Reinsurance News

AXA issues €1bn of green bonds

7th April 2021

Global insurer AXA has successfully placed €1 billion of subordinated green bonds, which will be issued under AXA Group’s newly established Sustainability Bond Framework. This first green subordinated bond issuance to institutional investors is due 2041 and the initial fixed coupon has been set at 1.375% per annum. AXA reported that investor ... Read the full article

How catastrophe events can affect elections: Q&A with PCS’s Johansmeyer

6th April 2021

So far, there hasn't been a catastrophe that has directly affected a U.S. presidential election, but as highlighted by Hurricane Zeta in October of last year, there's clearly potential for major events to impact society more broadly. In reality, not that many states in the U.S. are prone to large catastrophes ... Read the full article

Amwins acquires Worldwide Facilities

6th April 2021

Amwins Group, the independent wholesale distributor of specialty insurance products in the US, has completed the acquisition of broker Worldwide Facilities. Worldwide is set to compliment Amwins' brokerage, binding authority, underwriting and group benefits capabilities and growth strategy. The acquisition will also strengthen Amwins' casualty and professional lines capabilities, specifically around Construction, ... Read the full article

Ardonagh Global Partners launches, acquires AccuRisk

6th April 2021

Re/insurance broker The Ardonagh Group has announced the launch of Ardonagh Global Partners and its first acquisition in the US. Led by former Chief Executive Officer of Bravo Group Des O'Connor, AGP will look to invest in leading platforms operating in markets and product verticals outside of the UK and Europe ... Read the full article

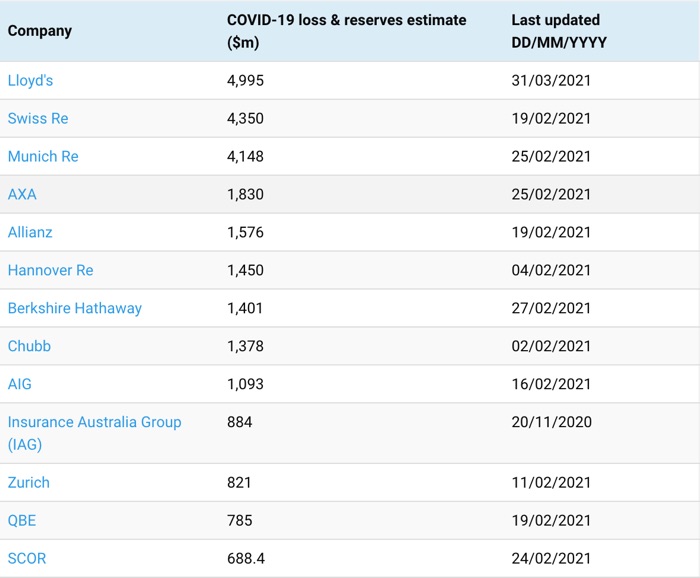

Q4 reporting sees COVID-19 losses jump 21% for re/insurers: PeriStrat

6th April 2021

Overall, publicly reported COVID-19 pandemic-related losses, IBNR reserves and estimates from insurers and reinsurers now stands at just shy of $38 billion, according to data compiled by Zurich-based financial services advisory, PeriStrat LLC. With the fourth-quarter and full-year 2020 results season now complete, COVID-19 loss numbers have, unsurprisingly, continued to trend ... Read the full article

FEMA announces new NFIP rating methodology

6th April 2021

FEMA is updating the National Flood Insurance Program’s (NFIP) pricing methodology in an effort to communicate flood risk more clearly. The US government agency says Risk Rating 2.0—Equity in Action provides actuarially sound rates that are equitable and easy to understand. FEMA will now be able to equitably distribute premiums across all ... Read the full article

HDI Global SE hires new Director of Liability Underwriting

6th April 2021

Primary commercial specialist HDI Global SE, UK & Ireland has appointed Owen Digman as Director of Liability Underwriting. Digman held his previous role as Liability Manager with HDI for eight years. Prior to joining HDI, he held various senior management roles at RSA, Willis Towers Watson and Marsh. This news comes following ... Read the full article

PartnerRe’s 2020 performance validates decision to retain company, says Exor

6th April 2021

In its most recent annual letter to shareholders, Agnelli family owned holding company Exor has said that its decision not to sell PartnerRe last year was validated by the reinsurer's earnings and balance sheet resilience. In March 2020, Exor and Covéa entered into a Memorandum of Understanding (MoU) under which Read the full article

IGI adds Richard Foster to lead property, political violence & contingency lines

6th April 2021

International General Insurance has announced the appointment of Richard Foster to its London office as head of property, political violence lines of business. Foster will also be taking on the newly created contingency insurance line of business. The company is set to launch a contingency line of business to take advantage of ... Read the full article

Athora profits rebound to €700mn

6th April 2021

European life insurance and reinsurance group Athora Holding, Ltd. has reported IFRS profit of €700 million in 2020, from continuing operations before tax. This compares to a loss of €13 million in 2019, with Athora attributing the rebound primarily to the consolidation of Athora Netherlands in April 2020 and a gain ... Read the full article

AXA XL reorganises reinsurance under new entity

6th April 2021

AXA XL has moved to consolidate its reinsurance operations under the newly-formed AXA XL Re entity, in an effort to more easily bifurcate and evaluate the performance of its insurance and reinsurance business segments. AXA XL Re's business will predominantly consist of renewing reinsurance policies previously underwritten by XL Bermuda Ltd. The ... Read the full article

Aeolus names Lancashire’s Andy Richardson as a Portfolio Manager

6th April 2021

Andy Richardson, currently Head of Property Treaty at Lancashire Insurance Company Limited, has been announced as a Portfolio Manager at Aeolus Capital Management Ltd. Richardson will assume his new role following Bermuda immigration approval and after fulfilling his obligations with Lancashire. Before joining Lancashire, he served as a broker at reinsurance brokerage ... Read the full article

Aviva wraps up €453m sale of Italian life venture to UBI Banca

6th April 2021

Aviva has announced the completion of its previously announced 80% shareholding in Italian life insurance joint venture to its partner UBI Banca. Aviva received €453 million in cash consideration, a figure which includes €40 million received for the replacement of a subordinated loan provided by Aviva Italia Holding S.p.A. to Aviva ... Read the full article

Marsh (MMA) acquires Montana-based PayneWest Insurance

6th April 2021

Marsh & McLennan Agency LLC (MMA), the middle market agency subsidiary of Marsh, has announced the acquisition of PayneWest Insurance, a Missoula, Montana-based independent agency. PayneWest, which was founded almost 30 years ago, provides business insurance, surety, employee benefits, and personal insurance services to firms and individuals across the Northwest through ... Read the full article

Helios syndicates improve mid-point forecasts

6th April 2021

Helios, the unique investment vehicle which acquires and consolidates private underwriting capacity at Lloyd's, has announced improved mid-point forecasts for its Lloyd’s syndicates. The current mid-point forecasts are for Helios’ portfolio of syndicate capacity for the 2018 and 2019 years of account based on fourth quarter 2020 estimates. These latest forecasts show ... Read the full article