Reinsurance News

Court ruling on Prudential/Rothesay expected to disrupt de-risking plans: Fitch

28th August 2019

A recent UK High Court judgement to block Prudential's proposed £12 billion annuities transfer to Rothesay Life, is a sign that some insurers will likely have to retain business that they hoped to offload, warns Fitch Ratings. The proposed Part VII portfolio transfer from Prudential to Rothesay Life, which followed ... Read the full article

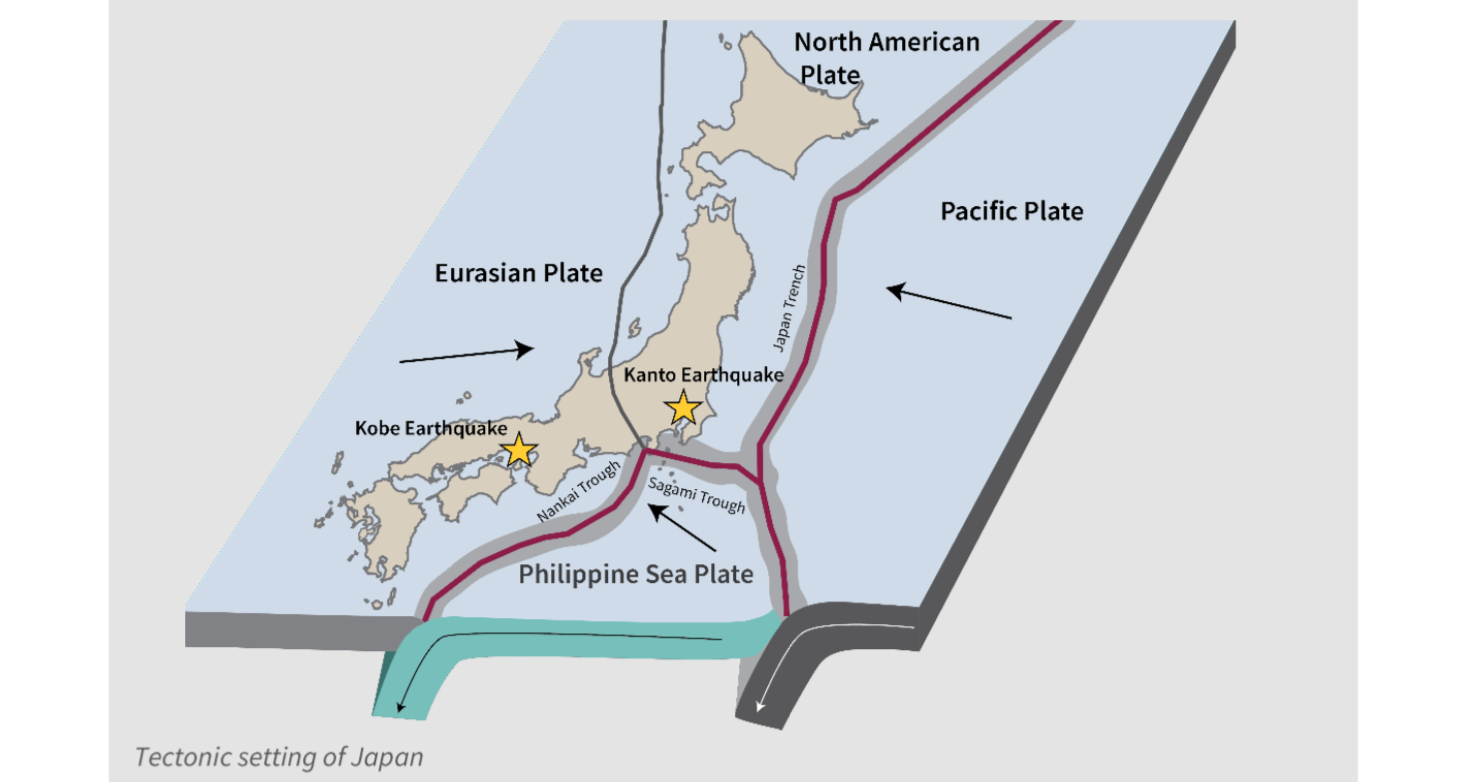

Karen Clark & Co highlights vast loss potential from large Tokyo quake

28th August 2019

Analysis by catastrophe risk modeller Karen Clark & Company (KCC) claims that a large magnitude earthquake event impacting Tokyo could drive overall property losses of more than $3 trillion. Japan's positioning at the juncture of four tectonic plates means it is one of the most seismically active areas of the world. Over ... Read the full article

EU re/insurers push for “level playing field” ahead of ICS adoption

28th August 2019

Two advocacy groups representing EU insurers and reinsurers have called on the European Commission to provide a “global level playing field” ahead of the monitoring period for the Insurance Capital Standard (ICS). Insurance Europe and the Pan European Insurance Forum (PEIF) wrote a joint letter to the Commission’s Vice President, highlighting ... Read the full article

