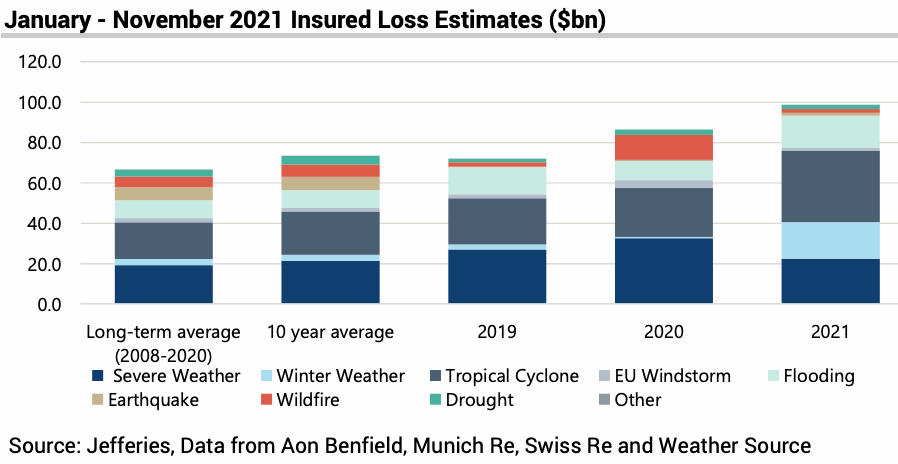

Analysts at Jefferies have reported that insured natural catastrophe losses are running 48% higher than the long-term average, as of the end of November, and 34% above the 10-year average.

It now appears certain that insured catastrophe losses will be far higher than the annual totals for the past three years, Jefferies says, despite November being the lowest month for insured losses so far this year.

And this is without factoring in the recent series of Midwest tornadoes, which KCC estimates will add $3 billion to re/insurers’ catastrophe bills, but which many in the industry believe will be far higher.

In November, Jefferies notes that losses were minimal and spread across a broad range of perils and regions, with the Canadian floods thought to be the highest industry loss at around $400 million.

Windstorm Arwen, which affected the UK, Ireland and France with strong winds and power outages, is similarly estimated to have driven around $300 million of re/insured losses.

Overall, Jefferies estimates that insured catastrophe losses in November were 65% below the 10-year average, making this the third consecutive benign month and the lowest monthly loss total of 2021 so far.

Analysts say this was mainly due to the near total absence of wildfire and tropical cyclone losses reported relative to previous years, particularly in the US.

But looking at the full year, it is a much different picture, with numerous high severity events spreading across multiple perils and regions, including Hurricane Ida in August and US severe winter weather in Q1.

Outside the US, Europe has also seen especially volatile weather, most notably in July, when flooding caused more than $10bn of losses.

According to Jefferies, Ida was the costliest catastrophe event of the year as of November-end, driving an estimated $32.2 billion of insured losses, following by US severe weather at $17.2 billion and then US winter weather at $15.3 billion.

Following this, analysts rank European floods at $10.2 billion, European severe weather at $3.8 billion, US wildfires at $1.5 billion and China floods at $1.4 billion.

However, it’s worth reiterating that this analysis does not yet account for the December tornadoes in the US, which are set to rank highly on this list even at conservative estimates.

Jefferies concluded that the above-average losses of the year-to-date are likely to put additional pressure on the adequacy of many underwriter’s natural catastrophe loss budgets, with Q3 results already indicating that many budgets will be exceeded.

Consequently, analysts expect this to drive material rate rises for property-catastrophe contracts at the upcoming 1st January 2022 reinsurance renewals.