Reinsurance News

Terrorism reinsurance

Pool Re Solutions appoints Head of Risk Management

20th January 2020

UK government-backed terrorism reinsurer, Pool Re, has announced the appointment of Chris Medhurst-Cocksworth as Head of Risk Management within Pool Re Solutions. In his new role, Medhurst-Cocksworth will be tasked with leading the risk management services offered by Pool Re Solutions, a recently established specialist unit designed to help UK insurers ... Read the full article

Pool Re targets SMEs with cover changes

6th January 2020

UK government-backed terrorism reinsurer Pool Re is introducing a series of changes aimed at improving the accessibility of terrorism insurance for businesses in the UK. The reinsurer has expanded its definition of an SME to include firms with assets of up to £5 million, more than double the previous figure of ... Read the full article

LMA warns of “continued uncertainty” for US terrorism act renewal

2nd December 2019

The Lloyd’s Market Association (LMA) has published a letter to its members warning of “continued uncertainty” around the US Terrorism Risk Insurance Act (TRIA), which is currently set to expire in December 2020. The LMA said it was confident that the renewal will be achieved in good time in advance of ... Read the full article

Fidelis recruits Kayley Stewart as Terror and Political Violence underwriter

25th November 2019

Fidelis Insurance, the privately owned Bermuda-based holding company, has added Kayley Stewart to its Fidelis Underwriting Limited (FUL) London underwriting team as part of a push to build out its Terrorism and Political Violence account. Stewart arrives at Fidelis from Liberty, where she most recently served as a senior underwriter. She has ... Read the full article

US House approves long-term TRIPRA extension

20th November 2019

The Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) is set to go before the U.S. Senate after legislation extending the bill for seven years easily passed through the U.S. House of Representatives. The bill, which was initially passed in 2002 in the aftermath of the September 11 attacks, received strong bipartisan ... Read the full article

IFTRIP highlights divergent views on cyber terrorism across commercial market

11th November 2019

Further collaboration and discussion is needed around the response to, and definition of, cyber terrorism, while more broadly, divergent views around the insurability of cyber risk remains across the commercial market. This is according to delegates that attended the 2019 International Forum of Terrorism Risk (Re)Insurance Pools (IFTRIP) conference, held in ... Read the full article

TRIPRA uncertainty may impact re/insurance availability: Metropoulos, Guy Carpenter

21st October 2019

Uncertainty regarding the future of the US Terrorism Risk Insurance Protection and Reauthorization Act (TRIPRA) may impact the “nature and availability" of re/insurance coverage, according to Emil Metropoulos, Terrorism Center of Excellence Practice Leader at Guy Carpenter. Metropoulos does not foresee major resistance to a reauthorisation of TRIPRA, which is currently ... Read the full article

Talbot’s Gillingham named head of war, terrorism at StarStone

18th October 2019

Specialty insurer StarStone has announced the appointment of Henry Gillingham as head of war & terrorism within its crisis management division. Gillingham will be based in London and is set to join in the first half of 2020. He joins from Talbot Underwriting, where he most recently served as a senior ... Read the full article

Heightened reinsurance use amid potential TRIPRA expiration: A.M. Best

18th October 2019

In the event that the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) is not renewed at the end of next year, insurers continue to take appropriate risk management measures, including the increased purchase of reinsurance protection, according to A.M. Best. Signed by President Obama in January 2015, TRIPRA extended the expiration ... Read the full article

TRIPRA expiration could cause “domino effect” of price rises: Marsh CEO

17th October 2019

John Doyle, President and CEO at Marsh, has warned that a failure to renew the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) could cause a “domino effect” of price increases across multiple re/insurance lines. Doyle recently testified before the United States House Committee on Financial Services to advocate for a timely ... Read the full article

Joint cyber terrorism task force launched by IFTRIP & Geneva Association

10th October 2019

The International Forum of Terrorism Risk (Re)Insurance Pools (IFTRIP) has collaborated with the Geneva Association (GA) on the launch of a joint task force on cyber terrorism and cyber warfare. The launch of this new task force was announced at the IFTRIP 2019 International Conference in Brussels, Belgium. The initial findings ... Read the full article

