Rising expense ratios and a steady but “relentless” decline in the underlying return on equity (RoE) is challenging the profitability of the subset of reinsurers in the Willis Reinsurance Index, reports reinsurance broker Willis Re.

Willis Re’s latest biannual Reinsurance Market report highlights a decline in global, dedicated reinsurance capital by 5% in 2018, for the reinsurers that make up the Willis Reinsurance Index. As well as the Index, the report breaks out the performance of a subset of companies within the Index, defined as those firms that disclose nat cat losses and prior year reserve releases.

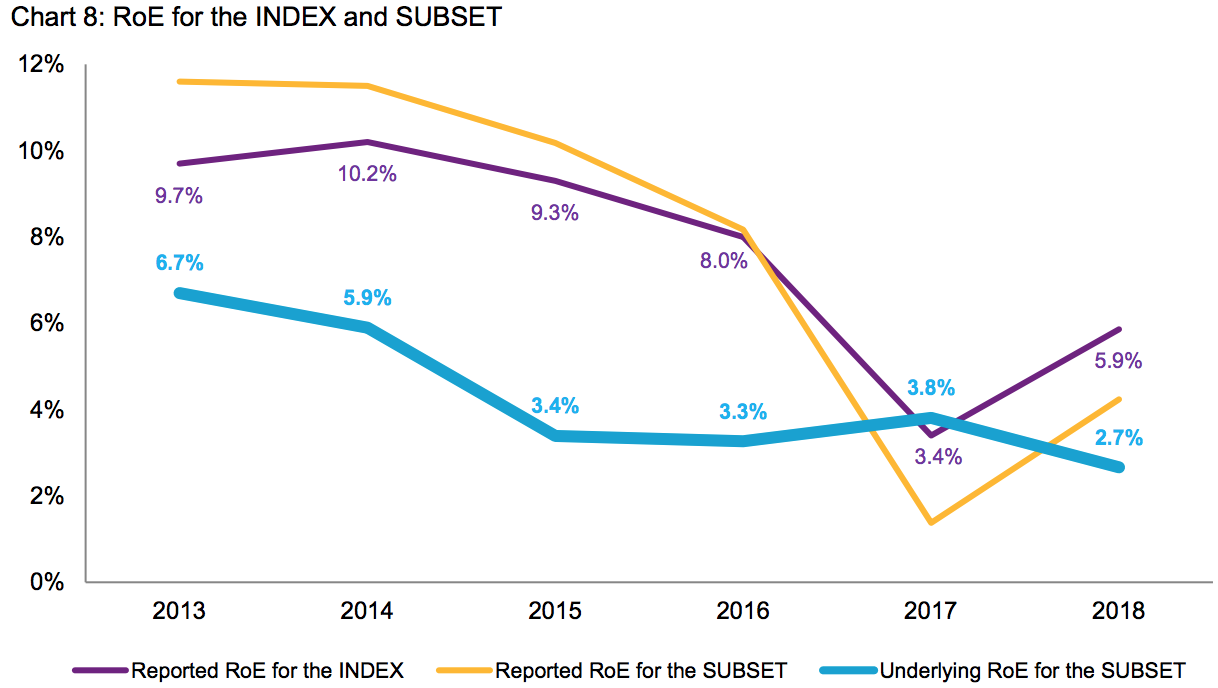

For the Index, the reported RoE improved to 5.9% in 2018 from 3.4% a year earlier. At the same time, the subset reported an RoE of 4.2% at year-end 2018, which, although an improvement on the 1.4% reported a year earlier – owing to a lighter catastrophe load – is significantly down on the 8.2% reported at year-end 2016.

As the above chart highlights, the “underlying RoE has seen a gradual yet relentless decline”, which the reinsurance broker attributes mostly to the deterioration in the underlying combined ratio, although somewhat offset by an increased investment yield.

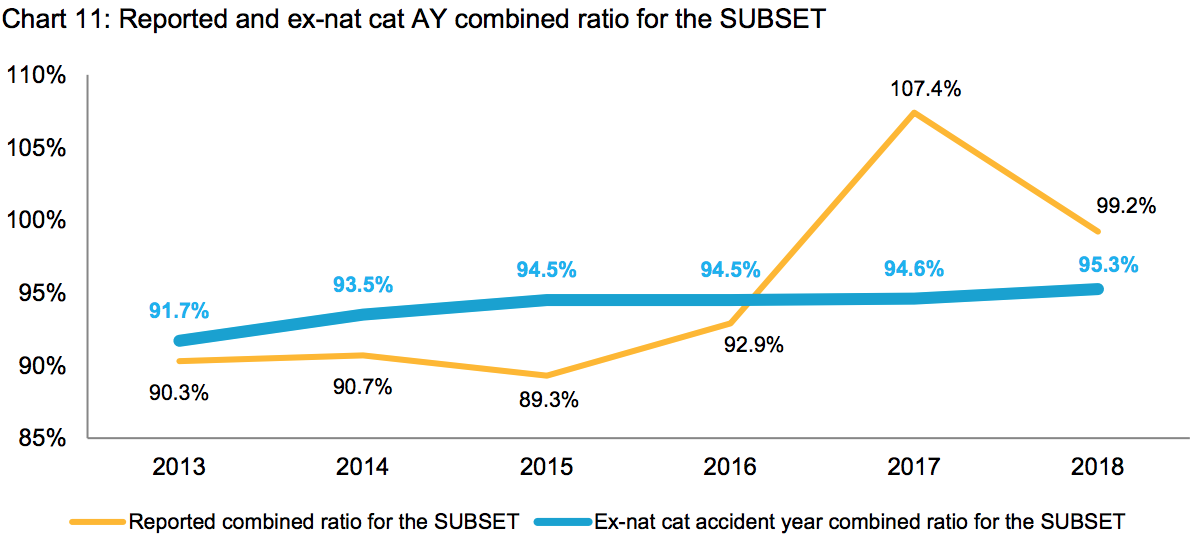

According to Willis Re, and as shown by the chart below, the underlying combined ratio for the subset has weakened to 95.3% in 2018 from 91.7% in 2013. At the same time, the reported combined ratio for the subset did improve at year-end 2018 to 99.2%, reflecting a return to underwriting profitability after a very challenging 2017.

“However, stripping out 4.6 percentage points of reserve releases (marginally lower than 2017’s releases) and 8.6 percentage points of nat cat losses (significantly down on 2017’s 18.1 percentage points), results in an ex- nat cat accident year combined ratio of 95.3%, a deterioration versus 2017’s 94.6%,” explains Willis Re.

While still a significant contribution at 4.6 percentage points, the broker notes that the support reserve releases provided did fall in 2018 for the fourth consecutive year.

Further hitting the combined ratio is rising expense ratios, says Willis Re. In fact, the broker states that since 2007, rising expense ratios have added 3.8 percentage points to the combined ratio for the subset. At year end 2018, the expense ratio for the subset hit 33%, compared with 29.2% in 2007.

Ultimately, higher expense ratios year-after-year are putting additional downward pressure on the profitability of reinsurers. Willis Re estimates that had the weighted average expense ratio for the subset stayed at 2007’s level, the reported RoE would have been 2.7 percentage points higher.