Analysts at Aon have warned that inflation, in combination with other factors, are likely to magnify insured losses in the first half of 2022 beyond initial estimates.

The broker’s data shows that insured losses from natural disaster events totalled $39 billion in H1, which is roughly 18% above the 21st Century average.

And in contrast to the above average volume of catastrophe losses experienced in the six-month period, global economic losses from natural disasters are preliminary down 24% on the 21st Century average of $121 billion, at $92 billion.

But Aon notes that the full financial accounts of many peril events usually take months or years to completely settle, with unknown factors including loss developments, Assignment of Benefits (AoB) or other third-party claims allocation, demand surge, claims litigation, and cyclical data releases by governmental agencies or private companies.

And this year in particular, one of the biggest drivers of nominal loss growth has been accelerated inflation across the world, which is anticipated to continue throughout the rest of the calendar year.

This has notably increased replacement values in the aftermath of events whether it be due to higher costs of supply, labor, or other discretionary spending to rebuild, Aon explains, and the effects of supply chain disruption from COVID-19 remain a non-negligible parameter as well which has added further loss stress.

The H1 2022 economic and insured losses are therefore considered preliminary and likely to increase.

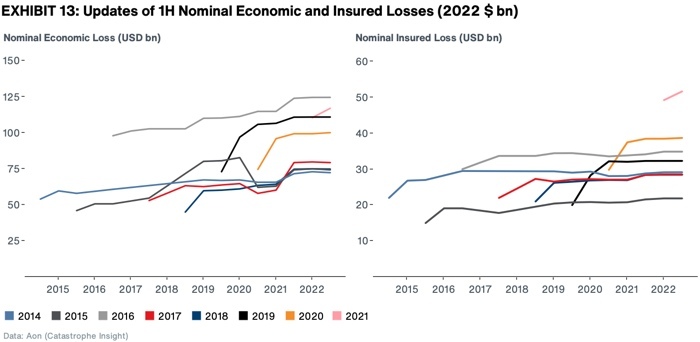

This trend is evident in Aon’s above graphy, which shows a ‘jump’ in losses in reach succeeding year. In addition, constant historical “reanalysis” which consists of revisiting, adding, and updating historical events, or expanding the database to previously under-reported countries minimize the data gap and ensure cataloguing of the most robust and up-to-date data.

Not adjusted for inflation, 2016 remained the costliest year for the H1 since 2014, Aon notes. Nominal insured losses were usually stagnant, whereas nominal economic losses exhibit more variability due to delayed and often uninsured reported losses frequently from drought and flood-related incidents.

This year, insured losses were largely driven by persistent severe convective storm (SCS) activity, with at least nine separate billion-dollar insured events recorded by Aon in the opening six months of 2022, all but one of which were weather-related. Further, at least 20 events were recorded with at least $500 million in insured losses, which Aon says ties H1 2022 with 2011 as the second highest H1 total this century, behind only the 24 seen in H1 2020.