Reinsurance News

China’s digitisation opening up previously uninsurable risks: Swiss Re

30th August 2019

The digital transformation currently taking place across China is expanding the boundaries of re/insurance and facilitating the development of solutions for previously uninsurable risks, according to a new report from Swiss Re. Swiss Re describes digitisation as the main engine of China’s economy and expects to see exponential sector growth over ... Read the full article

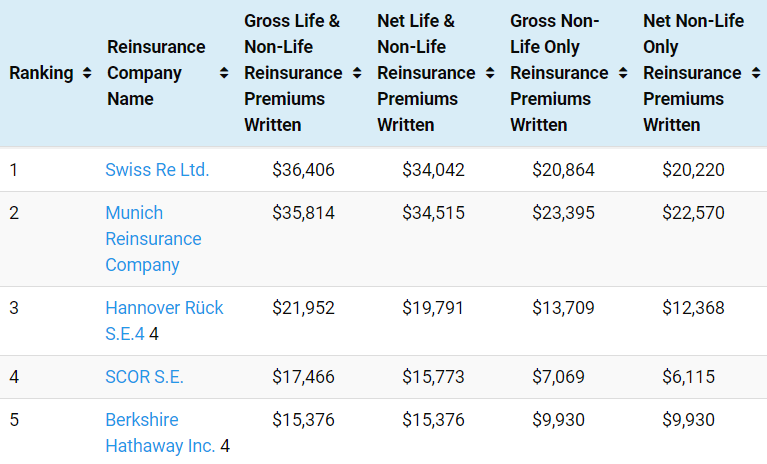

Swiss Re moves above Munich Re as world’s largest reinsurer: AM Best

29th August 2019

Global reinsurer Swiss Re has knocked Munich Re from its position as the world’s largest reinsurer, as measured by year-end gross premiums written (GPW) in 2018, according to AM Best data viewable at our Top 50 Global Reinsurance Groups directory. Munich Re had led the pack every year since ... Read the full article

Dorian set to become Category 4 hurricane, latest forecasts show

29th August 2019

The latest updates from the National Hurricane Center (NHC) forecast that Hurricane Dorian could now strengthen to a Category 4 storm as it approaches Florida, with maximum wind speeds of 115 knots, or 132mph. Dorian continues to track northwest across the Atlantic at roughly 13mph with wind speeds of 85mph, and ... Read the full article

Apollo and Athene to acquire GE Capital’s PK AirFinance

29th August 2019

Apollo Global Management, LLC, Athene Holding Ltd. and GE Capital, have entered into a definitive agreement for Apollo and Athene to purchase PK AirFinance from GE Capital's Aviation Services (GECAS) unit. As part of the agreement, Apollo will acquire the PK AirFinance aircraft lending platform and Athene will acquire PK AirFinance's ... Read the full article

Slight fall in earned premiums for life, health reinsurers in H1 2019: Fitch

29th August 2019

Analysts at Fitch Ratings say that, for life and health reinsurers overall, net premiums earned declined slightly in the first half of 2019, although five of the eight companies monitored by the firm reported higher net premiums earned. Meanwhile, pre-tax income for life and health reinsurance business decreased somewhat in 1H19 ... Read the full article

