Reinsurance News

Aon partners with insurtech Walbing on trade credit marketplace

8th July 2021

Re/insurance broker Aon has partnered with Hamburg-based fintech Walbing on the establishment of a service tailored for syndicated trade credit insurance. Those wanting to secure coverage will receive an offer directly via the new marketplace, with the respective contract concluded through Aon’s One Underwriting Agency. “In the midst of the corona pandemic, ... Read the full article

In raising $500m RenRe notes it could be used to replenish after catastrophes

8th July 2021

Bermuda domiciled reinsurer RenaissanceRe Holdings Ltd. (RenRe) has announced plans to raise $500 million via a share offering, the proceeds of which it says could be used to replenish its capital base after a catastrophe event. RenRe has agreed to sell 20 million depositary shares in an underwritten public offering, each ... Read the full article

SiriusPoint launches specialty MGA Banyan Risk with Usher-Jones

8th July 2021

SiriusPoint, the international specialty re/insurer recently formed via the merger of Sirius Group and Third Point Re, has announced the launch of a new managing general agent (MGA) that will underwrite Directors & Officers (D&O) business, called Banyan Risk. Banyan has been established by Founder and CEO Tim Usher-Jones in partnership ... Read the full article

LMA promotes Patrick Davison to Underwriting Director

8th July 2021

The Lloyd’s Market Association has promoted Patrick Davison to the role of Underwriting Director as part of a long-planned succession with Jane Hayes, who will step into an executive director role. Davison has served as Deputy Underwriting Director for the past 18 months, leading the market’s response on both COVID-19 and ... Read the full article

AXIS Re hires Lopiccolo to drive global broker engagement

8th July 2021

AXIS Re the reinsurance business segment of AXIS Capital Holdings has appointed Matt LoPiccolo as Strategic Account Executive, Global Brokers for its client engagement initiative, AXIS Re Strategic Partners. LoPiccolo joins AXIS Re after serving as Head of US Digital Distribution within the company’s insurance segment. He will continue to be based ... Read the full article

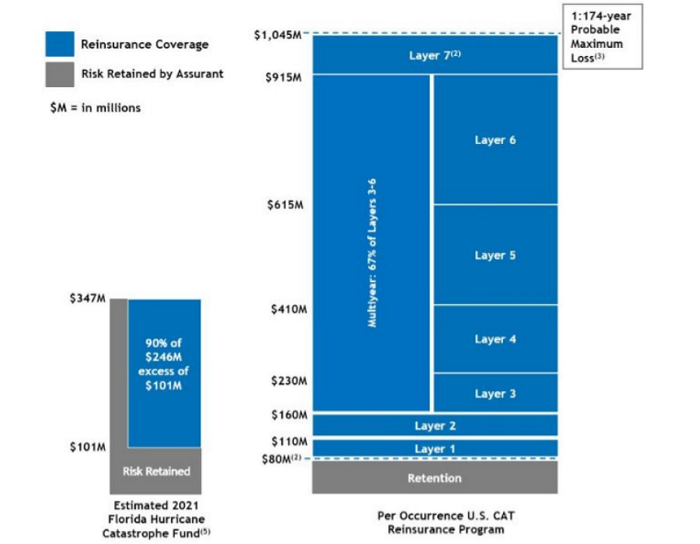

Assurant details reinsurance coverage for 2021

8th July 2021

US specialty insurance group Assurant has detailed its 2021 property catastrophe reinsurance program, which provides $965 million of coverage in excess of a $80 million retention for a first event, with retention lowering to $55 million for a second and third event. The company decided to reduce its retention for certain ... Read the full article

Pool Re sets up systemic risks advisory group

8th July 2021

UK government-backed terrorism reinsurer Pool Re has announced the formation of a new expert advisory group to explore how to better protect the UK economy from systemic risks. Re:New will bring together figures from re/insurance, government, industry and academia to discuss how re/insurers, the private sector, public sector and the public ... Read the full article

Guy Carpenter announces two senior hires

8th July 2021

Guy Carpenter, the reinsurance broking arm of Marsh McLennan, has appointed Matt Petka as Managing Director and Riley Underwood as Senior Vice President within its GC Access business unit. Petka will assume a senior leadership role within GC Access, where he will be responsible for overseeing solution development and client management. Alongside ... Read the full article

Moody’s turns stable on UK life sector

8th July 2021

Moody’s has decided to change its outlook on the UK life insurance sector to stable from negative, one year after the coronavirus pandemic resulted in a shift to negative The rating agency notes that the sector’s operating profit and capitalisation were resilient in 2020, and are expected to remain robust over ... Read the full article

CRC Group acquires Constellation Affiliated Partners

8th July 2021

CRC Group has closed on the acquisition of Constellation Affiliated Partners, more than doubling the size of its Specialty Programs Division and creates one of the largest program managers in North America. CRC Group’s new Specialty Programs Division now places more than $2.4B in premium across more than ten industry and ... Read the full article

Discipline holding as market balance returns: Willis Re’s Vickers

7th July 2021

James Vickers, Chairman of Willis Re International, has said that “discipline is still there,” even as the latest edition of the broker’s 1st View Report shows that recent reinsurance price increases have brought the market close to equilibrium. Speaking in an interview with Reinsurance News, Vickers noted that the reinsurance market ... Read the full article

BMS Re opts for Relay’s F1 electronic placement system

7th July 2021

The US reinsurance arm of specialist broker BMS has selected Relay’s F1 electronic placement system to support its push for further growth across the sector. The broker portal combines a range of features designed to increase the ease of doing business, facilitate and integrate quotes from all reinsurers, and reduce the ... Read the full article

Tokio Marine HCC Intl. adds trio to professional risks team

7th July 2021

Tokio Marine HCC International, a member of Tokio Marine Group, has announced the appointments of Matthew Clayton and Ross Thompson as Senior Underwriters and Jonathan Olle as Senior Media Property and Liability Underwriter, all within its Professional Risks team in London. Clayton joins after a 16-year stint at Hiscox, where he ... Read the full article

Ascot announces Boston Indemnity Company acquisition

7th July 2021

Bermuda-domiciled specialty re/insurer Ascot reached an agreement to acquire Boston Indemnity Company (BIC) from Great Midwest Insurance Company (GMIC), a subsidiary of Skyward Specialty Insurance Group. The acquisition has been described as an attempt to facilitate Ascot’s entry into the US contract and commercial surety market. It has also been stated that ... Read the full article

Aviation claims edging closer to normal as Covid loosens grip, says Allianz

7th July 2021

Inspired by an inevitable surge in domestic travel following the decline of COVID-19’s disruptive influence, global insurer Allianz has categorised the aviation industry as one largely on the rebound. However, as a rising number of aircraft return to the skies, Allianz' report highlights a number of potential challenges, including “rusty” pilots ... Read the full article