Commercial insurance prices in the U.S saw modest growth in the first quarter of 2018, with increases exceeding 1% for the first time in nearly three years, according to broking and solutions company Willis Towers Watson.

The company’s Commercial Lines Insurance Pricing Survey (CLIPS) compared prices charged on policies written during Q1 2018 with those charged on policies written in Q1 2017.

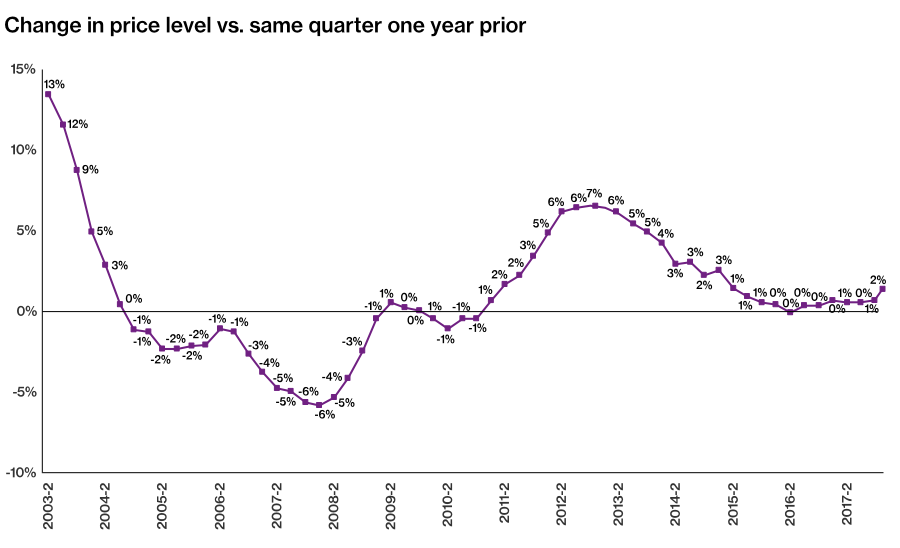

The survey found that price changes were in excess of 1% for the first time in 11 quarters, breaking the moderating trend in price increases that has been exhibited since 2013.

Commercial auto, commercial property, and excess/umbrella liability lines exhibited particularly pronounced price increases, as commercial property overcame recent price decreases to exhibit low-to-mid-single digit growth for the second consecutive quarter, while commercial auto once again saw price increases nearing double digits.

Willis’ survey also found that workers compensation lines continue to see ongoing price reductions, in contrast to all other surveyed lines.

Price changes were also generally positive across all account sizes, with pricing trends for mid-market and large accounts moving closer to the larger increases recorded for small accounts.

Price changes were also generally positive across all account sizes, with pricing trends for mid-market and large accounts moving closer to the larger increases recorded for small accounts.

Pierre Laurin, Americas Property & Casualty (P&C) sales and practice leader for Insurance Consulting and Technology at Willis Towers Watson, commented: “Commercial insurance prices trended upward across nearly all lines during the first quarter of 2018, with aggregate price changes crossing the 1% threshold for the first time in almost three years.

“Workers compensation was the only line showing a downward price trend, as claims frequency declines and workplace safety continues to improve.”