Reinsurance News

AIG working on sale or deconsolidation of legacy play Fortitude Re

17th May 2019

Global primary insurance giant AIG is actively working on some kind of a sale or deconsolidation of the legacy book and run-off play Fortitude Re, as it seeks to go further than a simple separation of the start-ups operating model from the parent. AIG officially launched the legacy and run-off ... Read the full article

Property cat business expected to drive underwriting profit at Third Point Re

17th May 2019

As hedge fund-backed reinsurer Third Point Re continues to build and evolve its underwriting platform, which now includes property catastrophe reinsurance business, it expects to achieve underwriting profitability within the next year or so, according to Dan Malloy, Third Point Re's Chief Executive Officer (CEO). The hedge fund-backed reinsurer adopts an ... Read the full article

Mexico showing strong re/insurance growth despite regulatory concerns: A.M. Best

17th May 2019

A.M. Best believes that Mexico continues to offer significant growth opportunities for re/insurers and has even benefited from the introduction of the Solvency II framework, which some anticipated would be a limiting factor for the market. The rating agency noted that premium growth has been inconsistent since the regulatory system was ... Read the full article

Bermuda removed from EU tax blacklist

17th May 2019

Bermuda has been removed from the European Union’s (EU) list of non-cooperative jurisdictions after implementing commitments to address concerns about its tax transparency. The island nation and global reinsurance hub was added to the list alongside 14 other countries last month for failing to comply with good governance standards on ... Read the full article

Ping An growth helps China overtake as most valuable insurance market: Brand Finance

17th May 2019

China has overtaken the U.S as the largest global insurance market in terms of brand value, according to valuation consultancy Brand Finance, in part due to the continued growth of Chinese insurance giant Ping An. Ping An, which outpaced Allianz to become the world’s most valuable insurance brand in 2017, grew ... Read the full article

Deutsche Rück profits up in 2018 despite underwriting loss

17th May 2019

German re/insurer Deutsche Rückversicherung AG (Deutsche Rück) reported a net profit of €56.0 million, after tax, in 2018 despite turning an underwriting loss, partly driven by claims from weather events such as Storm Friederike/David. The improved result, which was well above the net profit of €3 million recorded in 2018, was ... Read the full article

Munich Re member firm HSB announces cyber cover for farmers

17th May 2019

Munich Re member firm The Hartford Steam Boiler has announced a new cyber solution designed to help protect farmers and farm technology from hackers, malware and other cyber attacks. HSB Farm Cyber Insurance protects farmers against cyber attacks involving computers and electronic devices located on the farm premises, including the farm ... Read the full article

David McMillan departs QBE to become CEO at esure

17th May 2019

esure Group plc has announced that David McMillan, current Group Chief Operating Officer at QBE, is to join the company as Chief Executive Officer (CEO) in August 2019. McMillan joined QBE in September 2017 and has since been based in the re/insurer’s London office. Prior to this, he was CEO for Europe ... Read the full article

A.M. Best revises Third Point Re outlook to negative

17th May 2019

International financial services ratings agency, A.M. Best has revised the rating outlooks to negative from stable of Third Point Reinsurance Ltd. and its subsidiaries, in light of the firm's inability to produce an underwriting profit. At the same time, A.M. Best has affirmed the Financial Strength Rating of A- (Excellent) and ... Read the full article

Aon invests in Global Reinsurance Clients unit, adds executive team

17th May 2019

Global insurance and reinsurance broker Aon has announced a number of organisational changes within its Global Reinsurance Clients team, which launched in 2014 and forms part of its Reinsurance Solutions operation. Currently, Aon's Global Reinsurance Clients team supports 25 large, global insurance companies, providing firms with a service to accelerate their ... Read the full article

Korean Re sets up Swiss reinsurance branch

17th May 2019

Korean Reinsurance Company (Korean Re), the Seoul-based reinsurer, has established a new branch in Zurich, Switzerland, as part of a push to expand into the European market. The subsidiary, called Korean Reinsurance Switzerland AG, is licenced to start reinsurance business from June 1, 2019, the company disclosed. It will be led by ... Read the full article

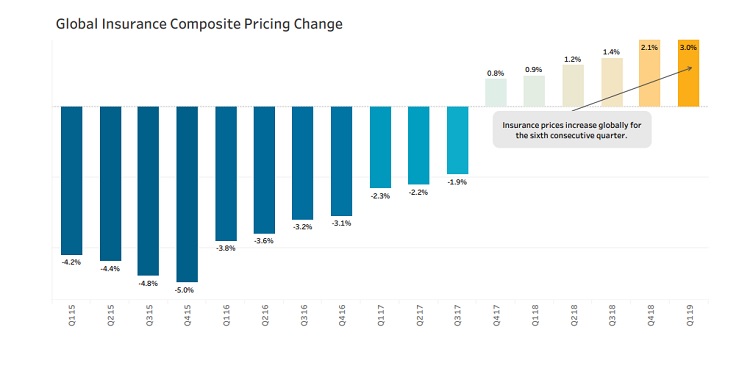

Commercial insurance prices continue growing at Q1, finds Marsh

17th May 2019

Global commercial insurance prices increased by 3% during the first quarter of 2019, according to data from re/insurance broker Marsh, marking a sixth consecutive quarter of price increases. Marsh also noted that the rate of growth in commercial insurance prices was at its highest since it began its survey in 2012. Regionally, ... Read the full article

Allstate posts catastrophe losses of $290mn for April

17th May 2019

The Allstate Corporation has announced that its estimated catastrophe losses for the month of April 2019 were $290 million, pre-tax ($229 million, after-tax). Two wind/hail events, which primarily impacted Texas, accounted for approximately 70% of the month’s catastrophe losses, Allstate revealed. The insurer was impacted by seven catastrophe events in April, which ... Read the full article

Warmer climate is driving higher re/insurance costs: Swiss Re report

16th May 2019

Rising global temperatures due to climate change have heightened the risk of costly events such as wildfire and drought and significantly impacted the level of re/insurance industry losses in recent years, according to the latest sigma report by Swiss Re. Swiss Re expects that climate change will cause more frequent occurrences ... Read the full article

Victor adds Anthony Stevens as President of international operations

16th May 2019

Victor Insurance Holdings, the Managing General Underwriter previously known as The Schinnerer Group, has announced the appointment of Anthony Stevens as President of Victor International, effective immediately. In his new role, Stevens will oversee the advancement of Victor’s insurance strategy outside of North America. He succeeds Paul Drake, who previously announced his ... Read the full article