Reinsurance News

Laurence Liao resigns from Sirius’ board

23rd August 2019

Laurence Liao has resigned from global re/insurance group Sirius International’s Board of Directors and his role as Chair of its Finance Committee. Sirius has stated that Liao made the decision to leave in order to focus on his role at CMIG International Holding. CMIG International is a subsidiary of China Minsheng Investment ... Read the full article

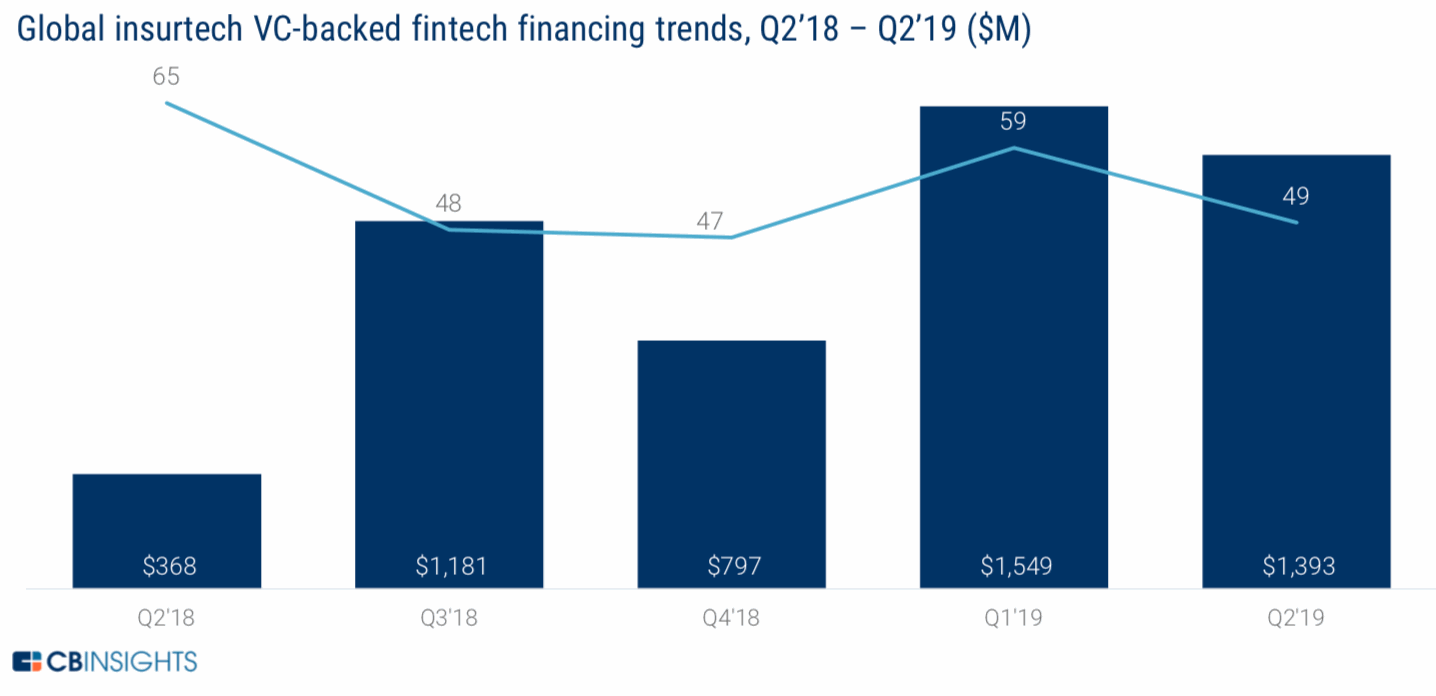

Insurtech funding rises nearly 280% in Q2: CB Insights

23rd August 2019

A handful of very large insurtech funding deals in the second-quarter of 2019 helped to take the total amount of fundraising for the quarter to almost $1.4 billion, which is almost 280% up on the prior year. Data from CB Insights shows that insurtech funding was down slightly on Q1 of ... Read the full article

ABIR announces key regulatory appointments

23rd August 2019

The Association of Bermuda Insurers and Reinsurers (ABIR) has appointed Wendy King as Public Policy & Regulatory Affairs Analyst. Additionally, the firm’s Director of Policy and Regulation, Suzanne Williams-Charles, has been appointed with additional responsibilities as ABIR Corporate Secretary. King, who most recently served as Senior Officer at the BMA’s Policy and ... Read the full article

