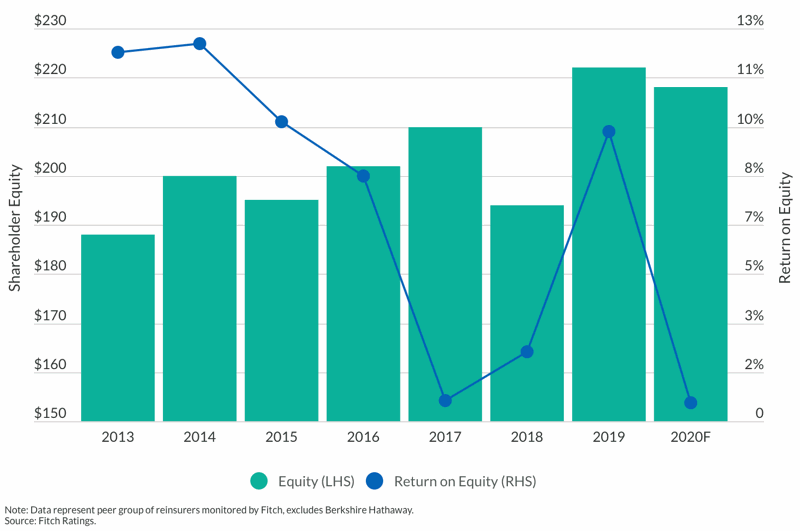

Analysts at Fitch Ratings have forecast that losses from COVID-19 will severely limit reinsurer’s profitability in 2020, with overall return on equity forecast at just 0.6% for the year.

This would be a major downturn compared with the 9.6% return on equity reported by the market last year.

Instead, levels would be closer to those reported in 2017 and 2018, when reinsurer return on equity was at 0.7% and 2.3%, respectively.

Prior to this, returns had fallen steadily each year, according to Fitch, moving from 12.5% in 2014, to 9.9% in 2015, and then 8.1% in 2016.

But despite this, shareholder equity continues to remain at a solid level, with Fitch projecting LHS of $218 for 2020, down only slightly from the $222 reported last year.

The rating agency maintained its stable rating outlook on the global reinsurance and North American P/C insurance sectors in March, based on a view that favourable capital adequacy levels will allow the vast majority of insurers to withstand the pandemic fallout.

However, Fitch moved the fundamental sector outlook for both sectors to negative on weaker profit fundamentals and an expected decline in investment and operating performance.

But it noted that capital levels have remained robust as companies have managed downside risk more effectively than in the past, unlike the fallout after Sept. 11 terrorist attacks, which led to a string of insolvencies.

Alongside this analysis, Fitch warned that the recent influx of underwriting capacity could halt reinsurance pricing momentum beyond 2021.

Hardening rates were observed widely at the June renewals, following years of accumulating catastrophe losses, investment market losses, and fallout from the COVID-19 pandemic.

In response, an estimated $5 billion or higher of new equity funds have been raised in the last few months, as companies such as RenRe, Hiscox, Beazley and Lancashire look to take advantage of the improved pricing conditions.