S&P Global Ratings has highlighted the ongoing impact of 2018’s Typhoon Jebi on global insurers and reinsurers, as unfavourable loss development continues to affect earnings in 2019.

The insured loss estimate of Jebi rose dramatically from $6 billion at the end of 2018 to around $15 billion by the first half of 2019, making it the most costly Japanese typhoon ever in terms of insured loss.

For reinsurers, S&P notes that while the top 20 global firms will likely be able to manage Jebi’s loss creep, further material developments could yet occur.

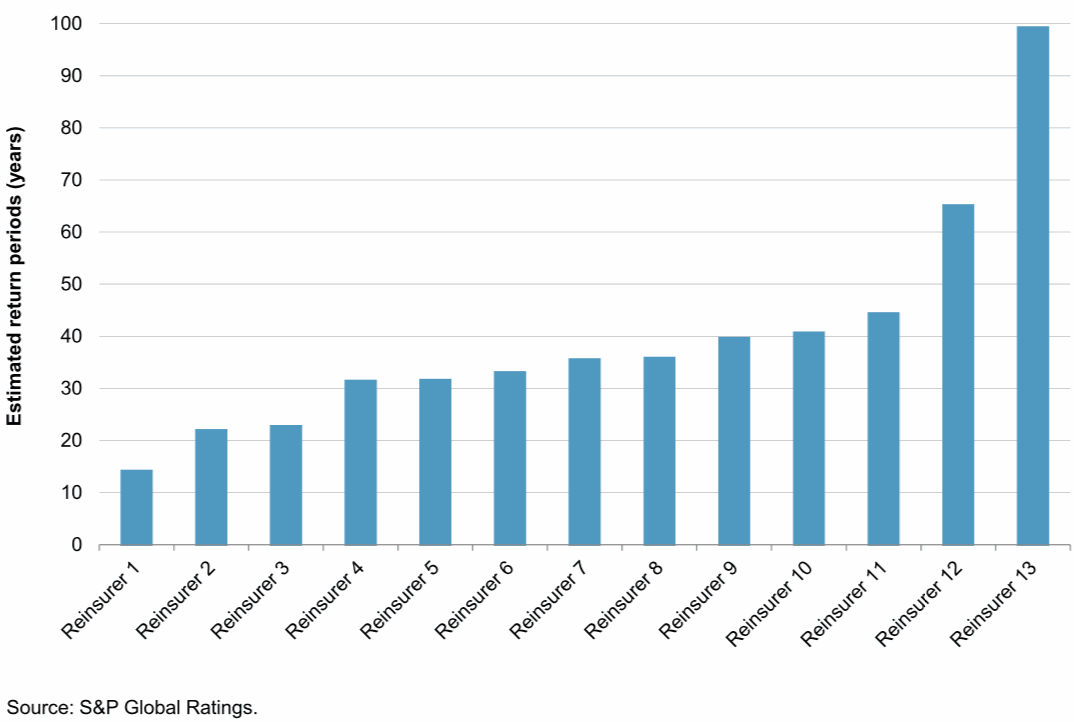

S&P analysts expect Jebi to represent over 15% of the top 13 reinsurers’ catastrophe budget and estimate a return period of more than 1-in-40-years for the event.

S&P analysts expect Jebi to represent over 15% of the top 13 reinsurers’ catastrophe budget and estimate a return period of more than 1-in-40-years for the event.

The ratings agency highlights Jebi as an important reminder of the significant uncertainty associated with early loss estimates.

Although initial loss estimates for some large events in 2017 (such as Hurricane Harvey) proved conservative, S&P says other claims developed negatively (Hurricane Irma).

If the industry were to experience a mega event loss of over $50 billion, the risk and uncertainty stemming from substantial loss creep could be significant, the firm adds.