Trans Re promotes Andy Taylor to regional CUO oversight role

23rd August 2019

Transatlantic Holdings (Trans Re), the reinsurance arm of the Alleghany Corporation, has announced the appointment of Andy Taylor as Chief Underwriting Officer for its London, Continental Europe, Middle East and Asia Pacific businesses. The decision follows numerous changes made recently to its regional leadership teams, including the appointment of Louise ... Read the full article

Industrial cyber vulnerability could spell multi-billion dollar loss for re/insurers

23rd August 2019

Analysis by predictive cyber risk modelling firm Kovrr has warned of the potential for a multi-billion dollar loss to the re/insurance industry stemming from a recently discovered vulnerability in the IoT operating system of a major security company. Kovrr modelled two scenarios in which attackers exploit the URGENT/11 exposure in VxWorks, ... Read the full article

Ryan Specialty Group to acquire hotel-focused program manager

23rd August 2019

Ryan Specialty Group (RSG) has entered an agreement to acquire the assets and operations of The Suitelife, a program manager based in West Chester, PA that specialises in hotels. Founded in 2010, Suitelife offers package, liability, property, umbrella, auto and workers’ compensation coverages to hotels, resort properties and private resort communities. Its ... Read the full article

Asian reinsurers continue to grapple with intense competition: Fitch

22nd August 2019

Reinsurance companies in Asia continue to look at mergers and acquisitions (M&A) and access to alternative capital markets in order to offset intense competition, according to analysis by Fitch Ratings. In a new report, financial services rating agency Fitch notes challenges facing Asian reinsurers driven by high competition to negotiate improved ... Read the full article

EPIC Insurance Brokers adds RBS Re founders to reinsurance unit

22nd August 2019

EPIC Insurance Brokers and Consultants, a retail property and casualty (P&C) broker and employee benefits consultant, has announced the appointment of four ex-RBS Re employees to its growing reinsurance unit, EPIC Reinsurance (EPIC Re). Alex Soria, Tony Rodriguez, Randy Baker and Ken Knopp form a team of healthcare reinsurance specialists who ... Read the full article

Oscar Health announces US expansion

22nd August 2019

US domiciled health insurer Oscar has announced plans to expand its coverage to six new states and a total of 12 new markets in 2020. The move marks the third consecutive year of expansion for Oscar, bringing its total geographic footprint to 15 states and 26 markets. The firm intends to expand ... Read the full article

Stonybrook advises on Florida Peninsula’s $30m senior debt raise

22nd August 2019

Investment banking and reinsurance brokerage Stonybrook Capital has announced its involvement as exclusive advisor to homeowners insurer Florida Peninsula on a senior debt facility of up to $30 million. The transaction is believed to have enabled Florida Peninsula to refinance its existing debt and bolster regulatory capital. "The debt market is an ... Read the full article

Liberty Mutual unit bolsters leadership team with CUO hires

22nd August 2019

US primary insurer Liberty Mutual has announced the appointments of Jon Tellekamp as Chief Underwriting Officer for National Insurance, Excess Casualty, and Doug Manwaring as CUO of National Insurance, Public Entities and Programs. Tellekamp, who has served at Liberty Mutual since 2005, has had roles of increasing responsibility in the energy ... Read the full article

First project to utilise SCOR-backed solar energy cover announced

22nd August 2019

Venture-backed Managing General Underwriter Energetic Insurance has named the first solar energy project to use its EneRate Credit Cover. With initial capacity provided by SCOR Global P&C back in April, the product covers default risk for payments made by businesses, without a public credit rating, that purchase electricity through long-term power ... Read the full article

Marsh strengthens leadership of US, Canada Energy & Power Practice

22nd August 2019

Global re/insurance brokerage Marsh has appointed Amy Barnes and Brad Vescarelli to leadership positions within its US and Canada Energy and Power Practice. Barnes had previously worked to help to shape the newly formed Marsh-JLT Specialty Energy and Power team. She will now report to Pat Donnelly, Head of US and Canada ... Read the full article

Cigna exploring sale of its group benefits insurance business: sources

22nd August 2019

US health insurer Cigna Corp is considering a sale of its group benefits insurance business as part of a shift in focus towards healthcare cover, according to sources at Reuters. Reports from people familiar with the matter said a potential sale of the unit, which offers disability insurance, life, and accidental ... Read the full article

UK motor claims inflation up 8.6% with more pressure to come: WTW

22nd August 2019

Motor claims payout inflation in the UK rose by 8.6% in 2018, with further pressure expected throughout 2019, according to the latest benchmarking analysis from broker Willis Towers Watson (WTW). Analysts found that the average cost per claim now comes in at £4,791, having increased for the fourth consecutive year Gross accidental ... Read the full article