Munich Re’s ERGO Germany implements AI-powered fraud and risk solution

28th August 2019

ERGO Germany, a division of reinsurance giant Munich Re, has completed the implementation of the FRISS solution, an AI-powered fraud and risk solution for the property & casualty (P&C) insurance sector. The implementation enables ERGO Germany with the ability to leverage AI to optimise its portfolio and fasten its claims management ... Read the full article

Liberty Specialty promotes Garside to Head of Bermuda Property

28th August 2019

Liberty Specialty Markets, a division of Liberty Mutual Insurance Group, has announced the promotion of Nicholas Garside to Head of Bermuda Property, effective September 1. Garside, who holds over 15 years’ experience in the insurance space, joined Ironshore Bermuda as Senior Vice President in 2018 prior to its LSM rebrand. Before that, ... Read the full article

Storms, hail & heavy rains drive €1.3bn of losses for German insurers in H1: GDV

28th August 2019

Natural hazards in the first-half of 2019 in Germany, underpinned by storms, hail, lightning and heavy rains, resulted in insured losses of €1.3 billion (USD 1.44 billion), according to the German Insurance Association (GDV). The €1.3 billion loss total represents damages from natural hazards in H1 2019 in Germany to both ... Read the full article

Zurich NA, Wright to launch residential private flood insurance

28th August 2019

The North American arm of global insurer Zurich is partnering with flood insurer Wright National on a stand-alone product, due to launch in Florida on September 3, called Zurich Residential Private Flood Insurance With plans to expand coverage to 11 additional states in the future, the product allows property owners to ... Read the full article

Bank of Montreal (BMO) pulling back on reinsurance, citing climate change

27th August 2019

The Bank of Montreal, which underwrites reinsurance including catastrophe risk exposure through its BMO Reinsurance Limited (BMO Re) vehicle in Barbados, is to pull-back, citing climate change and inadequate returns. During the Bank Of Montreal earnings conference call today, the firms CEO Darryl White explained that after recent heavy catastrophe loss ... Read the full article

Peak Re profits down 55% in H1 despite premium growth

27th August 2019

Hong Kong domiciled reinsurer Peak Reinsurance Company Limited (Peak Re) saw its net profit slide 55% over the first six months of 2019 despite significant premium growth. Peak Re recorded net profit of US $13.5 million in H1 2019, down from $30.2 million for the same period last year and ... Read the full article

HDI SE appoints Stephanie Ogden as Director of UK & Ireland

27th August 2019

HDI Global SE, the industrial insurer of the HDI Group, has announced the appointment of Stephanie Ogden as Director of UK and Ireland operations. Effective September 2, Ogden’s role will see her take responsibility of distribution strategy, broker and client relationship management and marketing. She will also become a member of the ... Read the full article

Argo Surety expands appetite, reshuffles senior leadership

27th August 2019

Specialty underwriter Argo Surety, part of re/insurer Argo Group, has announced a new and increased treasury listing capacity providing the firm with the ability to consider single bonds up to $100 million. Argo Surety has also expanded its appetite to support eligible customers for an aggregate surety bond program of up ... Read the full article

US P&C underwriting income declined 9.6% in H1, reports AM Best

27th August 2019

The US property and casualty (P&C) industry’s net underwriting income declined by 9.6% to $4.8 billion in the first half of 2019, according to a new report from AM Best. The rating agency found that underwriting income was down from $5.3 billion for the same period in 2018, based on companies’ ... Read the full article

Manulife partners with insurtech Blink on parametric flight insurance

27th August 2019

Canadian multinational insurer Manulife has signed an agreement that will see a suite of parametric travel disruption insurance solutions, provided by travel insurtech Blink, to its customers. Blink's solutions offer a real-time service designed to ease the stress of a flight delay or cancellation by providing instant payment when a flight ... Read the full article

China Re launches nation’s first commercial earthquake cat model

27th August 2019

China Reinsurance Corporation (China Re) has launched a new proprietary commercial earthquake catastrophe model for China, which aims to benefit the country’s re/insurance sector through improved costs and accuracy. China Earthquake Catastrophe Model v2.0, which has been certified by the Seismological Society of China, is also expected to fundamentally change the ... Read the full article

Lockton appoints Teegarden as Senior VP, Client Exec

27th August 2019

Global re/insurance brokerage Lockton has announced the appointment of Andrew Teegarden as Senior Vice President, Client Executive. Teegarden brings over 16 years’ experience to the role and joins from Aon, where he served as a Senior Vice President responsible for risk management clients across multiple industries. Prior to Aon, he spent three ... Read the full article