Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

AXIS maintains XOL attachment point at mid-year, renews quota shares at consistent levels

3rd August 2023

When renewing its outwards reinsurance for its property portfolio at the mid-year renewals, Bermuda-based AXIS Capital avoided raising the attachment point on its excess of loss occurrence cover. For its insurance property book of business, AXIS renewed coverage at an attachment point in line with the previous year at $100 million, ... Read the full article

Reinsurer appetite increased amid more stable trading conditions at mid-year renewals: AIG CEO

2nd August 2023

The reinsurance market was more orderly during the key mid-year renewal season and sellers' appetite for more discrete purchases rose somewhat, which helped buyers fill shortfalls experienced at 1/1, according to Peter Zaffino, Chairman and Chief Executive Officer (CEO) of global insurer AIG. Speaking recently during the large primary insurer's Q2 ... Read the full article

Allstate’s reinsurance costs increase as it reduces size of Florida tower

2nd August 2023

U.S. insurer Allstate has completed the placement of its 2023-2024 catastrophe reinsurance programs, which, excluding reinstatement premiums, were secured at a total cost during Q2 2023 and H1 2023 of $242 million and $461 million, respectively, up significantly from $173 million in Q2 2022 and $317 million in H1 2022. The ... Read the full article

Chubb renews global property cat reinsurance program with higher retention

31st July 2023

Global insurer Chubb successfully renewed its global property catastrophe reinsurance program at the April renewal for its North American and International operations, as well as its terrorism coverage, with "no material changes in coverage from the expiring program," although the retention has increased. Effective April 1st, 2023, through March 31st, 2024, ... Read the full article

There’s still pressure, but reinsurance market has found equilibrium in property cat: Aon

28th July 2023

Within reinsurance, pressure remains on the capital side, but opportunities are there and as the market has shifted, it's getting to an equilibrium around pricing property catastrophe risks, according to executives at re/insurance broker Aon. Greg Case, Chief Executive Officer (CEO) and Eric Andersen, President of insurance and reinsurance broker Aon, ... Read the full article

Current hard market has surpassed the post-Andrew market: Everest CEO Andrade

27th July 2023

Juan Andrade, the President and Chief Executive Officer (CEO) of Bermuda-based re/insurer Everest Group, feels that the current reinsurance market is now firmer that it was following the impacts of hurricane Andrew in 1992, as the firm continues to take advantage of strong rate momentum in the property catastrophe space. Speaking ... Read the full article

Airlines face elevated war insurance premiums: Reuters

27th July 2023

Industry sources have told Reuters that they believe airlines could end up paying twice as much for the insurance they need to protect themselves against losses triggered by war as providers of coverage look to offset recent losses. The recent conflict between military factions in Sudan earlier this year led to ... Read the full article

Travelers secures additional hurricane reinsurance at renewal, upsizes Northeast property cat treaty

20th July 2023

US primary insurer Travelers has again increased the size of its Northeast property catastrophe excess-of-loss (XoL) reinsurance treaty by $100 million at the mid-year renewals, during which the firm also entered into a new personal insurance hurricane catastrophe XoL treaty. Renewed at the July 1st, 2023, reinsurance renewals, Travelers' Northeast property ... Read the full article

The soft reinsurance market is decidedly over, insurers must adapt: DBRS Morningstar

14th July 2023

Global property reinsurance prices increased sharply in 2023 on lower capacity, above-average catastrophe losses, higher inflation, and more financial and macroeconomic volatility, with analysts at DBRS Morningstar predicting tougher reinsurance market conditions to continue as the soft market is "decidedly over." As noted by analysts, the last six years have seen ... Read the full article

Hard market likely to persist in reinsurance as lack of capital inflows ensures discipline: BofA

12th July 2023

Europe's big four reinsurers stand to benefit from a continuation of favourable market conditions in 2024 on the back of strong outcomes at the mid-year renewals, driven in part by the lack of new capital inflows in the current hard market cycle, according to analysts at BofA Securities. In contrast to ... Read the full article

Berkshire gets giant $1bn share of Florida Citizens reinsurance renewal

11th July 2023

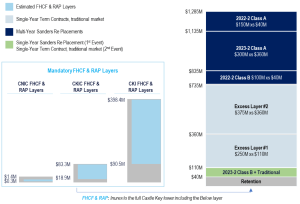

Florida’s Citizens Property Insurance Corporation has completed the placement of its 2023 risk transfer program, securing just over $2.98 billion of protection from a mix of traditional and collateralised reinsurers for its Coastal and Personal Lines (PLA) accounts, of which more than $1 billion was secured from Berkshire Hathaway. As well ... Read the full article

Florida’s insurance market overcomes challenges and shows signs of growth: Aon

10th July 2023

Florida's insurance market has made a significant turnaround during the 2023 mid-year renewal, providing a much-needed boost to the state's insurers, according to Aon's Reinsurance Market Dynamics report. Despite worries following Hurricane Ian about a possible shortage of capacity for Florida-based insurers, catastrophe reinsurance capacity was accessible during the mid-year renewal, ... Read the full article

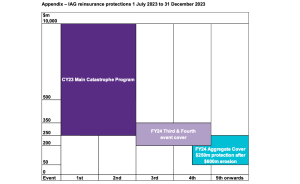

IAG purchases less aggregate reinsurance with higher attachment point at renewal

7th July 2023

Australian insurer IAG has confirmed the completion of its whole-of-account quota share arrangement, aggregate reinsurance and third/fourth event covers for the financial year ending June 30th, 2024. The primary insurer has adjusted its aggregate reinsurance coverage for FY24 in light of current reinsurance market conditions. This year, IAG has secured aggregate reinsurance ... Read the full article

Increased pressure from reinsurers to place cyber separately at renewals: Gallagher Re

6th July 2023

According to Gallagher Re's 1st View report, cyber insurance carriers continued to explore standalone cyber placements at the mid-year renewals in response to increasing pressure from reinsurers. Gallagher's report also noted that incumbent reinsurance markets continued to grow following improved rate and portfolio optimisation across cyber insurance risk, building on the ... Read the full article

Improved timing & concurrence at mid-year renewals: Guy Carpenter

5th July 2023

Broader market trends seen at January 1 continued at mid-year renewals, but with improved timing and concurrence around terms and conditions, according to Guy Carpenter, a leading global risk and reinsurance specialist and a business of Marsh McLennan. Guy Carpenter suggested that while property pricing saw continued risk-adjusted rate increases in ... Read the full article