Global catastrophe risk modeller RMS has collaborated with the Cambridge Centre for Risk Studies (CCRS), part of The University of Cambridge, to develop and launch a new Data Definitions Document v1.0 for 14 different classes of insurance exposure.

The new, published insurance exposure Data Definitions Document v1.0 offers a standardised schema for insurers to have a consistent method of both monitoring and reporting their exposure across numerous different classes of insurance.

According to an announcement on the launch, this new data standard is set to improve interchanges of data between market players to refine risk transfer to reinsurance companies and other risk partners, reporting to regulators, and also exchanging information for risk co-share, delegated authority, and bordereau activities.

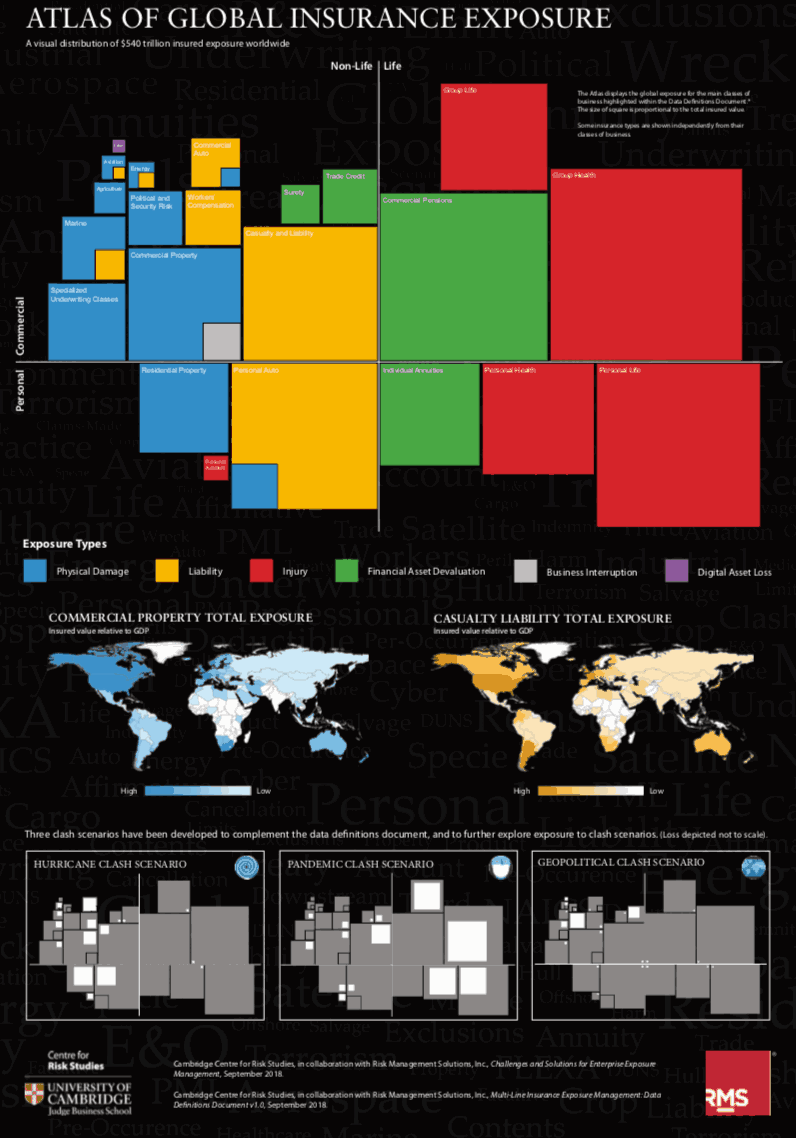

The 14 classes of insurance exposure include casual liability, specialty lines, trade credit and surety, agriculture, life and health, and annuity exposure, which covers an estimated $554 trillion of total insured limits globally.

Chief Risk Modelling Officer at RMS, Dr. Moshen Rahnama, said: “We’re honored to partner with the Centre for Risk Studies on this data schema project. Establishing a current and market relevant data standard for managing exposure consistently is a priority for an industry managing accumulations and clash risk more widely. The release of this new data schema will solve risk challenges at an enterprise level across multiple classes of insurance.

“By making this schema open to the market, we hope to enable a new generation of risk model development and improvements across the insurance market in the ability to manage their multiline exposure risk.”

CCRS completed a two-year exercise documenting the full range of insurance categories that are available in the market and also a classification system for all the assets that they protect. This exercise, which was completed in collaboration with RMS, involved comprehensive interviews with 130 industry specialists and consultation with 38 insurance, analyst, and modelling organisations.

The launch announcement explains that a key reason for developing this new data schema is to identify concentrations of exposure, as well as assessing accumulation risk by enabling new types of loss models.

The project demonstrated a need for the data definitions documentation to provide a framework for loss modelling by examining three separate catastrophe scenarios, including: A severe hurricane striking the energy fields and marine installations in the Gulf of Mexico alongside personal and commercial lines properties; an influenza pandemic that hits life and health insurance companies, as well as causing financial losses to both the economy and stock markets; and, a geopolitical conflict located in Southeast Asia that triggers losses across all the major classes of insurance.

Academic Director of Cambridge Centre for Risk Studies, Professor Danny Ralph, commented: “A standardized view of risk is necessary to enable a consistent understanding of exposure across multiple insurance portfolios. Understanding this, the Cambridge research team has engaged deeply with the insurance community to develop data standards that align with current practices and are practical to implement.

“We are pleased to partner on the development of this data schema with RMS and offer it as an open source document to the insurance and risk management industry.”