The reported return on equity (RoE) for the Willis Reinsurance Index declined from 8% at the end of 2016 to 3.4% at year-end 2017, as higher natural catastrophe losses and a rising expense ratio contributed to diminished profitability, underlined by a combined ratio of 104.8%, according to Willis Re.

The reinsurance arm of international brokerage Willis Towers Watson, Willis Re, has released its April 2018 Reinsurance Market Report, which reveals profit deterioration in light of high nat cat losses for the group of reinsurers it tracks via its Willis Reinsurance Index.

The report also details the performance of a SUBSET of reinsurers, which Willis Re describes as “those companies that make the relevant disclosure in relation to cat losses and prior year reserve releases,” and which account for 49% of the aggregate capital INDEX.

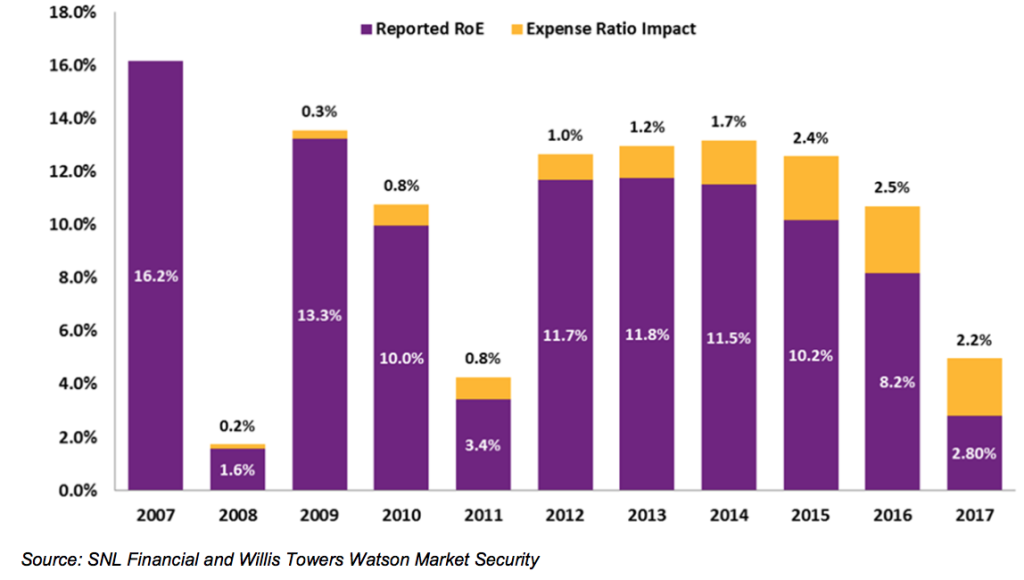

According to Willis Re’s analysis, the RoE for the Index fell to 3.4% in 2017, while the RoE for the SUBSET declined from 10.2% at year-end 2015 to 8.2% at year-end 2016, before declining further to just 2.8% at the end of 2017.

For the SUBSET, Willis Re explains that higher expense ratios over the last decade has contributed to such a steep decline of the RoE.

In 2017, the expense ratio for the SUBSET actually declined slightly from 33.2% to 32.5%, year-on-year, although Willis Re explains that this was flattered as a result of rising reinstatement premiums in 2017.

However, since the end of 2007 the aggregate expense ratio for the SUBSET has actually increased by 3.3%, and Willis Re states that were reinsurers that make up the SUBSET able to maintain expense ratios at 2007 levels, the aggregate SUBSET RoE of 2.8% at year-end 2017 would have been roughly 2.2% higher, so somewhere around the 5% mark.

The chart below, provided by Willis Re, details the impact of expense ratio movement on RoE (base year – 2007) for the SUBSET.

Willis Re’s latest reinsurance market report also discusses the combined ratio of both the Index and the SUBSET, revealing that higher natural catastrophe losses and a lower net income resulted in a combined ratio for the Index of 104.8%, compared with 94.4% at year-end 2016.

For the SUBSET the combined ratio weakened considerably, from 92.9% at the end of 2016 to 107.4% at year-end 2017, which Willis Re attributes to an additional 13.4% impact from natural catastrophe events.

2017 was a challenging year for reinsurers, as natural catastrophe losses spiked on the back of prolonged market softening and the growing influence of alternative reinsurance capital. Willis Re reports that companies continue to utilise high levels of prior year reserves to offset deteriorating underwriting results, something that is likely unsustainable in current market conditions.

With rates increasing at the January renewals, albeit less than many hoped for, and the fact upward trend momentum is expected to persist through 2018, it will be interesting to see if reinsurance companies can reverse some of the negativity experienced in 2017, and ultimately push up the industry RoE and get the combined ratio back into profitable territory.