Reinsurance broker Willis Re has reported that reserve releases remained substantial over 2017, as reinsurers attempted to buoy net income and offset 2017 natural catastrophe losses with high prior year releases.

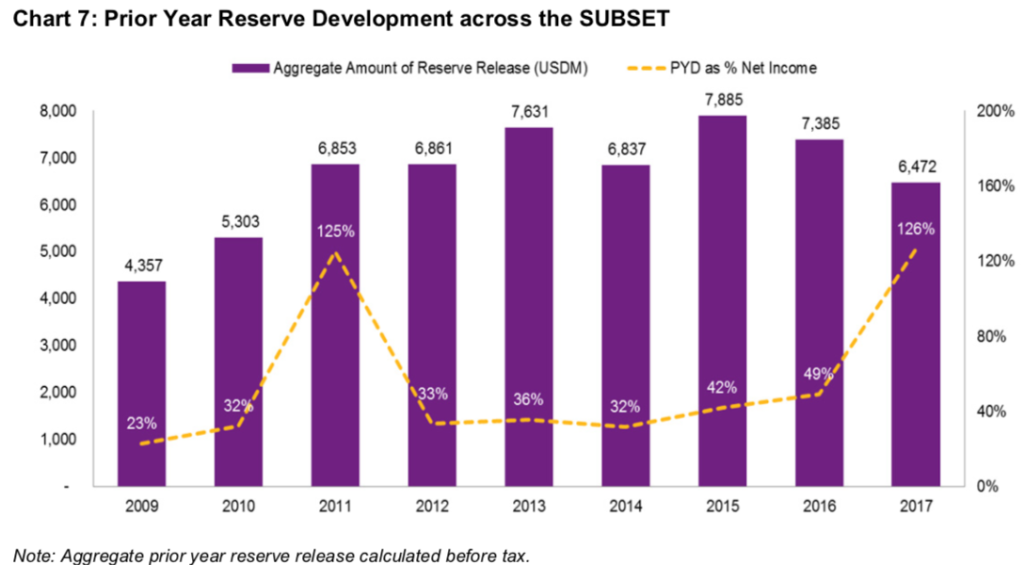

The company’s April 2018 Reinsurance Market Report found that SUBSET constituents – companies it tracks that disclose catastrophe losses and prior year reserve releases – generated almost three times as much of their net income from reserve releases in 2017 compared with 2016.

However, overall reserve releases for the year were down from 2016 due in part to the Ogden rate change.

However, overall reserve releases for the year were down from 2016 due in part to the Ogden rate change.

Shareholders’ funds also increased by 7.8% to $371 billion due to net income of $12 billion and unrealised investment gains of $34.7 billion, which were not reported within net income.

Additionally, the report found that the return on equity (RoE) for the Willis Reinsurance Index deteriorated significantly from 8.0% to 3.4% due to the impact of natural catastrophes losses, which were partly offset by realised investment gains of $9.7 billion, up from $7.0 billion in 2016.

The SUBSET exhibited significant support from prior year reserve releases at 2.9 percentage points, with potential downward pressure on RoEs expected over 2018 if the quantum of prior year reserve releases or realised investment gains reduces.

It was also found that high prior year reserve releases in the SUBSET were used to offset significant deterioration in combined ratios due to 2017’s severe natural catastrophe losses.

It is believed across the industry that reserves are dwindling for reinsurance market players, suggesting that companies will find it increasingly difficult to offset poor underwriting returns with high reserve releasing.