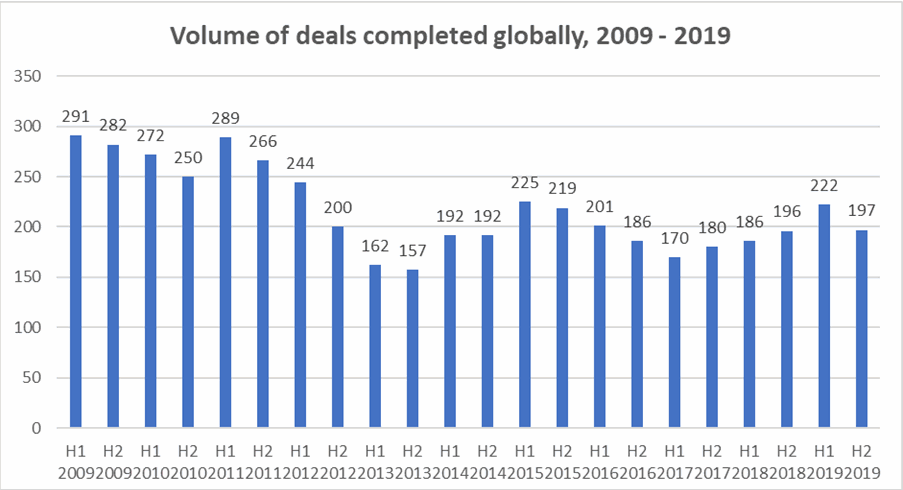

The volume of mergers and acquisitions (M&A) in the re/insurance sector increased by 10% in 2019 with 419 deals completed worldwide, marking a four-year high, according to Clyde & Co.

M&A volume was up from 382 in 2018, buoyed by an exceptionally strong first half of the year, the global law firm said. And while M&A dropped back in the second half of the year it still remained high compared to the levels of recent years.

The Americas continued to be the most active region (182 deals in 2019), down slightly from 189 in 2018, with activity balanced between the first and second halves of the year (93 and 89 transactions respectively).

But Europe saw the biggest year-on-year increase with 155 deals (88 in the first half and 67 in the second), up from 122 in 2018, possibly due to deal activity that had previously been put on hold during Brexit negotiations.

Asia Pacific followed a similar pattern of annual gains with the larger number of deals coming in H1, while the Middle East and Africa saw rises throughout the year, albeit from a low base.

“M&A has surged in the last 12 months,” said Ivor Edwards, European Head of Clyde & Co’s Corporate Insurance Group. “While insurers have had some reasons for cheer in the past year, with reduced natural catastrophe losses and price rises taking hold across a range of classes of business, investment returns are still flat.

“This makes deal making a trusted route to growth and a means of satisfying shareholders,” Edwards added. “Although deal makers in some markets may adopt a more cautious approach, the quick start to 2020 in certain markets suggests there’s more to come.”

Clyde & Co believes that insurtech was the most important driver of M&A in every region last year, with notable investments including $250 million from Munich Re into Next Insurance, $90 million into insurtech Singapore Life from Japan’s Sumitomo Life, and MS Amlin’s purchase of an undisclosed stake in Envelop Risk.

“Technology is now a key consideration in any deal,” said Joyce Chan, a Clyde & Co Partner in Hong Kong. “Potential buyers are thinking how they can improve existing processes as well as develop new ones. They will be looking at targets which can deliver technological benefits at the back end – in terms of greater efficiencies – and enhance their customer reach and offering in the market.”

“With many insurtech start-ups now reaching the point of maturity where their business models are proven, we expect a new wave of investment from carriers through acquisition, joint venture or partnership in the coming year.”

Looking ahead, Clyde & Co predicts that re/insurance business will continue to look at M&A transactions to deliver growth, given that market hardening is not yet at the point where it will have a significant balance sheet impact.

In the first half of 2020, M&A activity is expected to maintain the recent trend level at just under 200 deals worldwide.

“A number of regional factors will impact M&A in 2020,” Edwards continued. “The US presidential election may push some deal-makers to complete transactions ahead of a possible change in administration, while others will plans on hold until uncertainty over the result is resolved.”

“Europe should see a return to business as usual now Brexit preparations are mainly completed but as the details of the future trading relationship between the UK and the EU remain unclear, this may spur transactions during the transition period. In Asia-Pacific the fundamentals are in place for continued M&A, with the caveat that the length and the severity of the Coronavirus outbreak has the potential to deter potential investors and damage insurers’ balance sheets.”