Reinsurance News

MGA premium growth outpacing P&C market: Conning

5th July 2021

A new report by investment management firm Conning shows that the managing general agent (MGA) and program market continued its upward trajectory in 2020 with premium growth outpacing the overall property-casualty market. Despite the pandemic’s challenges and associated uncertainties, Conning found that many MGAs and program administrators continued to thrive last ... Read the full article

L&G Re names Amy Ellison as new CEO

5th July 2021

The global reinsurance arm of Legal & General Group, L&G Re, has announced the appointment of Amy Ellison as its new Chief Executive Officer (CEO), succeeding Thomas Olunloyo. Ellison moves to L&G Re from within the L&G Group, having joined in the UK in 2016. Most recently, she served as Finance ... Read the full article

COVID-19 to impact $40bn worth of Chinese circuitry exports

5th July 2021

Risk management company Russell Group has warned that Covid-driven delays at the Chinese ports of Guangzhou, Yantian, Shenzhen, Shekou and Nansha will impact the exporting of integrated circuit boards (ICB) worth over $40 billion. The rise in cases has been concentrated in Southern China, which is where China’s manufacturing and technology ... Read the full article

Howden declares a ‘digital pandemic’ as ransomware attacks rise 170%

5th July 2021

Insurance broker Howden has released a report examining today’s cyber insurance market, one it says is being driven by rampant ransomware attacks, higher rates and shifting regulation. Declaring a ‘digital pandemic’, Howden says ransomware is now the predominant cyber threat confronting businesses of all sizes, with 170% more attacks having taken ... Read the full article

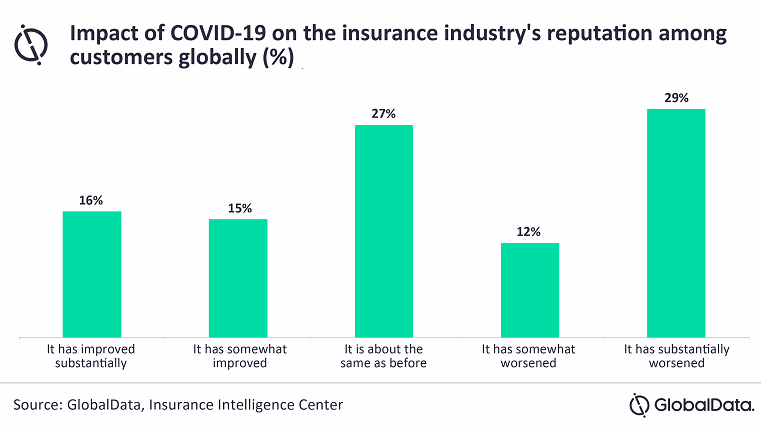

Insurer reputation in decline since COVID-19, GlobalData poll finds

2nd July 2021

A recent poll conducted by data and analytics company GlobalData shows a decline in the insurance industry’s reputation globally, resulting largely from its response to the COVID-19 pandemic. A third of respondents felt that their opinions on global insurers had substantially worsened because of the pandemic. Overall, a total of 41% felt ... Read the full article

Lockton Re hires Showvanik Dasgupta as Senior Broker, P&C

2nd July 2021

Lockton Re, the reinsurance arm of the global brokerage, has appointed Showvanik Dasgupta as Senior Broker in its International P&C division in London. Showvanik is a Fellow of the Institute of Actuaries with experience across the insurance market having spent time at Beach Re, Tokio Millennium Re and Aspen Re where ... Read the full article

Arch wraps up $622mn Watford acquisition

2nd July 2021

Arch Capital Group has officially wrapped its $622 million acquisition of Watford Holdings, roughly eight months after first signing a merger agreement. Arch and investment partners Kelso and Warburg Pincus pursued the merger agreement through an affiliated entity of which Arch owns approximately 40%, and funds managed by Kelso and Warburg ... Read the full article

McGill and Partners appoints Peter Chesman as Partner

2nd July 2021

Specialist re/insurance broker McGill and Partners has appointed Peter Chesman as Partner within its UK-based Structured Solutions team. Chesman brings 17 years’ experience to the role, with 15 of those spent at Aon. He’s expected to help focus on alternative risk financing and support risk transfer strategies for large complex clients. “Peter brings years of ... Read the full article

Commercial property rates up 9.6% in Q2: MarketScout

2nd July 2021

Data from MarketScout shows that commercial property rates increased by 9.6% over the second quarter of 2021, as pricing continued to increase despite moderation in some lines of business. Other lines with significant rate increases over Q2 included business interruption up 7%, umbrella/excess up 11.6%, commercial auto up 9%, and D&O ... Read the full article

No question you’ll see more life reinsurers in Bermuda: Brad Adderley, Appleby

2nd July 2021

While the emergence of property and casualty (P&C) startups in Bermuda is likely to be muted in the months ahead, the influx of life reinsurers is expected to continue and will only strengthen the Bermuda marketplace, according to Brad Adderley, Partner at global law firm Appleby. An expectation of significant rate ... Read the full article

ABI announces changes to Board of Directors

2nd July 2021

The Association of British Insurers (ABI) has announced changes to its Board of Directors to strengthen its focus on improving trust. The association will be recruiting a new independent Chair and an independent non-executive director (NED). The ABI will also create a new Board-level Reputation and Customers Committee in order provide more ... Read the full article

Actuaries forecast €2.5bn+ loss following European storms

2nd July 2021

Actuaries from Meyerthole Siems Kohlruss (MSK) are forecasting that insurance industry losses from the severe weather that impacted parts of Europe over the last ten days could exceed €2.5 billion. The estimate follows analysis from Aon’s Impact Forecasting unit, which put the cost of the storms in the region of hundreds ... Read the full article

New Zealand again extends Aon / WTW merger decision date

2nd July 2021

The New Zealand (NZ) Commerce Commission's ongoing investigation into the proposed $30 billion combination of Aon and Willis Towers Watson (WTW) has been extended once more, with a conclusion now expected by August 20th, 2021. This is the second time New Zealand’s Commerce Commission has extended its deadline after launching an ... Read the full article

LiquidX gains brokerage license in Singapore

2nd July 2021

LiquidX, a global fintech solutions provider for working capital, trade finance, and insurance, has been granted approval by the Monetary Authority of Singapore (MAS) to offer insurance brokerage services in the country. The firm's Singapore entity, LiquidX Insurance Services (Singapore) Pte. Ltd. (LISS), can help banks, asset managers and funds, and ... Read the full article

MS Amlin hires James Maxwell as interim CRO

2nd July 2021

Lloyd’s global specialty re/insurer MS Amlin Underwriting has appointed James Maxwell as interim Chief Risk Officer. Maxwell will take up the role this month following the departure of Vishal Desai, who is leaving the company for personal reasons. Maxwell brings over 25 years of experience in financial, operational and enterprise risk management. He ... Read the full article