The Texas Windstorm Insurance Association (TWIA) has now finalised its reinsurance and risk transfer for the 2023 wind season, with its tower placed to the targeted $4.508 billion after the insurer secured an additional $1.043 billion of traditional reinsurance.

As we wrote previously, TWIA was in the market for an additional $1.043 billion of reinsurance protection after its Board voted to establish its 1:100 probable maximum loss (PML) for the 2023 storm season at $4.5 billion, including LAE.

TWIA has now completed the placement of its reinsurance and risk transfer for 2023, which includes a mix of traditional reinsurance and catastrophe bonds, as well as other funding.

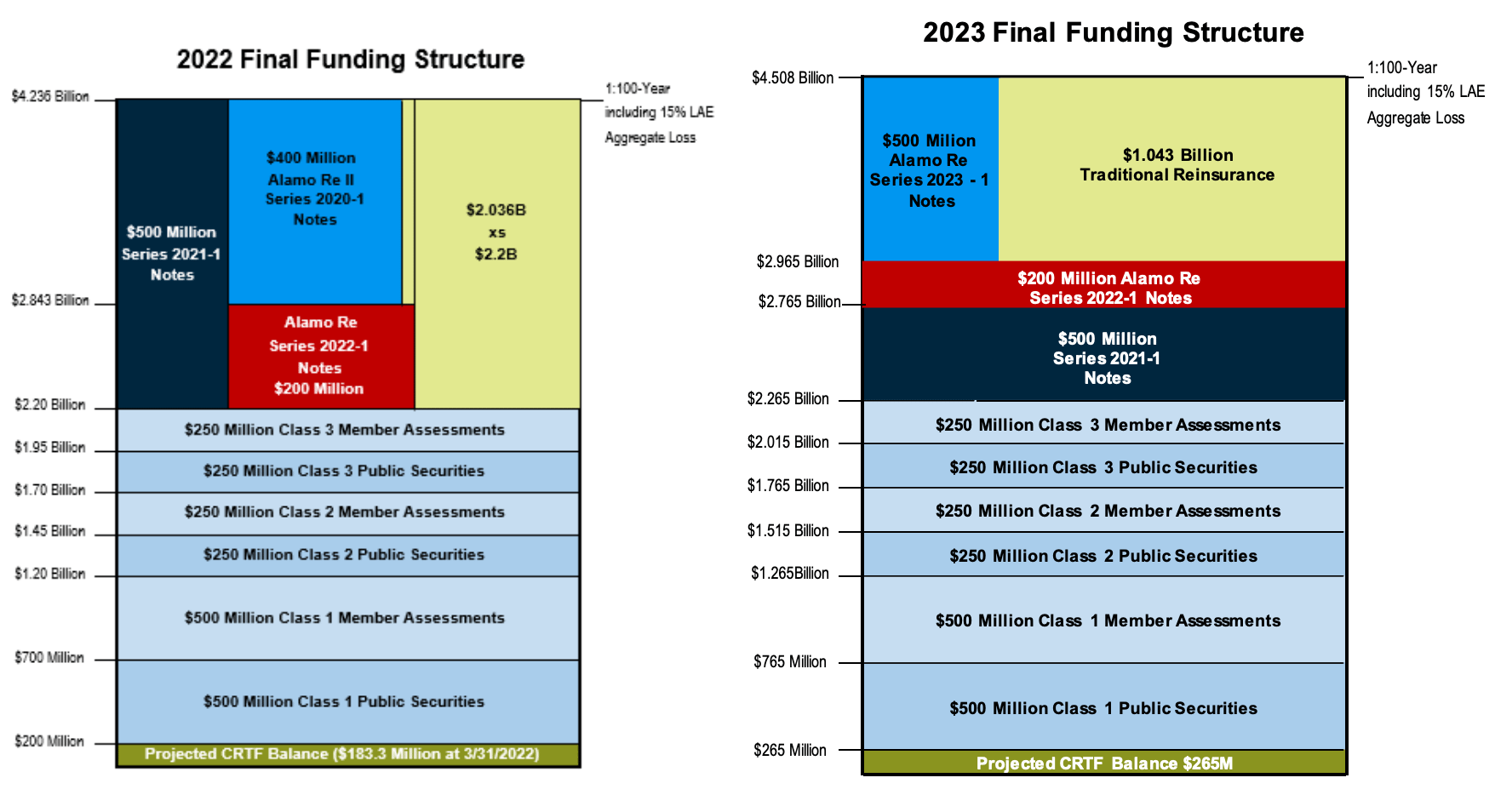

For 2023, the risk transfer part of TWIA’s tower attaches at $2.265 billion of losses up to the $4.508 billion. Of this, $1.2 billion is from catastrophe bonds and $1.043 billion is from the traditional reinsurance market.

From the $2.265 billion attachment point up to $2.965 of losses sits protection in the form of catastrophe bonds. Above this, so attaching at $2.965 billion up to the $4.508 billion, sits the $1.043 billion of traditional reinsurance protection and a further $500 million of catastrophe bond coverage from its 2023 issuance.

Overall, then, TWIA has secured around $2.238 billion of reinsurance and cat bond risk transfer for the 2023 wind season.

In contrast, the 2022 reinsurance tower featured $2.016 billion of reinsurance and cat bonds, with $1.1 billion coming from the latter.

You can compare the TWIA reinsurance and funding towers for 2022 and 2023 below:

It’s worth noting that in early May a memo stated that TWIA would look to secure the additional $1.043 billion of protection from a mix of traditional reinsurance and from the capital markets.

However, TWIA decided to purchase all of this from the traditional market, which could be for numerous reasons, such as stronger appetite from reinsurers for the risk or that the cat bond markets were not as receptive as initially hoped.

Regardless, TWIA has now secured the level of reinsurance and risk transfer it required for the upcoming wind season.