Reinsurance News

APAC MAT industry expected to grow to $14.5bn in 2025: GlobalData

22nd July 2021

According to data and analytics company GlobalData, the marine, aviation and transit (MAT) insurance industry in Asia-Pacific is projected to grow from $11.2bn in 2019 to $14.5bn in 2025, in terms of written premiums. The report also revealed that that MAT insurance industry in Asia-Pacific is expected grow at a compound ... Read the full article

RLI grows underwriting incoming in Q2 as premiums up 25%

22nd July 2021

US property and casualty insurer RLI Corp. has reported improved underwriting income during the second quarter of 2021, despite an overall decrease in net earnings. Net earnings came to $81.8 million for the quarter, compared to $92.2 million for the same period last year, mostly due to lower unrealized gains. But operating ... Read the full article

Zurich announces two senior hires

22nd July 2021

Global insurer Zurich has appointed Annarita Roscino as Group Claims Data and Insights Leader, and Nelcia Oliveira as Regional Chief Claims Officer for Latin America. In her new role, Roscino will focus on establishing and executing the Group Claims data and insight strategy, developing data science capabilities across regions and countries. Roscino ... Read the full article

Beazley highlights shifting expectations of insurance partners

22nd July 2021

Specialist insurer Beazley has released a report highlighting an increase in the rising level of expectations clients have of their insurance partners. Beazley’s findings are based on research involving 1,000 senior executives and insurance buyers in the US and UK, from across 10 industry sectors. The report says homogenised policies and a ... Read the full article

Aki Hussain to succeed Bronek Masojada as Hiscox Group CEO

22nd July 2021

Global insurer and reinsurer Hiscox has announced that its Chief Executive Officer (CEO), Bronek Masojada, will be retiring from the company at the end of the year and will be succeeded by Aki Hussain, effective January 2022. Hussain joined Hiscox in 2016 and currently serves as the company's Chief Financial Officer ... Read the full article

ASR secures additional $10mn capacity for PVT from Atrium Underwriting

22nd July 2021

Africa Specialty Risks (ASR) has secured an additional $10 million capacity for its Political Violence and Terrorism (PVT) division from Atrium Underwriting (Atrium). This is in addition to the multi-year binder capacity across all of ASR’s business lines, of up to $25 million per risk through a partnership with GIC of ... Read the full article

CAPE Analytics secures $44m in funding

22nd July 2021

CAPE Analytics, a provider of geospatial intelligence for property risk and valuation, has secured $44 million in Series C financing, led by Pivot Investment Partners. Additional investors, Aquiline Technology Growth and HSCM Bermuda also joined the Series C round, with participation from existing investors, including Formation8 and Brewer Lane Ventures, as ... Read the full article

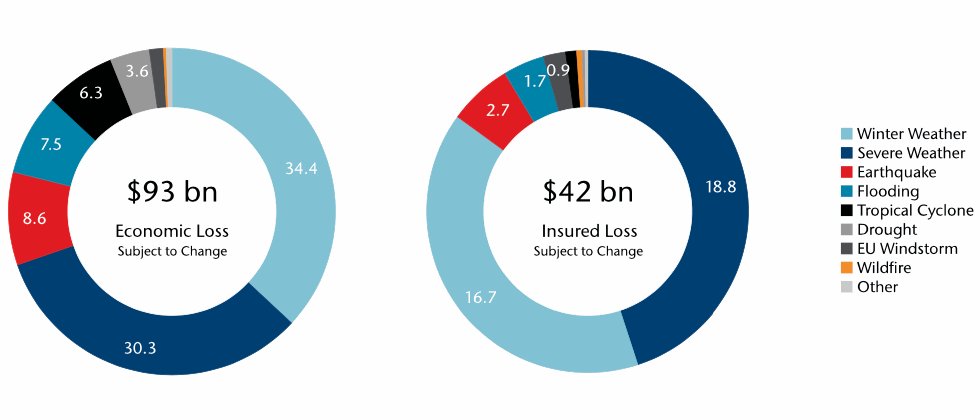

Aon pegs first-half insured catastrophe losses at $42bn

21st July 2021

Analysts at re/insurance broker Aon have estimated that insured catastrophe losses during the first half of 2021 amounted to $42 billion. This is roughly in line with the 10-year average of $41 billion, but 39% above the average for the 21st Century so far, which stands at roughly $30 billion. On the ... Read the full article

Tens of thousands of buildings impacted by European floods, says ICEYE

21st July 2021

Analysis from ICEYE, who builds and operates its own commercial constellation of SAR satellites, shows that a minimum of 43,400 buildings across Europe are estimated to have been impacted by recent flooding in the region. ICEYE operates a constellation of synthetic aperture radar satellites and through its Flood Monitoring Solution, offers ... Read the full article

Westfield hires Jack Kuhn for expansion into specialty lines

21st July 2021

Super-regional property and casualty (P&C) insurer, Westfield, has hired respected specialty lines leader Jack Kuhn as President of its newly launched specialty insurance business, Westfield Specialty. Westfield expects its entry into the specialty arena to create additional opportunities to profitably grow new customers and bolster its existing relationships. Additionally, Westfield Specialty ... Read the full article

Munich Re and Sapiens partner on commercial market services

21st July 2021

Munich Re has partnered with Sapiens International Corporation, a provider of software solutions for the insurance industry, to offer technology-led consultancy and services that will enable primary insurers to better serve the commercial insurance market. Initially focusing on small and medium sized businesses in the UK, the partnership also plans to ... Read the full article

Aon – Willis and US DoJ may be able to settle early on three counts

21st July 2021

According to court documents, it appears that Aon, its acquisition target Willis Towers Watson (WTW) and the US Department of Justice (US DoJ) are hoping to reach a settlement quickly on counts related to three of the market segments where the mega-merger was deemed potentially anti-competitive. It's news that could signal ... Read the full article

Insured loss from North Rhine-Westphalia & Rhineland-Palatinate floods at €4-5bn: GDV

21st July 2021

The devastating flooding experienced in the German states of North Rhine-Westphalia and Rhineland-Palatinate is expected to drive insurance and reinsurance industry losses of between €4 billion and €5 billion, according to the German Insurance Association (GDV). Last week’s flooding impacted parts of Central and Western Europe, including Belgium, the Netherlands, and ... Read the full article

H1 catastrophes eat through almost 80% of Travelers agg reinsurance retention

21st July 2021

Despite US primary insurer Travelers reporting a slowdown in catastrophe losses for the second quarter, year-to-date, the firm has accumulated approximately $1.5 billion of qualifying losses towards its aggregate retention of $1.9 billion. When reporting its Q2 2021 financials yesterday, Travelers announced catastrophe losses, net of reinsurance, of $475 million. While ... Read the full article

MCI receives in-principle approval to establish Syndicate 1902

21st July 2021

Specialist managing general agency Medical & Commercial International (MCI) has received ‘in-principle’ approval from Lloyd’s for Syndicate 1902 to underwrite business incepting on or after 1 January 2022. The syndicate will write gross written premium (GWP) of £45 million in year one. It will be established under ... Read the full article