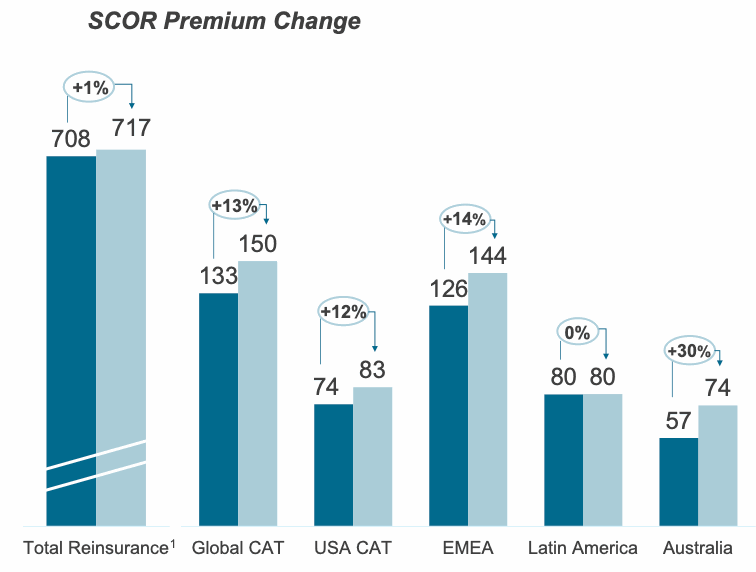

Global insurer and reinsurer SCOR’s gross reinsurance premiums grew 1.3% from €708 million to €717 million at the mid-year renewals, as the company took advantage of continued market hardening.

The re/insurer notes “strong price growth momentum,” reporting overall 8.2% price increases across its renewal book at the mid-year, with improvements materialising across geographies and lines of business.

According to SCOR, this reflects “the beginning of a “hard” market in treaty reinsurance,” a trend the company is anticipating to continue at the January 1st, 2021 renewals season, with COVID-19 serving as a main driver.

Broken down by segment, and SCOR reveals that it recognised 13% growth in its renewal book for global catastrophe business; 12% growth for USA catastrophe business; 14% growth in its EMEA renewal book; 30% growth in Australia; while Latin America business remained flat.

The image below, provided by SCOR, shows the outcome of the reinsurer’s June-July renewals.

Commenting on its renewal book in the U.S., SCOR notes that market dynamics are improving, “with double-digit rate increases and firming terms & conditions. SCOR Global P&C kept a prudent approach, growing on CAT driven segments where rates outpace loss cost increases and reducing on treaties with insufficient underwriting profitability improvement.”

The reinsurer also highlights a strong renewals outcome in its EMEA book, “with growth reflecting a combination of rate increases, incremental shares on renewing programs, and notable new business.”

In Latin America, SCOR says that the renewals were broadly flat while rates improved on contracts and geographies in need of large capacity. In Australia, SCOR says that a successful renewal included strong growth, increase in catastrophe pricing, and also notable non-cat new business.

“Overall renewed premium estimates were directly affected by the current Covid-19 crisis, especially proportional treaties on activity related lines of business such as Credit & Surety and Motor,” says the reinsurer.

The renewals commentary forms part of the reinsurer’s second-quarter 2020 results presentation, in which SCOR reported a net loss of €136 million as the estimated cost of the COVID-19 pandemic booked in Q2 reached €456 million.