Reinsurance News

MetLife completes first UK pension scheme liabilities longevity swap

21st January 2022

Metropolitan Tower Life Insurance Company has completed its first longevity swap of UK pension scheme liabilities. The transaction, which went through in Q4 2021, means that company—a subsidiary of MetLife—will provide reinsurance for longevity risk associated with $3.5bn of pension liabilities. The lead adviser on the deal was Aon, while the intermediary ... Read the full article

Swiss Re announces raft of promotions

21st January 2022

Swiss Re Corporate solutions has begun to undertake the process of transitioning from national to regional underwriting of its single carrier deals. Announced yesterday, the organisation said it was making a raft of promotions within its regional underwriting organisation. These include Sarah Magill, group head central (former team lead based in Chicago ... Read the full article

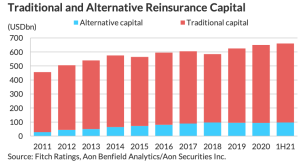

Reinsurance market capital rose 3-4% in 2021

21st January 2022

The reinsurance market is well capitalised and able to absorb demand for its coverage, according to data from Fitch Ratings. Despite catastrophe losses of more than $100 billion 2021, Fitch reports that traditional and alternative reinsurance capital increased together by around 3-4%. As a result of this growth, the ratings agency feels ... Read the full article

Shanghai port disruption a BI concern for re/insurers: Russell Group

21st January 2022

Analysis by risk management organization Russell Group shows that current port congestion at Shanghai is costing an estimated $4.5 billion a week in lost trade, opening the door to both supply chain and business interruption risks. The firm says this is a “clear worry” both for insurers and reinsurers, who could ... Read the full article

84% of board members fear “personal ramifications” of regulatory investigations: McGill

21st January 2022

A survey released by reinsurance broker McGill and Partners suggests that an overwhelming majority of board directors questioned fear the ‘personal ramifications’ of a regulatory investigation. The survey was reportedly conducted by NEDonboard from a sample of 97 board members. McGill and Partners reported that directors were ‘increasingly concerned’, despite offering ... Read the full article

American Integrity sees opportunity in challenged Florida market

21st January 2022

Florida-based property insurer American Integrity Insurance Company has launched a new product called Integrity Select that will look to capitalise on opportunities in the challenged Florida market. The product is designed to provide new property insurance options in capacity-constrained areas in the state. Bob Ritchie, President and CEO of American Integrity, acknowledged ... Read the full article

Chubb promotes Nathalie Meyer to President, Switzerland

21st January 2022

Global re/insurer Chubb has appointed Nathalie Meyer as Country President for Switzerland, where she will be responsible for Chubb's property and casualty, accident and health, and consumer lines operations across the country. Prior to this position, Meyer was the leader for Middle Market, SME and Industry Practices. She replaces Dawn Miller, outgoing ... Read the full article

Kin sees premium surge through 2021

21st January 2022

Kin Insurance, a US insurtech and primary carrier focused on home insurance for catastrophe-exposed areas, has reported that its total managed premium increased by more than four times during 2021. The company finished the year with $104.8 million in total managed premium, compared with $25.0 million at the end of 2020. Around ... Read the full article

Reask closes funding round led by Tencent

21st January 2022

InsurTech Reask has closed its seed funding round led by Tencent, the global technology giant headquartered in China. Reask plans to use the funding on product development, operational expansion, and business development worldwide, including a focus on the London Market. The insurtech is currently taking on legacy Nat Cat modelling firms by ... Read the full article

SiriusPoint invests into Honeycomb

21st January 2022

SiriusPoint has announced an investment into technology firm Honeycomb. The investment is part of Honeycomb’s latest round of funding, which has seen the firm raise $19m. The additional funds will reportedly be used to further deepen the company’s technological moat and help it expand into multiple additional states in the US. According ... Read the full article

DUAL NA partners with Munich Re to launch new underwriting platform

21st January 2022

DUAL North America has partnered with Munich Re Syndicate to launch a new Crisis Management underwriting program offering Product Recall and Contaminated Products Insurance products, starting from this month. The team will underwrite and provide specialty claims handling for a broad array of Food & Beverage, Agriculture, Consumer Products, and Manufacturing ... Read the full article

Aspen increases participation in Ryan Specialty’s intl. MGU portfolio

21st January 2022

Bermuda-based insurer and reinsurer, Aspen Insurance Holdings, has announced an expanded trading agreement with Ryan Specialty Group (RSG) to support an international portfolio of delegated underwriting authority business. From January 1st, 2022, Aspen joined an additional seven programs for Ryan Specialty Underwriting Managers' MGU portfolio. The pair state that this agreement utilises ... Read the full article

Lloyd’s appoints Dawn Miller as commercial director

21st January 2022

Dawn Miller is to join Lloyd’s as its new commercial director in a role set to begin in Q2 2022. According to Lloyd’s, Butler is to oversee Lloyd’s global network across the Americas, Europe, APAC, and MEA. She will be responsible for distribution, market development, global engagement with brokers, and new ... Read the full article

PIC signs £250mn partial buy-in with IMI pension fund

21st January 2022

Pension Insurance Corporation (PIC) has concluded another partial buy-in with the Trustee of the IMI plc's 2014 Deferred Fund, which covers £250 million in liabilities for approximately 1,200 Fund members, 95% of which are deferred members. The transaction, which was finalised in December, is the fifth buy-in since 2016 and takes ... Read the full article

Aon’s Stefan Weda to join WTW as leader of CRB Benelux

21st January 2022

Stefan Weda has joined insurance and reinsurance broker, WTW, from rival Aon as the new leader of the company's Corporate Risk & Broking (CRB) operation for the Benelux countries. Effective May 1st, Weda takes on responsibility for accelerating growth in the CRB markets across the region, and for leading the Benelux ... Read the full article