Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

Bermuda reinsurance market forecasts stability in property, tightening in casualty for 2024: KBW

13th December 2023

Executives from the Bermuda reinsurance market are expressing optimism about the 2024 property reinsurance operating environment, foreseeing stability in terms and conditions. While there is some divergence in views on January 1 property catastrophe rates, the consensus points towards a steady market. In the U.S. property catastrophe segment, there is a nuanced ... Read the full article

TWIA to start reinsurance renewal process amid need for additional $1bn in limit for 2024

13th December 2023

Staff at the Texas Windstorm Insurance Association (TWIA) explained that the wind and hail insurer of last resort for the state of Texas requires approximately $1 billion more in reinsurance funding for 2024 when compared with 2023, as exposure growth persists. TWIA's Board noted previously that the insurer would need ... Read the full article

Renewing aggregate reinsurance is likely to be challenging for Italian insurers: Berenberg

8th December 2023

Following a heavy year of losses, renewing aggregate reinsurance will likely be a challenge for Italian insurers, according to insights from investment bank Berenberg. Analysts believe the greatest challenge insurers in Italy will face in 2024 is pricing for non-motor insurance, following the exceptionally high €2.5bn hailstorm losses in the country ... Read the full article

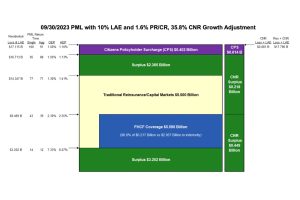

CEA hopes to renew $2.2bn of reinsurance limit at Jan 1

7th December 2023

The California Earthquake Authority (CEA) is hopeful it will be able to successfully renew $2.2 billion of expiring reinsurance limit at the upcoming January 1st, 2024, renewals, which is its largest syndicated placement, amid a continuation of higher rate-on-line pricing. The CEA is one of the largest buyers of natural catastrophe ... Read the full article

Property reinsurance rates to increase, casualty faces aggressive pricing challenges: Amwins

5th December 2023

In the latest Amwins State of the Market report for 2024, the reinsurance landscape appears to be experiencing subtle shifts, with notable developments in property and casualty sectors. The report notes an overall moderation in treaty reinsurance renewals and facultative buying, with property rates continuing to increase. However, there are indications that ... Read the full article

TWIA advised to commence 2024 reinsurance placement as soon as possible

5th December 2023

The Texas Windstorm Insurance Association (TWIA) has been advised by its reinsurance broker to begin the planning and purchase of its reinsurance as soon as possible, with the state's insurer of last resort potentially needing to buy more than $3 billion in limit for 2024 as exposure growth continues and ... Read the full article

Florida Citizens could purchase as much as $5.5bn of reinsurance for 2024

5th December 2023

Citizens Property Insurance Corporation, Florida's property insurer of last resort, could obtain as much as $5.5 billion of reinsurance and catastrophe bond risk transfer next year, as the insurer prepares to merge its three accounts ahead of the 2024 wind season. For 2023, Florida Citizens secured approximately $5.38 billion of ... Read the full article

Rate increases to persist through 2024 and probably into 2025: Gulbransen, Howden Tiger

30th November 2023

As negotiations intensify ahead of the January 1st, 2024, reinsurance renewals, Wade Gulbransen, Head of North American Reinsurance at Howden Tiger, has said that the broker sees the market continuing with both price and coverage into next year. Speaking with Howden Tiger's Head of Business Development, Michelle To, as part of ... Read the full article

Reinsurance rate increases for property cat to slow in 2024: Fitch

23rd November 2023

As per a new report from Fitch Ratings, reinsurance rate increases for property catastrophe business are likely to slow to below 10% on average when contracts are renewed in January 2024, though underlying profitability for the sector is still expected to improve throughout the year. "Price increases, and better terms and ... Read the full article

Cedents & reinsurers better prepared for Jan 2024 renewals: Aspen’s Hough

21st November 2023

According to Philip Hough, Global Head of Property Reinsurance and Head of EMEA & LATAM, Aspen, there was a calmness to the meetings at Baden-Baden this year ahead of 1:1, after "the chaos and uncertainty around capacity last year." "Capacity is available across all lines of business and both cedents and ... Read the full article

US regional property cat coverage remains healthy ahead of Jan 1: Gallagher Re

17th November 2023

Following a costly 2023 severe convective storm season, Gallagher Re's Josh Knapp, Executive Vice President, Broking, National, has noted that reinsurers are proving less willing to provide aggregate covers for regional property cat risk, though their overall appetite "remains healthy." Knapp's comments come following a poll in which Gallagher Re surveyed ... Read the full article

Incremental reinsurance demand to be in the single digit billions in 2024: RenRe CEO

8th November 2023

RenaissanceRe (RenRe) predicts incremental demand to come into the market throughout the course of 2024, and expects it to be in the single digit billions, according to CEO Kevin O'Donnell, who in a recent earnings call also highlighted that RenRe’s acquisition of Validus Re puts the company in a very ... Read the full article

Munich Re still very confident ahead of Jan renewals: CFO Jurecka

8th November 2023

With rates in many lines of business now at more appealing levels, Munich Re CFO Christoph Jurecka notes a "very attractive environment" and says the firm is confident heading into the 1.1 reinsurance renewals. "January renewal, we continue to be very confident. I think in many business lines prices are now ... Read the full article

Swiss Re expects “very strong demand” for reinsurance in 2024

3rd November 2023

"There's a lot of discussions to be had between now and Jan 1, and then during the course of 2024, to figure out what reasonable price levels and attachment points might be for the industry," says John Dacey, Group Chief Financial Officer at Swiss Re. In response to a question on ... Read the full article

TWIA to increase reinsurance limit in 2024 to support exposure growth

1st November 2023

Despite its reinsurance attaching higher due to growth in the Catastrophe Reserve Trust Fund (CRTF), the Texas Windstorm Insurance Association (TWIA) expects to need additional reinsurance limit for 2024 as exposure growth persists. TWIA, the Texas wind and hail insurer of last resort, is expecting annual exposure growth of 28.2% in ... Read the full article