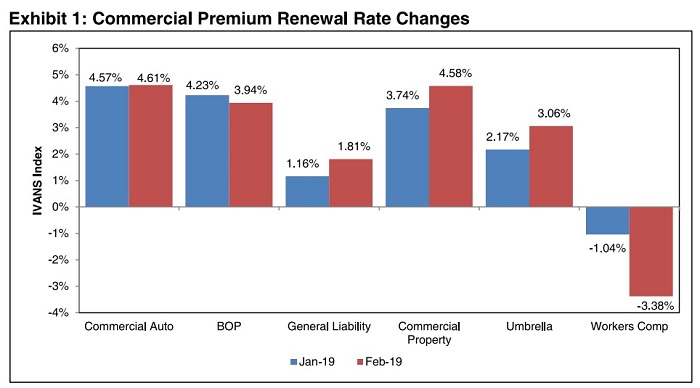

The February results of the IVANS Index show a year-on-year increase in premium renewal rate change across all major commercial lines of business, with the exception of Workers’ Compensation.

IVANS, which is a division of Applied Systems, also observed a month to month uptick in premium renewal rate change across Commercial Auto, General Liability, Commercial Property and Umbrella.

In contrast, BOP, and Workers’ Compensation experienced a negative rate change month over month.

Umbrella saw the most significant increase in rates, growing from 2.17% in January to 3.06% in February.

Meanwhile, Commerical Property lines increased from 3.74% at the end of January to 4.58% in February, while General Liability grew from 1.16% to 1.81% and Commercial Auto went from 4.57% to 4.61%.

The Index also recorded a decrease in BOP rates from 4.23% in January to 3.94% in February, as well as in Workers’ Compensation, which fell from -1.04% to -3.38%.

“The latest IVANS Index figures showed a slight variance, with the most significant trend changes occurring with Umbrella and Workers’ Compensation month over month,” said Brian Wood, vice president of Data Products Group, IVANS Insurance Solutions.

“The IVANS Index will continue to provide guidance to agents as they advise clients on premium changes at renewal and to insurers as they evaluate which lines of business to actively compete in,” he added.

Analysts at Keefe, Bruyette & Woods (KBW) also offered some comments on what the February index results mean for rates going forward.

“We expect commercial casualty rate increases to mostly gain steam (some monthly fluctuation is probably inevitable) over 2019 in response to inadequate underwriting returns, although Workers’ Compensation underwriting profitability should keep pushing that line’s rates down,” KBW stated.

The firm added that P&C pricing would depend on whether expected returns are adequate for incremental capital providers, which is not currently the case for commercial casualty lines and points to accelerating rate increases overall.

The IVANS Index analyses more than 120 million data transactions from 32,000 agencies and 400 insurers and MGAs to track premium rate trends year-over-year in the U.S insurance market.