The U.S individual disability insurance market continued to grow in terms of new sales in 2018, although at a slower rate than in 2017, according to a report from Gen Re, the global reinsurance subsidiary of Berkshire Hathaway.

Analysts reported that overall new individual disability sales were up 2.8% to $413 million in 2018, boosted by a 2.2% increase in non-cancelable sales and a 6.2% increase in guaranteed renewal (GR) sales.

Guaranteed standard issue (GSI) lines did, however, experience a down year in 2018, with new sales declining 9.8% to $41 million.

Results were based on feedback from 15 companies, although market growth was driven by only a third of reporting companies, with the remainder experiencing flat growth year-on-year or a decrease in sales compared with 2017.

Gen Re believes that some of the slow-down in the market can be attributed to the one time MetLife bump that carriers experienced in 2017, although it is not the sole reason that participants did not see growth last year.

“Lack of qualified distribution and limited market expansion continue to be a contributing factor when it comes to challenges with growing the business,” the report stated.

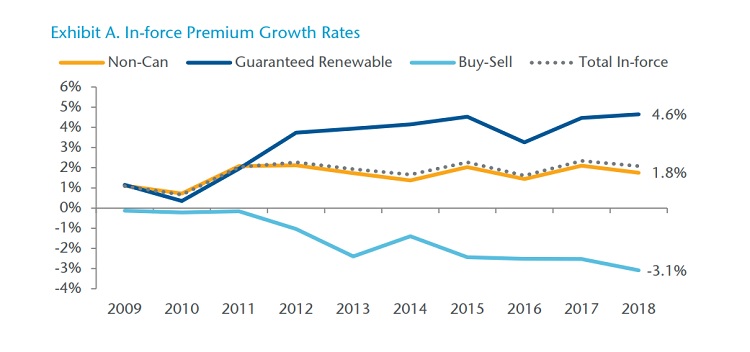

Total in-force premium grew by 2.1% in 2018, according to Gen Re, with participants reporting a combined total of 3 million policies with $4.8 billion of in-force premium.

Around two thirds of respondents said that actual sales were below their 2018 plans, although 87% of companies said that their overall experience in 2018 was better or as they expected.

Only 27% of participating companies said they are using some form of automated underwriting in their business, although every other respondent stated that they have plans to implement this technology to some level within the next three years.

Additionally, looking to the future, half of the respondents said they were anticipating issues with recruiting qualified candidates for underwriting and claims positions in the next five years.

“In closing, the results for 2018 were mixed,” Gen Re concluded. “A number of carriers experienced challenges with new sales, yet overall earnings were positive for the industry.”

“Gen Re continues to have some concerns around the concentration of risk for certain occupations but feels confident in the underwriting discipline that the market continues to show,” it added.

“In conversations with several carriers, it seems that the first quarter of this year was extremely positive. Our hope is that increased activity continues throughout the year.”

Companies participating in the market survey included: Ameritas Life; Assurity Life; Federated Life; Guardian Life; Illinois Mutual; MassMutual; Mutual of Omaha; Northwestern Mutual; Ohio National; Principal Financial Group; RiverSource Life; Standard; State Farm; Thrivent Financial; and Unum.