Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

Reinsurance T&Cs improving, margins to follow: Jefferies

7th January 2021

Analysts at Jefferies have reported a marked improvement in terms and conditions (T&Cs) at the recent January 1 2020 reinsurance renewals, which it believes will ultimately lead to a knock-on improvement in margins. Jefferies noted that the tightening of T&Cs is perhaps unsurprising given that terms are usually the last thing ... Read the full article

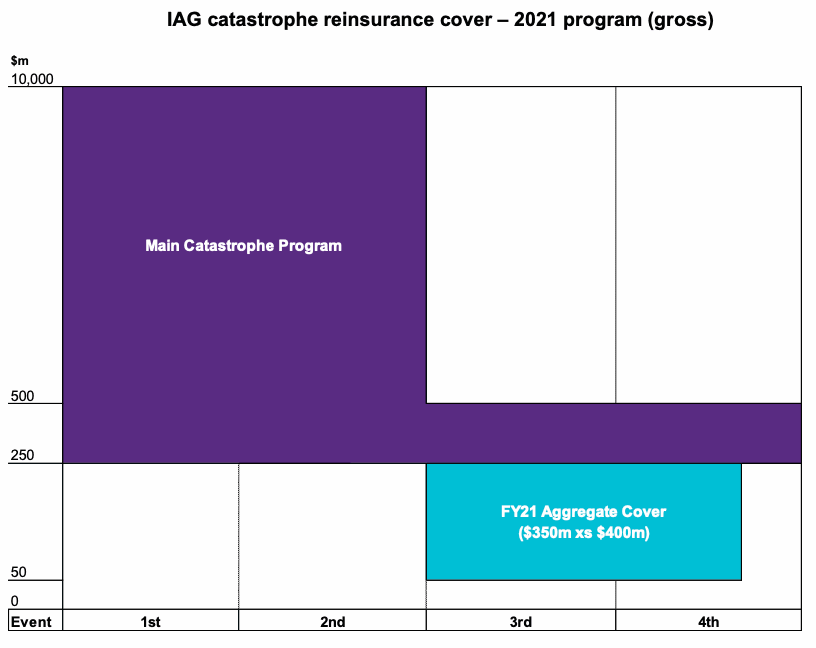

IAG completes $10bn catastrophe reinsurance renewal

6th January 2021

Australian insurer IAG has completed its 2021 catastrophe reinsurance program, maintaining its gross protection cover at up to $10 billion, with IAG retaining the first $250 million of each loss. Both the level of gross protection and retention of each loss are the same as the insurer's 2020 catastrophe reinsurance program. IAG ... Read the full article

Ample capital levels moderated price increases at Jan 1: Guy Carpenter

5th January 2021

With reinsurers eager to deploy capacity in various sectors and capital levels high at the important January 1st, 2021 reinsurance renewals, price increases were more moderate than initial expectations, according to Guy Carpenter, the reinsurance broking arm of Marsh. On the back of a prolonged soft market state, the lower for ... Read the full article

Jan 1 renewals yield sharpest price changes in recent memory: Howden

5th January 2021

International insurance broker Howden has reported that a multitude of factors coalesced at the January 1, 2021 renewals to drive “the sharpest price changes in recent memory.” According to Howden, lower investment yields, higher loss cost trends, another above-average loss year, concerns over climate change and general risk aversion were among ... Read the full article

FEMA secures $1.153bn of NFIP flood reinsurance for 2021

5th January 2021

The U.S. Federal Emergency Management Agency (FEMA) has secured $1.153 billion of flood reinsurance for the National Flood Insurance Program (NFIP) for 2021, at a premium of $195.8 million. It was announced in September of 2020 that FEMA had returned to the traditional reinsurance market and commenced the procurement of ... Read the full article

Focus on exclusions drove late Jan 1 renewals: James Vickers, Willis Re

4th January 2021

Although renewal negotiations started off early, challenges around exclusionary language as reinsurers continued to respond to the pandemic, resulted in a late January 1st, 2021 renewals, according to James Vickers, Chair, Willis Re International. In an interview with Reinsurance News around the launch of reinsurance broker Willis Re’s latest 1st View ... Read the full article

January reinsurance renewals adequate. Capital blamed as momentum stalls

4th January 2021

The January 2021 reinsurance renewal season is largely concluded and while the overall perception from the market appears to be that pricing was adequate, it's clear that momentum stalled as the year drew to a close. We say largely concluded as there are some programs that remain unfilled, particularly in the ... Read the full article

International Group finalises reinsurance structure for 2021

21st December 2020

The International Group of P&I Clubs has now completed its pooling and GXL reinsurance contract structure for 2021, after securing a two-year placement on layers 1-3 of the programme in 2020. In light of the two-year placement completed last year, the focus this year has been on the Group's Collective Overspill ... Read the full article

KBW says 1/1 looks satisfactory, not spectacular

18th December 2020

After conducting a virtual tour of Bermuda, analysts at Keefe, Bruyette & Woods are expecting a satisfactory, albeit unspectacular 1/1 renewal. Although all of the executives KBW analysts met still expect property reinsurance rate increases during the pending renewals, current rate increase have been described as ambitions and are seen as ... Read the full article

McGill and Partners adapted well to COVID-19: Paul Summers

10th December 2020

Whilst some in the (re)insurance industry are still reeling from the shock of COVID-19, start-up specialist (re)insurance broker McGill and Partners says a focus on technology and creativity has allowed it to adapt well to the pandemic. This is the view of Paul Summers, Head of Global Facultative Reinsurance, who in ... Read the full article

Today, you can do a lot more as a new carrier: Hendrick, Vantage

9th December 2020

Meaningful advances in technology and analytics provides a new re/insurance carrier with far greater capabilities today than in previous periods of market hardening, according to Greg Hendrick, Chief Executive Officer (CEO) of Vantage. Vantage announced its launch last week with $1 billion of equity capital ahead of the January 1st, ... Read the full article

Hardening market sees Fitch turn stable on global reinsurance

3rd December 2020

The current hardening environment and rising prices, coupled with stabilising losses related to the ongoing COVID-19 pandemic, has led Fitch Ratings to revise its sector outlook for global reinsurance in 2021 to stable. After turning negative on the segment back in March, the ratings agency maintained its negative outlook for ... Read the full article

Inigo obtains Lloyd’s approval ahead of 1/1; hires Stratts to lead First Party

3rd December 2020

New specialty insurer and reinsurer, Inigo Limited, has now received approval in principle from the Corporation of Lloyd's and will start writing business for 2021, the company has confirmed. The news comes weeks after the new London insurance group confirmed the successful raising of $800 million in start-up capital from ... Read the full article

Uncertainty diminishing ahead of “complex” 1/1 renewals: GC

30th November 2020

Guy Carpenter (GC), the reinsurance arm of global brokerage Marsh, has warned that the upcoming January 2021 renewals will be uniquely “complex” due to the manifold challenges in the market this year. However, the broker added that re/insurers seem “ready to respond” to these complexities, and noted that some areas of ... Read the full article

United (UPC Insurance) secures additional reinsurance protection

24th November 2020

Property and casualty insurance holding company, United Insurance Holdings Corp. (UPC Insurance), has expanded its current quota share reinsurance programme for United Property & Casualty Insurance Company (UPC) and Family Security Insurance Company (FSIC), effective December 31st, 2020. For both UPC and FSIC, the insurer has expanded its current quota share ... Read the full article