Reinsurance News

Lloyd’s £300m debt issuance significantly oversubscribed

2nd February 2017

The specialist Lloyd's of London insurance and reinsurance marketplace recently announced a £300 million capital raise, a 30-year Non-Call 10 subordinated bond that attracted more than £2 billion of orders. The bond was announced on 24th January 2017 with final pricing at UK Government 10-year Gilts plus 330 basis points, and ... Read the full article

Reinsurance News – Thursday 2nd February 2017

2nd February 2017

Here’s your daily Reinsurance News for Thursday 2nd February 2017: Hannover Re increases profit guidance for 2017 to €1bn+ Reinsurance giant Hannover Re has increased its profit guidance for 2017 to more than €1 billion ($1.1 billion), after a strong round of treaty renewals at January 1st, 2017. Read the full article

Reinsurance market conditions remain tense: IAIS

1st February 2017

Conditions in the global reinsurance market are set to remain "competitive and challenging" in a situation described as "tense" by the International Association of Insurance Supervisors (IAIS). The IAIS notes that competition is a factor across all of non-life re/insurance, with the market experiencing soft pricing conditions, but says that this ... Read the full article

Aon hires U.S. intelligence expert in Cyber role

1st February 2017

Reinsurance broker Aon Benfield has hired U.S. intelligence expert Craig Guiliano, as Technology Consultant in its Cyber division, as it looks to improve its understanding of cyber risks across the world. Guiliano joins the firm with more than 13 years of experience in conducting human and business intelligence, the assessment of cyber ... Read the full article

Reinsurance Broker Ed appoints new Underwriting CEO

1st February 2017

Reinsurance broker, Ed, has named Gary Corke, as the newly appointed Chief Executive Officer (CEO) of Underwriting. Corke, who is joining Ed from SHA Specialist Underwriters, will start his new role in February, and report to Group CEO Steve Hearn. As CEO of Ed’s Underwriting, Corke will head up the firm’s global ... Read the full article

RGA commences India operations

1st February 2017

U.S. domiciled life reinsurer, Reinsurance Group of America (RGA), has announced that it today commenced operations from its Mumbai, Indian branch, after receiving regulatory approval from the Insurance Regulatory and Development Authority of India (IRDAI), reports the Times of India. The IRDAI has given approval to a number of foreign ... Read the full article

Rate of re/insurance price softening expected to slow: Peel Hunt

1st February 2017

Rates of price softening are expected to slow down in the coming year, as reinsurance and insurance supply remains stable but demand for coverage grows as prices drop, according to a Peel Hunt report. Peel Hunt analysts quoted elevated loss activity in the second-half of 2016 as being likely to slow ... Read the full article

PERILS and CatIQ partner on Canadian loss data

1st February 2017

PERILS AG, the Swiss-based catastrophe insurance data provider, has formed a strategic alliance with Toronto-based Catastrophe Indices & Quantification (CatIQ) to provide Canada with industry loss data. The strategic partnership will see data for Canadian natural catastrophes with a market loss of CAD300 million (USD230mn) or above compiled by CatIQ and ... Read the full article

Re/insurers playing a potentially “dangerous” underwriting game: A.M. Best

1st February 2017

In a review of highlights from A.M. Best’s annual report for the U.S. property/casualty (P/C) insurance industry, the rating agency warned of insurance and reinsurance companies playing a potentially “dangerous game” of loosening up underwriting standards after seeing a spike in investment income. One of the major concerns of the current ... Read the full article

Reinsurance News – Wednesday 1st February 2017

1st February 2017

Here’s your daily Reinsurance News for Wednesday 1st February 2017: Reinsurers seek new opportunities as value-chain blurs: S&P Reinsurers are looking to take advantage of new opportunities to source risk as the value chain within the insurance and reinsurance industry continues to blur. RenRe records operating income ... Read the full article

Commercial insurers take advantage of reinsurance arbitrage: S&P

31st January 2017

In the current buyer's market environment, international financial services rating agency Standard & Poor's (S&P), has highlighted how commercial insurance players are making the most of market conditions and reinsurance arbitrage. Driven by intense competition from both traditional and alternative reinsurance sources, the benign loss experience and other market headwinds, rates ... Read the full article

European re/insurers advised to focus on M&A consolidation: A.M. Best

31st January 2017

A.M. Best has named M&A activity as the main factor affecting Western European insurers and reinsurers credit ratings last year, and while this trend is expected to continue throughout 2017, the rating agency has recommended firms focus on consolidating gains. Despite tough market conditions of low investment yields and an increasingly ... Read the full article

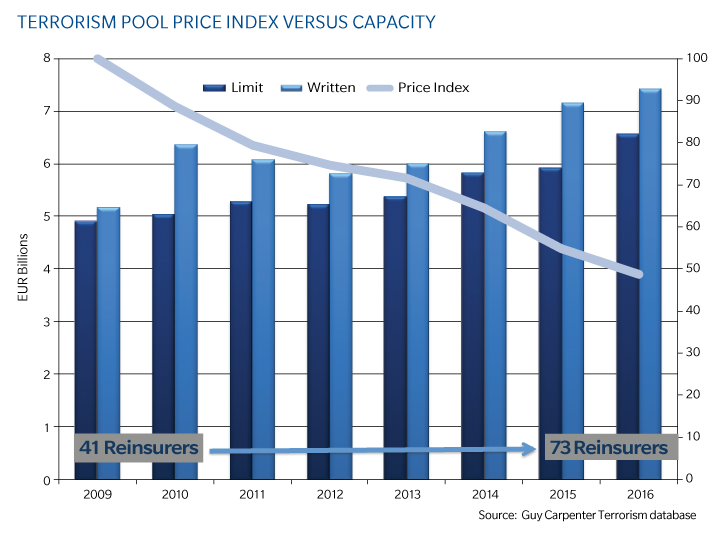

Reinsurers can help to close terrorism loss gap: Karhan, Guy Carpenter

31st January 2017

The global insurance and reinsurance industry should look towards closing the protection gap in terrorism risks, where economic impacts continue to far outstrip insured terror losses. Capacity remains abundant for terrorism reinsurance coverage but the market needs to shift its focus, according to Emma Karhan, a Managing Director with a specialism ... Read the full article

Reinsurers seek new opportunities as value-chain blurs: S&P

31st January 2017

The value-chain within insurance and reinsurance is blurring, with companies reacting to the highly competitive market environment, new entrants from the InsurTech arena and third-party capital players, but reinsurers are seeking to benefit by securing new opportunities to source risk. Ratings agency Standard & Poor's (S&P) discussed the "blurry value chain" ... Read the full article

PwC appoints London Market Insurance leader

31st January 2017

Global insurance, reinsurance, advisory and tax consultancy PwC has appointed Paul Delbridge - a Partner of the firm with 30 years experience in insurance and reinsurance - to London Market Insurance leader. In his new role Delbridge will be responsible for the Lloyd's, London Market company, and major broker markets’ audit, tax ... Read the full article