Reinsurance News

Mergers & acquisitions news

Reinsurance mergers and acquisitions news, covering details of M&A transactions in the works and completed, between insurance, reinsurance and related companies.

Constellation to pick up Michigan Professional Insurance Exchange

29th March 2022

Constellation has announced that it is to acquire the business, assets, and liabilities of Michigan Professional Insurance Exchange (MPIE). The agreement, which is subject to regulatory and subscriber approval, comes as AM Best said the financial strength rating and long-term issuer rating ratings of Constellation will remain unchanged. A release from Constellation ... Read the full article

Clyde & Co merges with BLM law firm

28th March 2022

Global law firm Clyde & Co and UK-headquartered law firm BLM have agreed to a merger following a vote in favour by partners at both firms, which is due to take place in July. The combined entity will be known as Clyde & Co and together will have a global revenue ... Read the full article

RGA buys minority investment in Velocity

25th March 2022

Reinsurance Group of America (RGA) has made a minority investment in Velocity Capital Advisers through a wholly owned subsidiary. In addition, the firm said it had entered into a long-term investment management agreement on behalf of one or more subsidiaries of RGA. Velocity has AUM of nearly $1.5bn. Leslie Barbi, executive vice ... Read the full article

Exor bumps up price of PartnerRe by €328m

25th March 2022

Exor has increased the sales price for PartnerRe by €328m. Last year, the firm made a deal with Covéa to sell PartnerRe for $9bn. However, Exor said, in announcing its board of directors approving its 2021 figures, that the price had risen. Exor wrote: “The agreed cash consideration of $9.0bn to ... Read the full article

Arthur J. Gallagher acquires Commercial Insurance Underwriters

25th March 2022

Global insurance broker, Arthur J. Gallagher & Co, has acquired Commercial Insurance Underwriters (CIU), a surplus lines agency offering commercial, personal and professional lines coverages for businesses and individuals with complex, unique or hard-to-place risks, primarily throughout the upper and lower Midwest. Founded in 1984, CIU is a surplus lines agency ... Read the full article

Aston Lark buys Braddons

25th March 2022

Broker firm Aston Lark, who is going to be acquired by Howden, has taken over Braddons. The company has been on an acquisitions spree in recent months, having acquired Marine & General Insurances DAC and Healthwise Group in February; the client book of Choice Benefits in December; ... Read the full article

BP Marsh buys 40% of Denison and Partners

25th March 2022

BP Marsh has bought a 40% stake in Denison and Partners, in what the firm says is its first investment in over eighteen months. As part of the deal, BP Marsh has also provided a loan facility to Denison and Partners. This facility is available from completion and will be drawn ... Read the full article

Aon names Colin Forrest as CEO, consulting

24th March 2022

Aon plc has appointed Colin Forrest as its insurance consulting team’s global chief executive officer in the firm’s Reinsurance Solutions arm. Forrest will be based in London and joins from WTW, where he was EMEA Regional Leader of WTW’s Insurance Consulting & Technology practice. Prior to WTW, he has held senior roles ... Read the full article

Miller acquires Henner Sports

24th March 2022

Insurance broker Miller has said it is acquiring Henner Sports. Henner Sports is a French broker with fourteen employees based in Paris. Its client base is focused on high profile professional athletes and sports organisations with clients including the French national basketball team and the French international football players. Henner Sports also ... Read the full article

Moody’s considers Alleghany upgrade on Berkshire takeover

23rd March 2022

Moody’s has placed its ratings for Alleghany Corporation under review for upgrade following the announcement that Berkshire Hathaway will acquire all outstanding Alleghany shares for approximately $11.6 billion in cash. The rating agency is considering an upgrade for the Baa1 senior debt rating of Alleghany, as will as for the ... Read the full article

