Re/insurance broker Aon has reported that year-to-date economic losses, including preliminary estimates for Hurricane Ian, are already at $277 billion year-to-date, of which $99 billion is expected to be covered by public and private insurers.

The firm’s latest Global Catastrophe Recap shows that global natural disaster losses by the end of the third quarter of 2022 were close to the average when compared to the 21st Century baseline.

The firm’s latest Global Catastrophe Recap shows that global natural disaster losses by the end of the third quarter of 2022 were close to the average when compared to the 21st Century baseline.

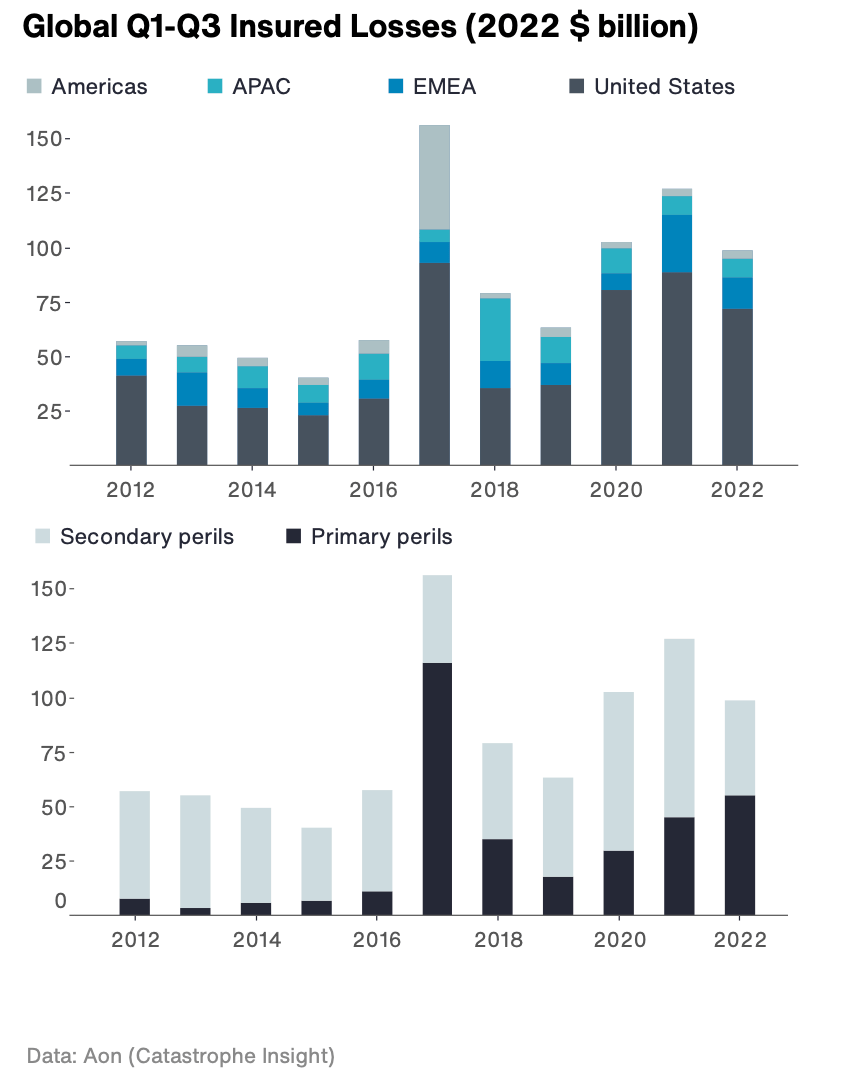

But aggregated losses sustained by the insurance sector were anticipated to notably exceed averages since both 2000 and 2012 and approach the average of the last 5 years.

This comparison, however, remains highly dependent on the eventual financial outcome of Hurricane Ian, Aon notes, which looks set to become on of the costliest insurer loss events on record globally, with losses to run well into the tens of billions of dollars.

Nevertheless, analysts anticipate that it will still take several months for an accurate loss picture of Ian to emerge as claims are settled.

While secondary perils such as severe convective storm and flooding dominated losses in the first half of the year, losses from primary perils accelerated in the third quarter due to tropical cyclone activity in the Atlantic and Western Pacific, Aon’s catastrophe report notes.

The United States accounted for the highest percentage of year-to-date economic losses at $114 billion, with Asia Pacific behind this at $56 billion and then Europe, Middle East and Africa at $42 billion.

And although losses are already at a significant level, Aon warns that impactful events could also be seen through the remaining quarter due to recurring La Niña conditions and the likelihood of above normal hurricane activity, with additional costs also potentially arising from inflationary pressures.

Anticipated insured losses from Hurricane Ian constitute a significant portion of the global insured losses, simultaneously driving Tropical Cyclone as the costliest peril for the insurance industry to date.

A large part of the toll will result from the widespread wind-related damage across the Florida peninsula, with most of the impact concentrated along the western and central counties of the state, often in areas that were also affected by Hurricane Irma in 2017.

Futher losses are expected due to catastrophic storm surge on the western coast and additional inland flooding because of heavy rainfall

However, Aon believes that most of the damage occurred in inland counties will not be covered by insurance due to the lower NFIP take-up rates. This is in contrast with the coastal counties affected by storm surge, which generally have above-average flood coverage.

Even though several firms and entities issued preliminary statements on expected volume of insured losses, Aon still believes it is too early to provide a definitive number, as damage assessment and liquidation of losses will take many months to fully measure.

Current insured loss ranges for Hurricane Ian from catastrophe modellers include a $53 billion to $74 billion range by RMS, a $31 billion to $53 billion range from CoreLogic, $42 billion to $57 billion from Verisk and $29.9 billion to $62.1 billion from KatRisk.