggling to cope with post-disaster economic fallout.

Analysis of last year’s insured and economic losses for earthquakes reveal a large protection gap in earthquake coverage; major earthquakes hit Japan, Ecuador, Italy and New Zealand.

“Yes, the earthquake in Ecuador did cause economic losses of USD 4 billion and insured losses of just USD 0.5 billion. But the coverage schism is no less dramatic in many advanced markets. The quake in Japan on the same day resulted in economic losses of USD 25 billion to USD 30 billion, while insured losses were USD 4.9 billion,” stated Swiss Re’s sigma report.

Figures from the insured and economic loss difference from earthquakes in Italy show a similar striking protection gap.

Combined economic losses from 2016 seismic shocks were at $43 billion, but the insured loss figure is at just $9 billion, “signalling a still-large earthquake protection gap.

“The protection gap is a global, not just an emerging market issue,” said Swiss Re.

The sigma report highlighted the gap in knowledge, or acknowledgement, of the extent of the risks governments, economies, and societies face from natural disasters.

“Italy is the eighth largest economy in the world, but just 1% of residential buildings are insured against quake risk. Historically, the state has intervened with ex-post disaster programmes set up under the pressure of the emergency, resulting in long-lasting and much-more-than-budgeted-for reconstruction drives. Public debate regarding the need for increased insurance penetration, or for alternative public solutions, arises in the wake of each disaster. But to date, no associated legislation has been enacted.”

“The low frequency of major earthquakes creates a false perception among exposed populations that earthquakes are not a major risk. This, and the absence of government awareness campaigns, means that the take-up rates of insurance protection remain low,” the Sigma report explained.

The growing protection gap across re/insurance markets signals the global vacuum for greater public-private partnership for sufficient uptake of risk transfer solutions.

Some industry experts have recently echoed the need for re/insurers to take on greater responsibility for raising risk awareness with information campaigns and by making risk modelling data and assessment readily accessible to public and government entities.

Resilience, and selling more comprehensive risk products that focus not only post-disaster relief, but also on lowering levels of risk, has become a hot topic within the insurance industry, and one that is likely to be taken up by the wider private market and government consumer base as entities seek more efficient means of offsetting the protection gap.