Analysts at Macquarie predict the pace of change at the Lloyd’s of London specialist insurance and reinsurance market to accelerate in the coming months after a challenging 2016, underlined by the continued deterioration of underwriting performance.

Macquarie believes the Lloyd’s marketplace is undergoing a “structural revolution” that is likely to change the dynamics of the market in response to underwriting performance deterioration, the entry of alternative capital, and digital and technological innovation.

2016 was a challenging year for the specialist Lloyd’s market, leading analysts to believe “that the pace of change will now accelerate.”

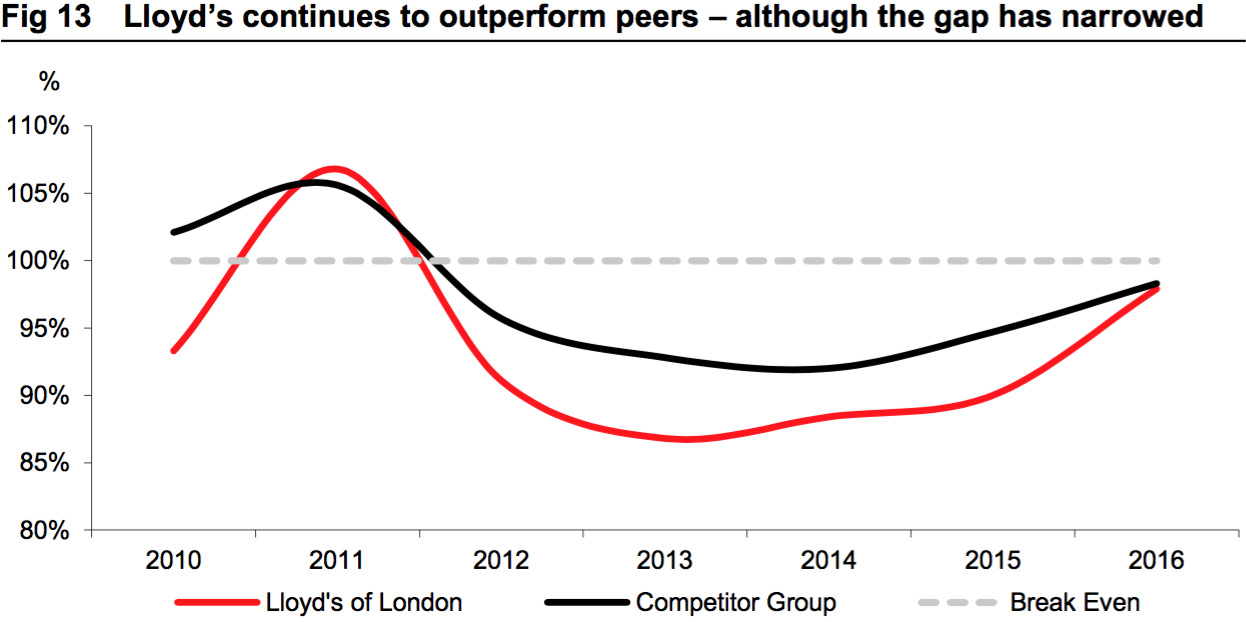

Underlining just how challenging 2016 was for the marketplace, Macquarie notes that Lloyd’s outperformance against its peers has reduced in recent times, from 4.4% over 2011-2015 to just 0.4% in 2016, as shown by the chart below.

Despite rising catastrophe losses in 2016 combined with lower reserve releases Lloyd’s still earned more than £2 billion, but these trends, coupled with falling rates saw underlying underwriting earnings decline by 77%.

The Lloyd’s market calendar year 2016 combined ratio deteriorated to 97.9% from 90% a year earlier, with reserves releases falling to 5.1% from 7.9% in 2015, and major claims increasing from 3.5% in 2015, to 9.1% in 2016.

“We expect that this deterioration will accelerate the pressure on the market to adapt,” says Macquarie.

Furthermore, and adding pressure to the Lloyd’s marketplace during the softening and challenging re/insurance market cycle, the market still has fairly high costs (40%+) when compared to its peers (30% – 35%), explains Macquarie.

With pressures mounting and other insurance and reinsurance markets around the world looking to increase efficiency and profitability in the current environment, taking advantage of technological advances, Lloyd’s needs to adapt to remain a global hub for re/insurance business, particularly at a time when the UK’s vote to leave the EU adds further uncertainty.

As a result of the market dynamics analysts feel the pace of change at Lloyd’s will accelerate to ensure it maintains and improves its outperformance, helped by the rise of digital innovation.

“One major change we expect over the next decade will be the move away from the market’s predominantly paper-based processes and using digital placing systems.

“In 2016 this process began in earnest, with an automated premium and claims processing system implemented for some classes of business – most notably terrorism. Lloyd’s ultimately expects that 90% of business in each class will be written using this system,” says Macquarie.

In fact, analysts expect that by 2025, Lloyd’s market digitalisation will reduce the overall expanse ratio to around 35%, compared with the 40%+ recorded in 2016.

Times are expected to remain challenging for the Lloyd’s of London insurance and reinsurance marketplace, with market pressures expected to persist throughout 2017 and even into 2018, absent a truly market turning event.

Efficiency and discipline remain vital practices in the current environment, and the faster Lloyd’s can adapt to the new market dynamics and evolving risk landscape, likely the better chance it will have at maintaining and expanding its outperformance and improving its deteriorating underwriting performance.