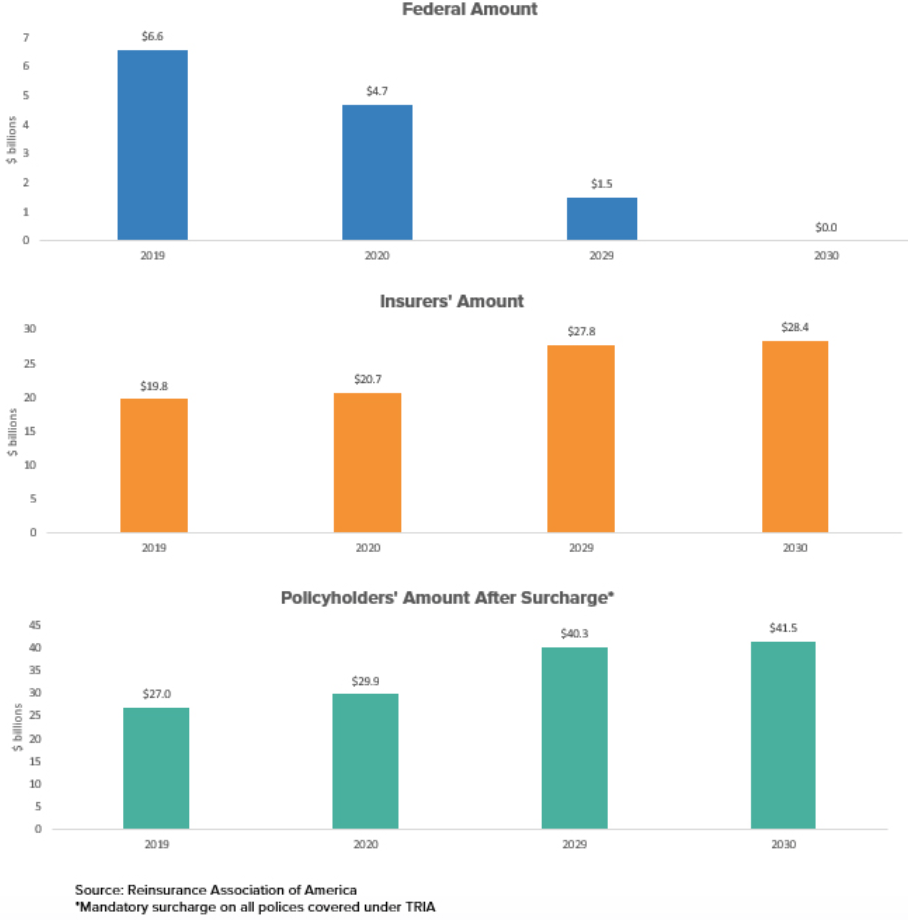

Gov’s contribution to insured losses under TRIA would decline over time, says report

8th October 2019

If the September 11th, 2001 attacks on the World Trade Centre were to happen today, the implementation of the Terrorism Risk Insurance Act (TRIA) would see the government's net payout fall below zero, according to the Insurance Information Institute (Triple-I). Analysis by Triple-I, which leverages data and analysis from the Reinsurance ... Read the full article

Terrorism Risk Act uncertainty driving reinsurance demand, says RAA President

7th October 2019

Uncertainty over the reauthorisation of the Terrorism Risk Insurance Act (TRIA) in the US is increasing the demand for terrorism reinsurance coverage, according to Frank Nutter, President of the Reinsurance Association of America (RAA). Speaking at the US Treasury's Advisory Committee on Risk-Sharing Mechanisms (ACRSM), Nutter observed that the reinsurance market ... Read the full article

Re/insurers appeal for extension to “vital” terrorism insurance act

17th September 2019

A coalition of insurers and reinsurers have penned a letter to members of the US Congress, urging them to pass a long-term reauthorisation of the Terrorism Risk Insurance Act (TRIA), which is currently set to expire at the end of 2020. The appeal described the act as a “vital public-private risk ... Read the full article

Tech, analytics can address terror, political violence risk challenges: Guy Carpenter

10th September 2019

Guy Carpenter, the reinsurance arm of Marsh, has underlined the important role technology and analytics play in addressing challenges across the terrorism risk landscape. The reinsurance broker argues that terrorism, political violence and other malicious acts are both dynamic and adaptive, with human intent driving profitability while also willing the impacts ... Read the full article