2017 has not been a fun year for profitability in the reinsurance industry, according to Swiss Re’s Chief Economist Kurt Karl, who said this morning that his company expects to see price hardening, particularly in the United States and loss affected areas but also more generally across the industry.

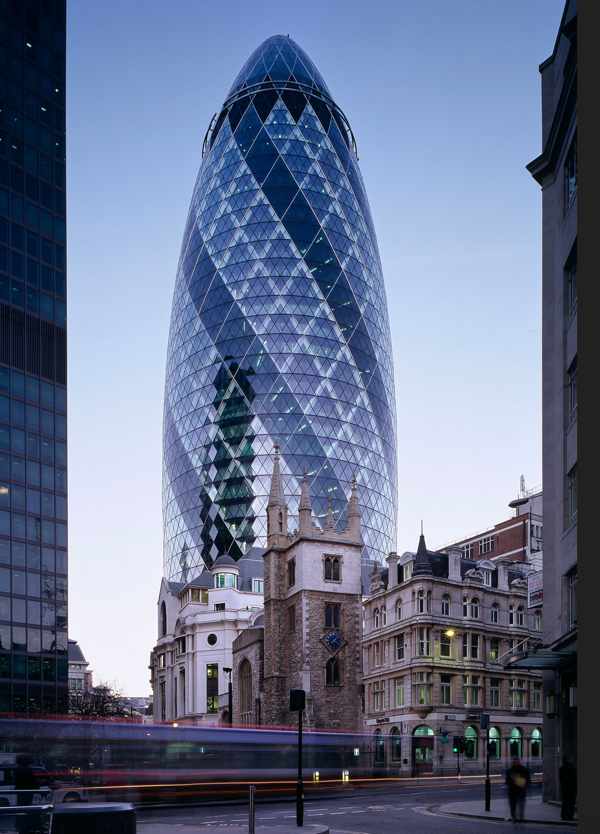

Speaking this morning at Swiss Re’s Chief Economist Media Briefing held in London, Karl said that the reinsurance sector is facing an unprofitable year, sufficiently so to result in rate rises.

Speaking this morning at Swiss Re’s Chief Economist Media Briefing held in London, Karl said that the reinsurance sector is facing an unprofitable year, sufficiently so to result in rate rises.

Discussing the impact of the recent catastrophe events, including hurricanes Harvey, Irma and Maria, the Mexico earthquakes and the California wildfires, Karl said.

“From our point of view this was both a capital and an earnings event and will have the effect of causing price increases in insurance and reinsurance lines,” he explained.

Karl said that the reinsurance sector as a whole is facing a full-year return on equity (RoE) of around -4% for 2017, with a combined ratio across the sector of 115%.

This should reverse the trend seen in recent years, of low catastrophe losses offsetting some of the headwinds reinsurers faced from low interest rates, high levels of competition and capital in the industry and the resulting softening of rates, Karl said Swiss Re believes.

As a result, 2017 has “Not been a fun year for profitability in the reinsurance industry” Karl said.

Due to these losses being a hit to both capital and earnings for much of the industry, Karl said that Swiss Re expects to see “quite a bit of hardening,” which alongside global growth will help to stimulate more reinsurance industry growth and a return to profits.

Price changes are expected to be particularly strong in the United States, with “very significant gains in loss affected areas,” such as where the U.S. hurricanes and Mexico earthquakes hit, according to Karl.

But Swiss Re expects a more general pricing turn as well, as the company believes that technical pricing has been too low for a number of years now.

On price movements Karl said, “Our expectation, given the low premium rates we’ve seen, is that we’ll have a turning in general.

“It appears that the risk may be actually up. So it’s the loss of capital but with the pricing so low and its below the technical rates. This indicates to us that we’re in a situation like 2011 and pricing will turn.”

For the last few years pricing has been below these technical levels, Karl explained, saying that the pricing has not been at levels that Swiss Re expects. As a result pricing should experience a more general turn.

The result is hoped to be that the market, “Gets back to fair pricing that we haven’t had for a couple of years,” Karl said.

Overall, Karl and Swiss Re believe that the combination of underwriting delivering insufficient returns and the erosion of capital from these recent losses, will cause prices to rise and not just in loss affected areas.