VIG acquires Aegon’s Hungary business for €620mn

23rd March 2022

Vienna Insurance Group (VIG) has acquired the business of the Dutch insurer Aegon in Hungary for EUR 620 million, after receiving the approval of the local Hungarian authorities. This completion is an important step towards the full closing of the sale of Aegon’s insurance, pension, and asset management businesses in Central ... Read the full article

Acrisure to acquire Volante Global; expects premiums to increase substantially

22nd March 2022

Insurance and reinsurance broker Acrisure is set to acquire managing general agent (MGA) Volante Global, a provider of niche, specialist re/insurance solutions with 2021 premiums of roughly $350 million. Under the arrangement, Acrisure will take control of all of Volante's brands, including Aesir Space, Horizon Europe AG, and all territory-based MGAs ... Read the full article

Alleghany could benefit over time from Berkshire Hathaway acquisition: AM Best

22nd March 2022

The merger between Alleghany and Berkshire Hathaway could see the former benefitting from the latter’s financial resources and flexibility, says AM Best. The ratings agency has released a new note saying that while the merger may not result in any immediate changes to Alleghany’s credit ratings, it and its affiliates could ... Read the full article

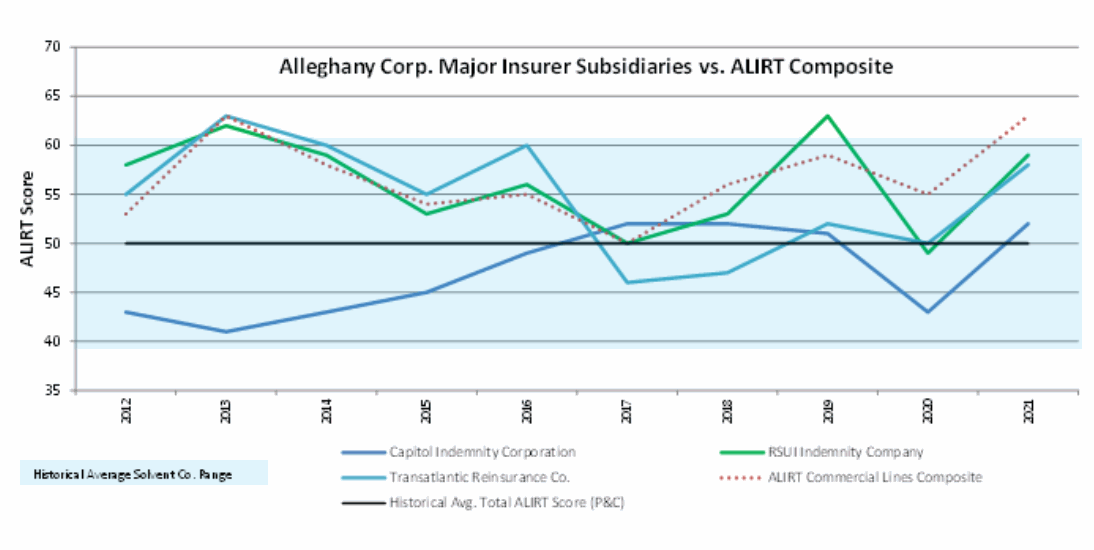

Alleghany a “perfect fit” for Berkshire Hathaway: ALIRT’s Paul

21st March 2022

David Paul, Principal at ALIRT Insurance Research, has argued that Alleghany Corporation is a “perfect fit” for the “growing insurance empire” of Warren Buffett’s Berkshire Hathaway. His comments follow news from earlier today when Berkshire Hathaway announced that it had acquired all outstanding Alleghany shares in an $11.6 billion transaction. The ... Read the full article

Berkshire Hathaway to acquire Alleghany for $11.6bn

21st March 2022

Warren Buffett's insurance and reinsurance firm, Berkshire Hathaway, has reached an agreement to acquire all of the outstanding shares of Alleghany Corporation in an $11.6 billion transaction. A definitive agreement between the pair sees Berkshire acquire all outstanding Alleghany shares for $848.02 in cash. The deal has been unanimously approved by both ... Read the full article