Analysts at JP Morgan have reported that European re/insurer solvency ratios have remained resilient in the face of macro uncertainties over the last 2 years, highlighting a steady improvement over the period.

The analysts write, “We believe that European insurers have weathered the macro challenges since the start of 2020 well, and are strongly capitalised in a historical context, which supports continued attractive capital return going forward, with strong buffers against claims and market risks.”

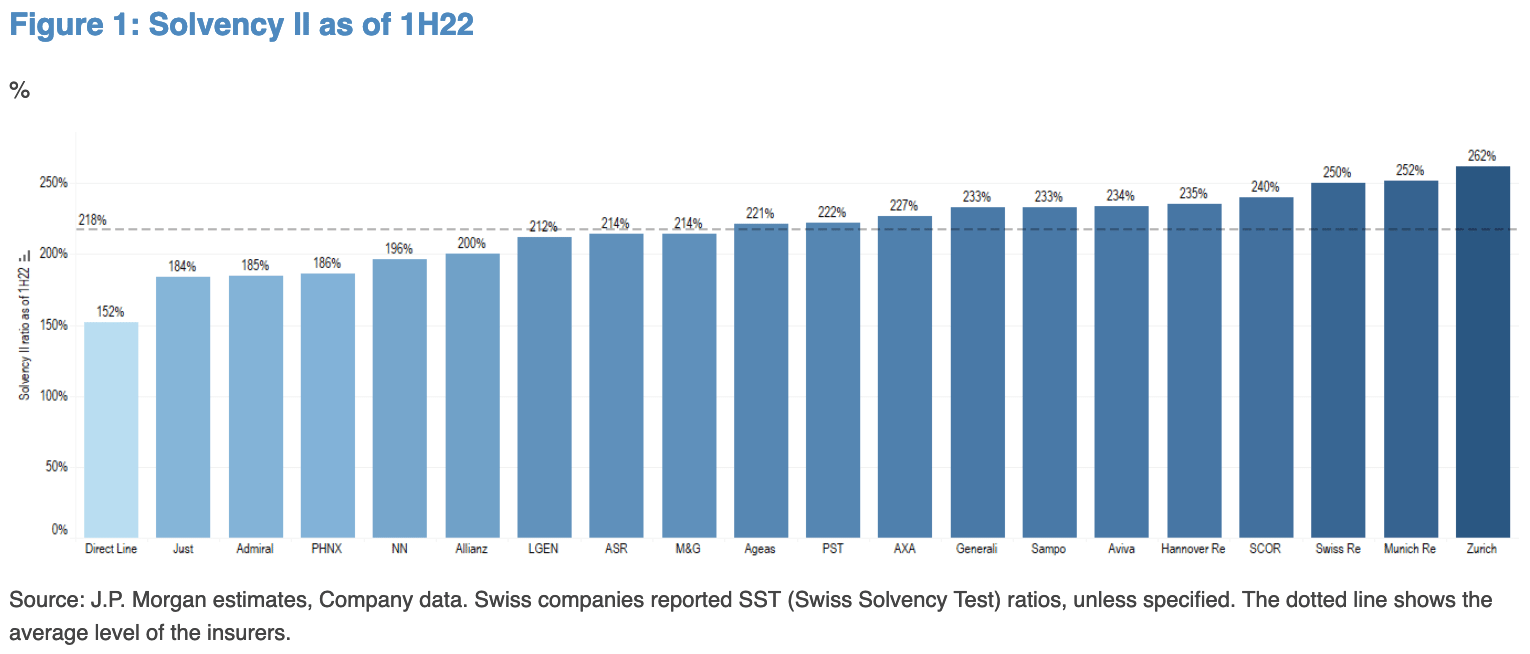

As the graphs below show, the average sector Solvency II position for European insurers is estimated at 218% at 1H22.

At the height of the pandemic, the sector’s average Solvency II ratio declined to 190%. It then steadily improved to 198% at FY20, 210% at FY21 and 218% at 1H22.

The analysts anticipate the ratio to remain at these comfortable levels at year-end 2022.

Meanwhile, the solvency position is strong across the subsectors, particularly for reinsurers and conglomerates, which the analysts note should further support the sector’s generous capital return going forward.

Reinsurers have average SII ratios of 244% (242% excluding Swiss Re) at 1H22. This is followed by the Composite insurers at 230% (223% excluding Zurich Insurance), while UK Motor insurers lag behind other European insurers with an average ratio of 170%.

JP Morgan writes, “Most insurers disclose sensitivities of their solvency ratios to major macroeconomic factors such as interest rates, credit yields and equity market movements.

“This data reveals that higher yields are supportive of the solvency positions of almost all insurers, with a few exceptions. On the other hand, the impact of credit spread widening can vary across companies.”