Reinsurance News

Mapfre

Pandemic triggers 12% contraction in LatAm market, MAPFRE finds

31st December 2021

The Latin American insurance market registered an 11.9% decrease in premiums during the year of the pandemic, to $134.4 billion, according to new data from MAPFRE. Of the total premium figure, 57% came from non-life insurance and the remaining 43% from life insurance, MAPFRE reported. The sector’s contraction was caused mainly by ... Read the full article

MAPFRE sells Bankia stake to Caixabank in €571m deal

30th December 2021

Spanish insurer MAPFRE has agreed to terminate its bancassurance agreement with Caixabank, following a change in ownership last year. The agreement sees MAPFRE sell its 51% stake Bankia’s insurance business in a deal worth €571 million, with the potential for an additional €52 million from an arbitration process. Caixabank, which took over ... Read the full article

MAPFRE highlights reinsurance growth as group hits €20bn in 9M revenues

29th October 2021

Spanish re/insurer MAPFRE has reported favourable growth of 14.5% within its reinsurance business, citing it as contributing factor in the overall group’s 6.4% increase in net earnings. MAPFRE RE contributed more than €95 million to earnings, compared to losses of €20 million for the same period in 2020, mainly related to ... Read the full article

Everything points in the same direction – further hardening: MAPFRE RE CUO San Basilio

16th September 2021

While rate momentum has slowed somewhat throughout 2021, the current favourable reinsurance market environment is expected to persist into 2022 amid ongoing pressures from the pandemic, natural catastrophes and social inflation, according to Javier San Basilio, Chief Underwriting Officer (CUO) for MAPFRE RE. In a recent interview with Reinsurance News, San ... Read the full article

Mapfre’s combined ratio falls to 95.1% in H1

27th July 2021

Spanish re/insurer Mapfre has released its H1 2021 results, showing an improved combined ratio of 1.6 points to stand at 95.1%, compared to 96.7% from the year prior. The group’s premiums grew by 6.2% in the first six months of the year, reaching almost €11.7 billion. It also announced its earnings have ... Read the full article

MAPFRE reports 36.7% attributable earnings growth in Q1

29th April 2021

Improved business in Spain, LATAM South and North America, in addition to an upturn in its reinsurance segment has helped MAPFRE secure €109 million in attributable earnings during the first quarter of 2021. MAPFRE considers this 36.7% growth particularly significant following the €109 million cost of COVID-related claims shouldered during the ... Read the full article

MAPFRE eyeing solvency ratio close to 200%

16th March 2021

Spanish re/insurer MAPFRE has stated that its solvency position currently reflects a ratio of 183.5% as at the end of 2020. However, the company expects to receive approval from the Spanish supervisor for the internal model for calculating longevity risk within the Group, which would elevate the ratio above 190%. Furthermore, the ... Read the full article

MAPFRE forecasts 3% premium growth for 2021

15th March 2021

Spanish re/insurer MAPFRE is forecasting premium growth of 3% over 2020, as well as net earnings of more than €700 million. It is also targeting a combined ratio of 95% for the year, and a return on equity of around 8.5%. For 2020, MAPFRE recorded an operating result of €658 million with ... Read the full article

MAPFRE RE reports €80mn COVID hit

11th February 2021

Spanish re/insurer MAPFRE has released its results for 2020, which include an €80 million hit to its reinsurance business from COVID-19. MAPFRE RE incurred a further €68 million in losses due to earthquakes in Puerto Rico but still managed to achieve slight growth (0.2%) in net earnings over 2020, which amounted ... Read the full article

China, US and India have highest insurance potential: MAPFRE

1st December 2020

According to the latest Global Insurance Potential index by MAPFRE Economics, China, the US and India currently rank top of the table of countries, both in terms of life and non-life lines. MAPFRE’s index looks at 96 insurance markets around the world to measure the insurance protection gap and create a ... Read the full article

MAPFRE Salud ARS launches in the Dominican Republic

27th November 2020

Insurer MAPFRE has announced that following its 51% acquisition of health insurer, ARS Palic, earlier this year, the Dominic Republic domiciled insurer has now rebranded as MAPFRE Salud ARS. The acquisition was announced in February this year, and aims to strengthen MAPFRE’s position in the country whilst leaving the León ... Read the full article

MAPFRE’s revenue falls 12% in first nine months of 2020

30th October 2020

Spanish re/insurer MAPFRE has reported a revenue of €19.1 billion euros for the first nine months of the year, an 11.9% decrease compared to the same period in 2019. Premiums also dropped 11.9% to €15.6 billion. Earnings came in at €450 million, a 2.7% drop compared to the first nine months of 2019. The insurance unit saw ... Read the full article

MAPFRE partners with insurtech Shift on customer claims experience

20th October 2020

MAPFRE is set to create a new claims process supported by technology from claims automation firm Shift. The Spanish insurer will leverage Shift’s end-to-end claims automation solution in an effort to deliver a more friendly and transparent experience for clients. Shift has joined MAPFRE's startup engagement program insur_space and over the coming ... Read the full article

MAPFRE RE unveils Javier San Basilio as CUO

1st October 2020

MAPFRE RE, the reinsurance arm of Madrid-headquartered insurer MAPFRE, has announced the appointment of Javier San Basilio as Chief Underwriting Officer (CUO). San Basilio, who is currently the European regional director of MAPFRE RE, based in London, replaces Miguel Ángel Rosa, who has been appointed as the new Chief Executive Officer ... Read the full article

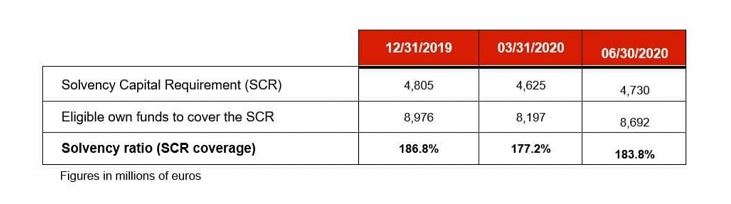

MAPFRE improves Q2 solvency ratio despite COVID challenges

21st September 2020

Spanish re/insurer MAPFRE has improved its Solvency II ratio in the second quarter of 2020, despite significant challenges associated with the COVID-19 pandemic. The company posted a ratio of 183.8% in Q2, representing a 6.6 percentage point increase on the 177.2% it recorded in Q1. It also compares with the Solvency II ... Read the full article