Reinsurance News

LMG adds Jardine and Wilson to Board

6th February 2017

The London Market Group (LMG) has announced that it's added Paul Jardine of XL Group and Matthew Wilson of Brit to its Board. Jardine serves as Executive Vice President and Chief Experience Officer of XL Group and was previously Chief Operating Officer (COO) at Catlin, and now has responsibility for XL's ... Read the full article

Reinsurance News – Monday 6th February 2017

6th February 2017

Here’s your daily Reinsurance News for Monday 6th February 2017: Challenging for Western EU reinsurers to deploy excess capital: A.M. Best Ratings agency A.M. Best has said that insurers and reinsurers across Western Europe have been able to increase their capital positions thanks to the abundance of industry capital, ... Read the full article

Indian regulator calls for reinsurers to report overseas transactions

3rd February 2017

The Insurance Regulatory and Development Authority of India (IRDAI) has called on reinsurance companies to submit details of reinsurance transactions that involve overseas firms. In a recent note, the IRDAI, which is the country's insurance and reinsurance industry regulator, said that "it has been brought to the notice of the Authority that Reinsurance/Composite ... Read the full article

Neil Perry joins broker Ed from Willis Towers Watson as CFO

3rd February 2017

Reinsurance broker Ed has announced the appointment of Neil Perry, previously of Willis Towers Watson, as Group Chief Financial Officer (CFO). Perry, who has 30 years of financial management experience, is set to take over the role from outgoing CFO Russell Benzies and will report to Chief Executive Officer (CEO) Steve ... Read the full article

Run-off market to double in 2017: DARAG

3rd February 2017

Run-off specialist DARAG has predicted legacy transactions will reach ground-breaking heights in 2017 as current market trends and pressures drive the sector’s rapid growth. DARAG Group Chief Executive Officer (CEO), Arndt Gossmann, called 2016 an “unprecedented year for run-off, both in number of transactions and volume,” and said this year will bring ... Read the full article

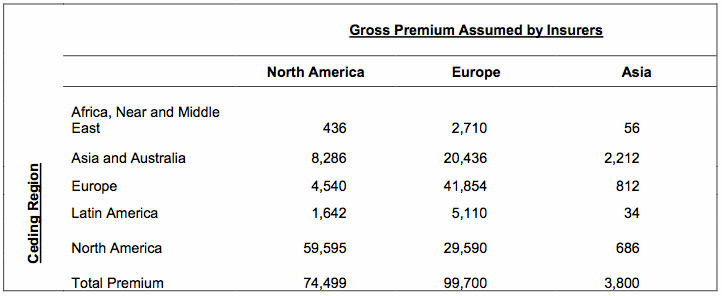

Differences in regional reinsurance ceding patterns highlighted in new data

3rd February 2017

How insurance companies cede their risk and what region the reinsurance firm it is ceded to is domiciled in has been highlighted in some new data from the International Association of Insurance Supervisors (IAIS). Globally diversifying risk is key to the success of the insurance and reinsurance markets, but patterns for ... Read the full article

Lloyd’s insurers to experience a positive 2017: RBC

3rd February 2017

RBC Capital Markets analysts have forecasted a positive and profitable coming year for Lloyd’s of London players, despite market conditions worsening in 2016. The analysts examined the key full-year 2016 issues facing Lloyd’s re/insurers, and said that firms will utilise reinsurance capacity to limit their net exposure and grow their gross written ... Read the full article

Everest Re announces new Insurance Claims Operation leader

3rd February 2017

Reinsurer Everest Re today announced that Megan Watt has joined the group as the new leader of its Insurance Claims Operation. Megan will oversee all aspects of the Insurance Claims Operations, reporting directly to Jonathan Zaffino, President of the North America Insurance Division. Jonathan Zaffino welcomed Megan to Everest; "Throughout her accomplished ... Read the full article

Challenging for Western EU reinsurers to deploy excess capital: A.M. Best

3rd February 2017

Insurers and reinsurers across Western Europe have been able to bolster their capital positions thanks to the abundance of efficient traditional and alternative reinsurance capital, but the ability to deploy excess capacity in an extremely competitive marketplace remains, according to A.M. Best. International financial services rating agency, A.M. Best, in a ... Read the full article

Reinsurance News – Friday 3rd February 2017

3rd February 2017

Here’s your daily Reinsurance News for Friday 3rd February 2017: Hannover Re increases sidecar use at 1/1, secures additional retro cover At the recent January 1st renewals Hannover Re increased its use of its K-Cessions retrocessional sidecar vehicle, purchased additional retro cover for large nat cats, and also saw growth ... Read the full article

Gulf Re goes into run-off, ratings removed by A.M. Best

2nd February 2017

International rating agency A.M. Best has withdrawn the ratings of Gulf Reinsurance Limited (Gulf Re). The Dubai-based company is in run-off and ceased writing new business from November 1st, 2016. Gulf Re, a subsidiary of Arch Reinsurance Ltd (Arch Re) operated as a specialist reinsurance company, underwriting a portfolio mainly made ... Read the full article

ACR completes acquisition of ACR Malaysia and ACR ReTakaful

2nd February 2017

Reinsurer ACR Capital Holdings today announced the completion of its acquisition of Asia Capital Reinsurance Malaysia and ACR ReTakaful Holdings. The acquisition will see ACR Malaysia and ACR ReTakaful, including operating entities ACR ReTakaful Berhad in Kuala Lumpur and ACR Re Takaful MEA B.S.C. in Bahrain, operate as wholly owned subsidiaries ... Read the full article

XL grows reinsurance book despite reduced pricing

2nd February 2017

Insurer and reinsurer XL Group increased its reinsurance segment gross premiums written (GPW) by a substantial 159.5% in Q4 2016 when compared with the previous year's quarter, despite pricing in the industry being down. The re/insurer has released its fourth-quarter and full-year 2016 results, which reveals an increase in P&C GPW ... Read the full article

Charles Taylor opens Latin America captive office, hires Arch Re exec

2nd February 2017

Charles Taylor has opened a new office in Panama in a move that expands its captive insurance services' capabilities across Latin America, and has appointed Alvaro Ortiz, formerly of Arch Reinsurance, Bermuda, to lead the new office. Ortiz joins the company as President and Chief Executive Officer (CEO of Charles Taylor RSLAC Inc., ... Read the full article

Swiss Re collaborates with SAP to improve re/insurance reporting tools

2nd February 2017

International insurer and reinsurer Swiss Re has announced a partnership with enterprise application software company, SAP SE, to create a solution that tackles complex issues related to financial steering and reporting of insurers and reinsurers from regulators. The new partnership, described by Swiss Re as "a strategic co-innovation initiative" aims to ... Read the full article