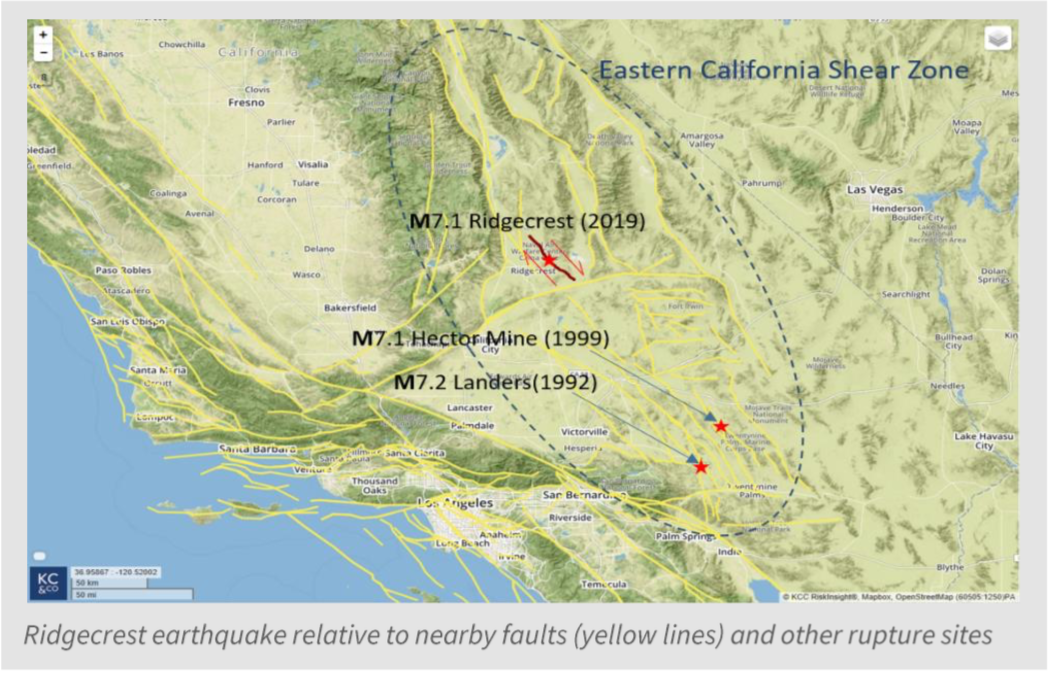

Ridgecrest quakes drive surge in insurance buying, reports CEA

29th August 2019

The California Earthquake Authority (CEA) saw a surge in the number of earthquake insurance policies bought in July, which it believes was driven by the magnitude 6.4 and 7.1 quakes that impacted the town of Ridgecrest and the surrounding region last month. The CEA gained 23,861 earthquake insurance policies in ... Read the full article

Reinsurers should embrace the evolution of the market, says A.M. Best

29th August 2019

Dramatic rate hikes and a subsequent hardening reinsurance market following large catastrophe events is a thing of the past, and reinsurers must embrace change and adapt in order to survive in an evolving industry, warns A.M. Best in a new report. The ratings agency states that the traditional reinsurance market cycle ... Read the full article

ARC, Africa CDC agreement aims to bolster epidemic disease resilience

29th August 2019

Parametric development insurance provider the African Risk Capacity (ARC) has signed an agreement with the Africa Centre for Disease Control (Africa CDC) in a move it says will strengthen resilience to infectious diseases of epidemic nature. The two organisations have for some time been working together on establishing the Africa Epidemic ... Read the full article

Re/insurers’ silent cyber concerns ease in 2019, finds Willis Re survey

29th August 2019

The re/insurance sector is considerably less concerned about silent cyber exposures than it was in 2018, according to an annual global survey by Willis Re, the reinsurance division of broker Willis Towers Watson. Analysts believe that the fall in silent cyber claims expectations could stem from the absence of wide-scale cyber ... Read the full article

Gov-owned AIC looks to offer crop reinsurance services outside of India: Reports

29th August 2019

India's Agriculture Insurance Company (AIC) is in discussions with intermediaries about the launch of crop reinsurance services in countries outside of India, reports Business Standard. According to reports, government-owned AIC has already received approval from the IRDAI (International Regulatory and Development Authority of India) for inward insurance, and is now in ... Read the full article

Divestiture of Chaucer makes The Hanover a desirable M&A target: JMP

29th August 2019

Analysts have said that following the successful takeover of its Chaucer business by China Re, domestic-focused insurer The Hanover Insurance Group is a desirable merger and acquisition (M&A) target longer term. Now that the Chaucer divestiture is complete, the core of the domestic franchise of The Hanover is a small/middle market ... Read the full article

Liberty Specialty Markets names Antoine Brodu Head of Financial Lines, France

29th August 2019

Liberty Specialty Markets, a division of Liberty Mutual Insurance Group, has appointed Antoine Brodu as Head of Financial Lines, France. Brodu's appointment is effective immediately and he joins the firm from AIG France, where he worked for 13 years, most recently as Client Director, Major Accounts. General Manager at Liberty Specialty Markets ... Read the full article

Tesla launches long-awaited insurance product, pulls it within hours

29th August 2019

Elon Musk-led automotive and energy company Tesla has officially announced the launch of its insurance product designed to cut auto policy costs for owners of its electric vehicles. Hours after unveiling the product however, Tesla has pulled the insurance signup page from its website entirely and replaced it with an “algorithm ... Read the full article

Hurricane Dorian: Analysts point to $10bn+ industry loss potential

29th August 2019

Industry analysts are now predicting a potential insured loss scenario of $10 billion to $30 billion as Hurricane Dorian intensifies and continues on its path towards Florida. Dorian has now strengthened to wind speeds of 85mph, and looks set to make landfall on the east coast of Florida as a major ... Read the full article

Munich Re-backed insurtech INSHUR raises further $1.5m

29th August 2019

INSHUR, a 100% digital provider of commercial auto insurance, has raised a further $1.5 million to its Series A funding round from Viola FinTech, part of the Israel-based technology investment group Viola. Backed by global reinsurer Munich Re, INSHUR is a mobile-first provider of commercial auto insurance for private hire ... Read the full article